News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

In Brief Arthur Hayes rapidly ramps up altcoin purchases amid market optimism. His acquisitions include Ethereum, Pendle, Lido DAO, and Ether.fi. Market sentiment shifts to "greed" territory, aligning with Hayes’s strategic timing.

In Brief HBAR displays a sideways trend, declining 2% in 24 hours against market uptrends. Coinglass data shows $6.42 million outflows, indicating cautious investor sentiment. Technical indicators suggest continued weakening, with potential price pressure intensifying.

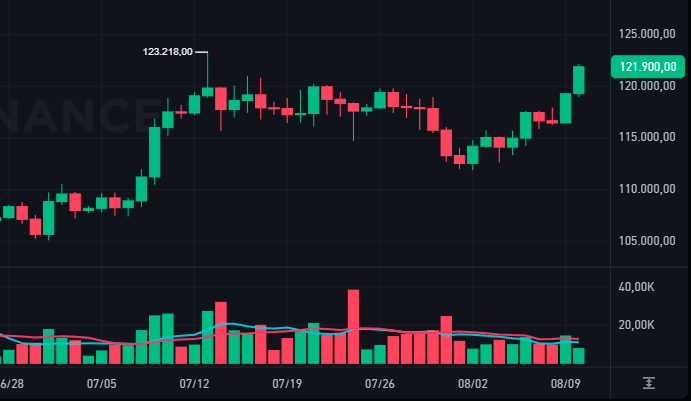

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

- 04:20Bitwise CEO: Bitcoin's annual new supply is much lower than gold and may become a superior store of value assetJinse Finance reported that Bitwise CEO Hunter Horsley stated, "Gold requires a large number of new buyers to maintain price stability or drive prices higher. In 2024, the global gold mining output is about 3,660 tons, with recycled gold amounting to approximately 1,370 tons. At current prices, this means that around $68 billion worth of new gold needs to be purchased (to balance supply and demand). In comparison, bitcoin currently has an annual new issuance of about 164,000 coins, which at current prices means only about $2.4 billion in new supply needs to be absorbed by the market. Therefore, I believe bitcoin will become a superior store of value."

- 04:13Matrixport: Bitcoin Fear Index Drops to 9%, Reaching Extreme Fear Zone; May Signal Short-Term Rebound but Market Sentiment Remains FragileJinse Finance reported that Matrixport released its daily chart analysis, stating, "Our real-time Bitcoin Greed and Fear Index (currently reading at 9%) has once again dropped below 10% (the index ranges from 0% to 100%)—historically, this level marks the market entering an 'extreme fear' state. From a strategic perspective, after such readings appear, the market often experiences a short-term rebound, so this could also serve as a contrarian bullish signal. However, we would prefer to see the 21-day moving average of this index also bottom out and rebound, which has not yet occurred. Coupled with last week's $1.2 billions outflow from Bitcoin exchange-traded funds (BTC ETF), ongoing market uncertainty, and Bitcoin's price remaining below the 21-day moving average, current market sentiment remains fragile. Until a clear macroeconomic or policy catalyst emerges to change the market narrative, maintaining a cautious stance remains the prudent approach."

- 03:50Fintertech, a subsidiary of Daiwa Securities, launches bitcoin-backed yacht purchase loan serviceChainCatcher news, Fintertech, a subsidiary of Daiwa Securities Group, announced that it has begun offering digital asset-backed loans to buyers of the "NOT A GARAGE" shared high-end transportation service. Users holding bitcoin (BTC) or ethereum (ETH) can obtain funds to purchase private jets or yachts without selling their crypto assets. The actual annual interest rate for the first year of the loan is 0% - 3%, and from the second year onwards it is 3.2% - 6%. The maximum loan amount is 500 million yen, with a collateral ratio of 40%. Since October 1, Daiwa Securities has started introducing this loan service at its branches nationwide, further expanding the application scenarios of crypto assets in the high-end consumer sector.