News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 20)|CFTC Crypto Regulation Consultation Deadline; STBL Launches $100M USST Minting; Polymarket Bets US Gov't Shutdown Lasts Beyond November2Here are Dogecoin’s key price levels to watch as DOGE set to rebound3Bitcoin falls below $110,000, is the market turning bearish?

ENS Token Transfer: Unpacking a Massive $4M Crypto Exchange Movement

CryptoNewsNet·2025/08/11 20:45

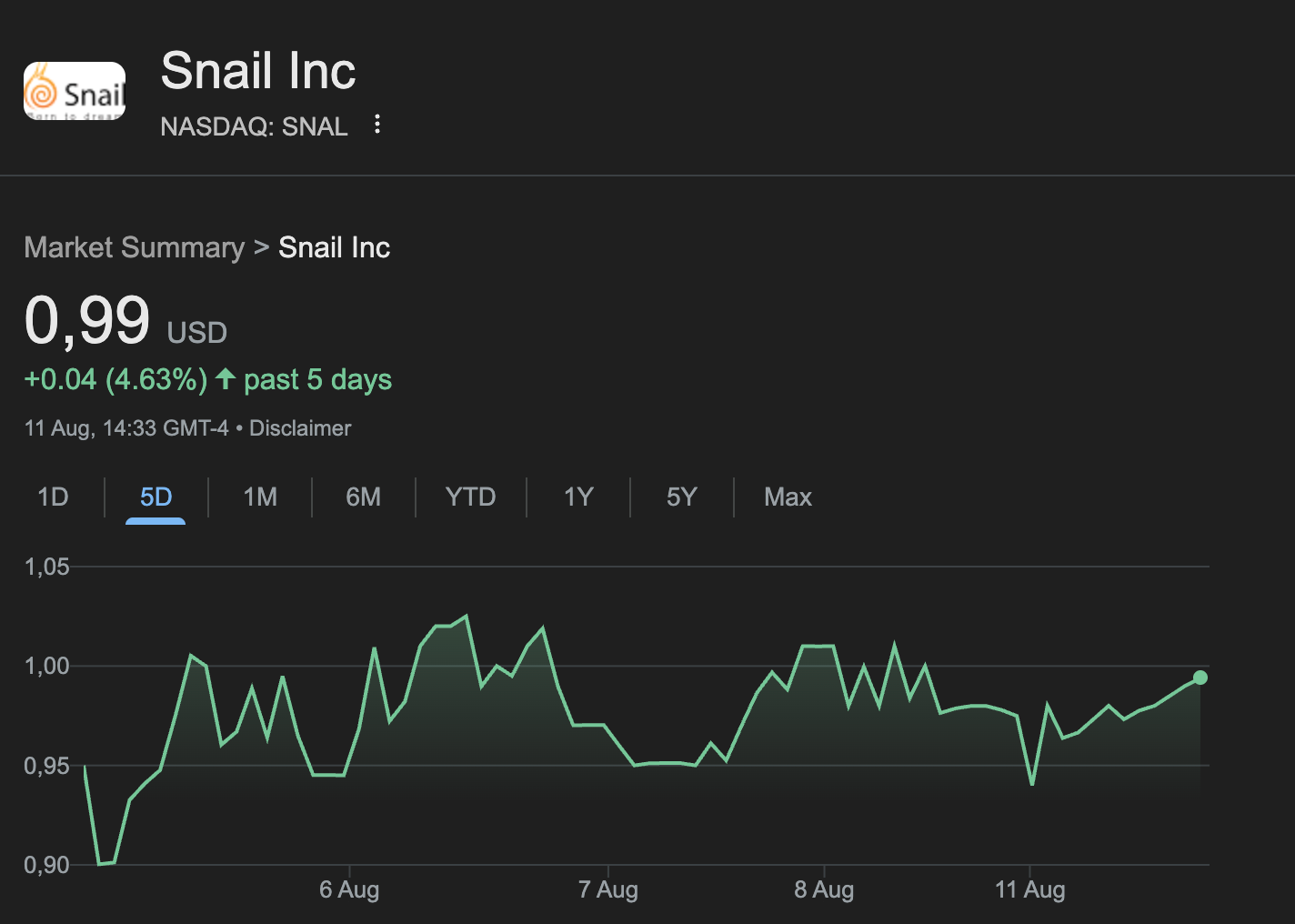

US Subsidiary of Early Chinese Game Dev Snail Digital Explores Stablecoin

CryptoNewsNet·2025/08/11 20:45

GENIUS ban won’t stop institutions from seeking stablecoin yield — ex-Standard Chartered exec

CryptoNewsNet·2025/08/11 20:45

Shocking Reality: Computer Science Jobs Face Unprecedented Challenges Amid AI Revolution

BitcoinWorld·2025/08/11 20:40

Gold Prices Explode: Trump’s Tariff Relief Sparks Remarkable Rally

BitcoinWorld·2025/08/11 20:40

Ripple SEC Settlement: Unprecedented Waiver Sparks Crucial Regulatory Debate

BitcoinWorld·2025/08/11 20:40

Ethereum Gains: Why ETH is Set to Stellarly Outperform Bitcoin in 2025

BitcoinWorld·2025/08/11 20:40

FG Nexus Ether Purchase: A Game-Changing $200 Million Investment

BitcoinWorld·2025/08/11 20:40

Trump China Tariffs: Crucial 90-Day Extension Offers Hope

BitcoinWorld·2025/08/11 20:40

Wisconsin’s Crucial Bitcoin ATM Bill: Understanding New KYC Regulations

BitcoinWorld·2025/08/11 20:40

Flash

- 04:20Bitwise CEO: Bitcoin's annual new supply is much lower than gold and may become a superior store of value assetJinse Finance reported that Bitwise CEO Hunter Horsley stated, "Gold requires a large number of new buyers to maintain price stability or drive prices higher. In 2024, the global gold mining output is about 3,660 tons, with recycled gold amounting to approximately 1,370 tons. At current prices, this means that around $68 billion worth of new gold needs to be purchased (to balance supply and demand). In comparison, bitcoin currently has an annual new issuance of about 164,000 coins, which at current prices means only about $2.4 billion in new supply needs to be absorbed by the market. Therefore, I believe bitcoin will become a superior store of value."

- 04:13Matrixport: Bitcoin Fear Index Drops to 9%, Reaching Extreme Fear Zone; May Signal Short-Term Rebound but Market Sentiment Remains FragileJinse Finance reported that Matrixport released its daily chart analysis, stating, "Our real-time Bitcoin Greed and Fear Index (currently reading at 9%) has once again dropped below 10% (the index ranges from 0% to 100%)—historically, this level marks the market entering an 'extreme fear' state. From a strategic perspective, after such readings appear, the market often experiences a short-term rebound, so this could also serve as a contrarian bullish signal. However, we would prefer to see the 21-day moving average of this index also bottom out and rebound, which has not yet occurred. Coupled with last week's $1.2 billions outflow from Bitcoin exchange-traded funds (BTC ETF), ongoing market uncertainty, and Bitcoin's price remaining below the 21-day moving average, current market sentiment remains fragile. Until a clear macroeconomic or policy catalyst emerges to change the market narrative, maintaining a cautious stance remains the prudent approach."

- 03:50Fintertech, a subsidiary of Daiwa Securities, launches bitcoin-backed yacht purchase loan serviceChainCatcher news, Fintertech, a subsidiary of Daiwa Securities Group, announced that it has begun offering digital asset-backed loans to buyers of the "NOT A GARAGE" shared high-end transportation service. Users holding bitcoin (BTC) or ethereum (ETH) can obtain funds to purchase private jets or yachts without selling their crypto assets. The actual annual interest rate for the first year of the loan is 0% - 3%, and from the second year onwards it is 3.2% - 6%. The maximum loan amount is 500 million yen, with a collateral ratio of 40%. Since October 1, Daiwa Securities has started introducing this loan service at its branches nationwide, further expanding the application scenarios of crypto assets in the high-end consumer sector.