News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.24)|Bitmine Buys Over $200M Worth of ETH Again; U.S. Q3 Real GDP (Annualized) at 4.3%; $200M in Long Liquidations Across the Crypto Market2Bitget US Stock Daily Report | S&P Hits Closing Record High; Gold Breaks $4500 for the First Time; US Q3 GDP Grows 4.3% (December 24, 2025)3Solana: Short-term pain, long-term hope? SOL faces liquidation test

Critical US Crypto Bill Faces Frustrating Delay: Key Issues Push Vote to January

BitcoinWorld·2025/12/13 19:24

Massive 2,265 Bitcoin Transaction: What This $205 Million Mystery Move Means for Crypto

BitcoinWorld·2025/12/13 19:24

Critical Alert: BOJ Interest Rates May Trigger Bitcoin’s Next Major Move

BitcoinWorld·2025/12/13 19:24

SOL Spot ETF Inflows Surge: $700M Milestone Nears Amid Powerful 7-Day Buying Streak

BitcoinWorld·2025/12/13 19:24

YouTube Enables PYUSD Payouts for US Creators, Boosting Stablecoin Adoption

DeFi Planet·2025/12/13 19:24

Bitcoin Doesn’t Hold Real Value, Says RBI Deputy Governor

Coinpedia·2025/12/13 19:12

Coinpedia Digest: This Week’s Crypto News Highlights | 13th December, 2025

Coinpedia·2025/12/13 19:12

Ripple News Today: VivoPower Launches $300M Institutional Ripple Equity Fund

Coinpedia·2025/12/13 19:12

Singapore Gulf Bank Launches Zero-Fee Stablecoin Minting on Solana Network

Coinpedia·2025/12/13 19:12

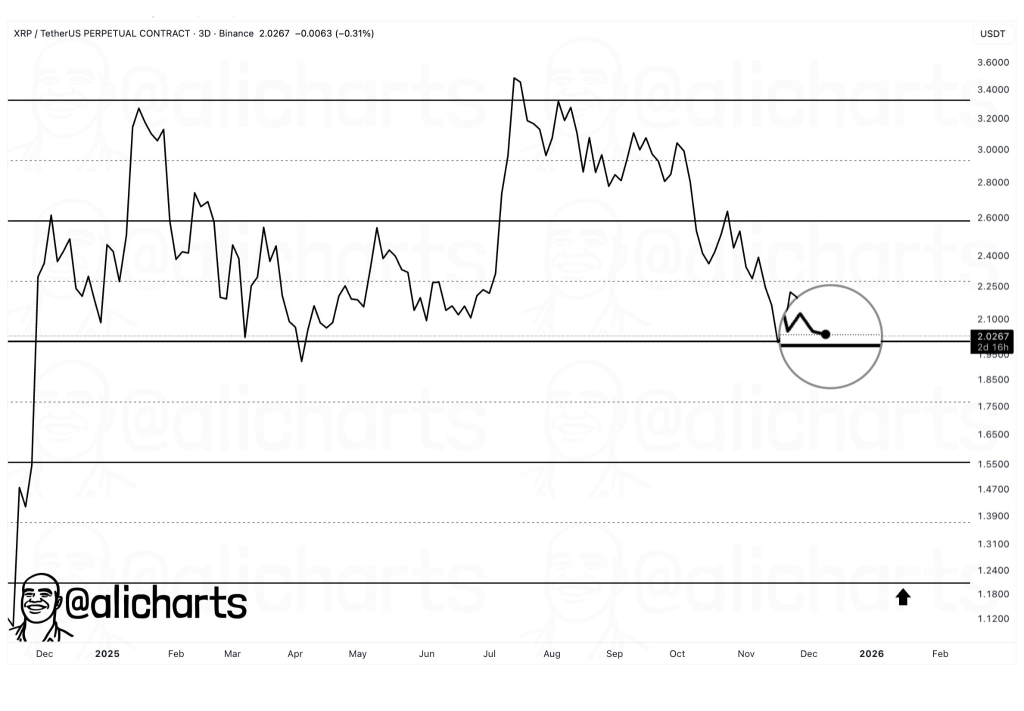

XRP Price Holds $2 as Ripple’s OCC Bank Approval Redefines Crypto’s Institutional Path

Coinpedia·2025/12/13 19:12

Flash

02:38

James Wynn added to his BTC long position and opened a new 10x long position on PEPE.BlockBeats News, December 24th, according to Onchain Lens monitoring, James Wynn increased his BTC 40x leveraged long position, with his current position worth approximately $1.48 million. He also added a new long position on PEPE with 10x leverage, worth around $117,000.

02:32

Suspected Arrington Capital unstakes nearly 5.7 million ETHFI tokens, worth approximately $4.04 millionAccording to TechFlow, on December 24, on-chain analyst The Data Nerd (@OnchainDataNerd) monitored that a wallet address suspected to belong to Arrington Capital unlocked 5.68 million ETHFI tokens (approximately $4.04 million) from the EthFi protocol 5 hours ago. This wallet also received an additional 3.24 million ETHFI tokens from the token unlocking plan in the past three months.

02:32

glassnode analyst: Bitcoin market pressure emerges as long-term holders slow down profit-taking salesForesight News reported that glassnode Chief Research Analyst CryptoVizArt stated in a post that the market weakness warned about in November has now largely materialized, and it is necessary to reassess these signals and reevaluate the overall market structure. Excessive selling by long-term holders (LTH) continues to put pressure on the market's absorption capacity. Since bitcoin prices broke through the historical highs of 2021-2022, long-term holders have realized profits on approximately 3.8 million bitcoins. However, the pace of selling by long-term holders has recently slowed down, and the continued cooling of this profit-taking activity is a key prerequisite for forming a lasting bottom pattern. The current scale of unrealized losses has stabilized at over 5% of the total market capitalization, marking the highest level of pressure in this cycle so far. Although the pressure is significant, it remains far below the extreme loss conditions seen during deep bear markets, such as the FTX collapse period. In the current price range of around $90,000, about 20-30% of the bitcoin supply is in a loss position. This market configuration is very similar to the first quarter of 2022—there is obvious market pressure, but the typical widespread capitulation seen in the later stages of a bear market has not yet occurred.

News