News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Hyperliquid’s HYPE token repurchased 8.7% of supply via $1.26B buybacks and burned 3,200 tokens in 24 hours, tightening float and creating bullish bias. - Whale wallets spent $35.9M to accumulate 641,551 HYPE tokens, driving 2.5–5.8% price surges and signaling institutional coordination. - Technical indicators show sustained upward momentum, with HYPE gaining 7.5% in August despite broader market declines, supported by $105M fee-funded buybacks. - Risks include Bitcoin correlation and whale manipulation

- Ethereum's institutional adoption accelerated in 2025 as corporate treasuries and ETFs controlled 9.2% of its supply, reshaping market dynamics. - 19 public companies and BlackRock's ETHA ETF dominated inflows, with $17.6B in corporate holdings and $27.66B in ETF assets by Q3 2025. - Regulatory clarity and yield-generating strategies reduced circulating supply, enhancing price resilience and positioning Ethereum as a regulated institutional asset. - Institutional accumulation created a flywheel effect, r

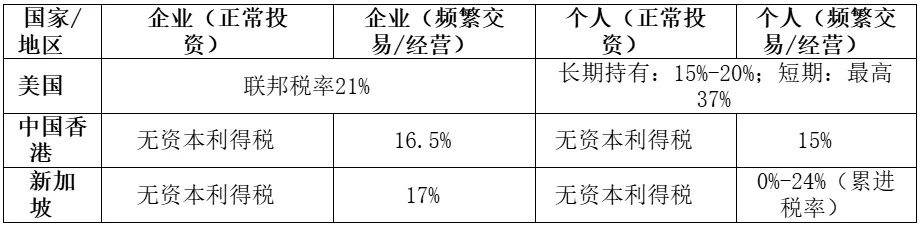

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- Bitcoin faces critical $110K–$112K resistance as on-chain metrics and institutional dynamics clash over bullish vs. bearish trajectories. - Taker-Buy-Sell ratio (-0.945) signals bearish pressure, while MVRV compression (1.0) suggests potential bull market rebalancing. - Institutional buyers accumulate during dips, offsetting whale-driven selling and ETF outflows amid $30.3B futures open interest. - Fed rate cut expectations and geopolitical risks create macro uncertainty, with 200-day SMA ($100K–$107K) a

- XRP faces a $3.08 breakout threshold, with technical indicators and institutional buying signaling potential for a $5.85 surge. - Post-SEC settlement, 60+ institutions now use XRP for cross-border payments, processing $1.3T via Ripple's ODL in Q2 2025. - $1.1B in institutional XRP purchases and seven ETF providers targeting $4.3B-$8.4B inflows by October 2025 reinforce bullish momentum. - A $3.65 price break would invalidate bearish patterns, while $50M+ weekly institutional inflows could validate the $5

- 08:58Dune releases in-depth report on prediction markets: Prediction markets are accelerating towards mainstream finance, with Opinion as a leading macro prediction market case, surpassing $6.4 billion in trading volume within 50 days.Dune Releases In-Depth Report on Prediction Markets: Prediction Markets Accelerate Toward Mainstream Finance, Opinion Leads as a Macro Prediction Market Example with Over $6.4 Billion in Trading Volume Within 50 Days 2025-12-17 08:54 BlockBeats news, on December 17, Dune, together with several institutions including Keyrock and KPMG, recently released an industry report on prediction markets. The report points out that macro-oriented prediction markets integrated with traditional institutions are rapidly heating up. Among them, prediction markets represented by Opinion are standardizing macroeconomic indicators such as inflation, interest rates, and employment into tradable assets, becoming a key example of prediction markets accelerating into mainstream finance. The report shows that trading activity on Opinion has grown rapidly, with cumulative nominal trading volume exceeding $6.4 billion within 50 days of launch, and single-day trading volume surpassing $200 million multiple times, ranking first in the industry. Original Link Report Correction/Report This platform is now fully integrated with the Farcaster protocol. If you already have a Farcaster account, you can log in to post comments

- 08:56JustLend DAO TVL surpasses $6.47 billionAccording to official news from Odaily, the latest weekly report from JustLend DAO, the leading decentralized lending protocol on TRON, shows that the platform's total value locked (TVL) has surpassed $6.47 billion, with cumulative incentives distributed exceeding $192 million, and global users now numbering over 480,000. As the core DeFi infrastructure within the TRON ecosystem, JustLend DAO is demonstrating the robust vitality of the DeFi market with strong data, providing efficient on-chain lending services to users worldwide.

- 08:55Dune Releases Prediction Market Liquidity Report: Prediction Markets Accelerating Towards Mainstream Finance, Opinion Leading the Way as a Macro Prediction Market Pioneer, with Trading Volume Surpassing $6.4 Billion within 50 DaysBlockBeats News, December 17th, Dune recently released a Forecast Markets Industry Report in collaboration with Keyrock, KPMG, and other institutions, stating that the macro-oriented forecast market combined with traditional institutions is rapidly heating up. In this trend, the prediction market represented by Opinion is standardizing macroeconomic indicators such as inflation, interest rates, and employment into tradable assets, becoming a key example of the forecast market accelerating towards mainstream finance. The report shows that Opinion's trading activity is rapidly growing, with a cumulative nominal trading volume exceeding $6.4 billion within 50 days of launch. The daily trading volume has surpassed $200 million multiple times, ranking first in the industry.

Trending news

MoreDune releases in-depth report on prediction markets: Prediction markets are accelerating towards mainstream finance, with Opinion as a leading macro prediction market case, surpassing $6.4 billion in trading volume within 50 days.

Altcoins update: XRP ETFs hit $1B in inflows; whales offload Ethereum