News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

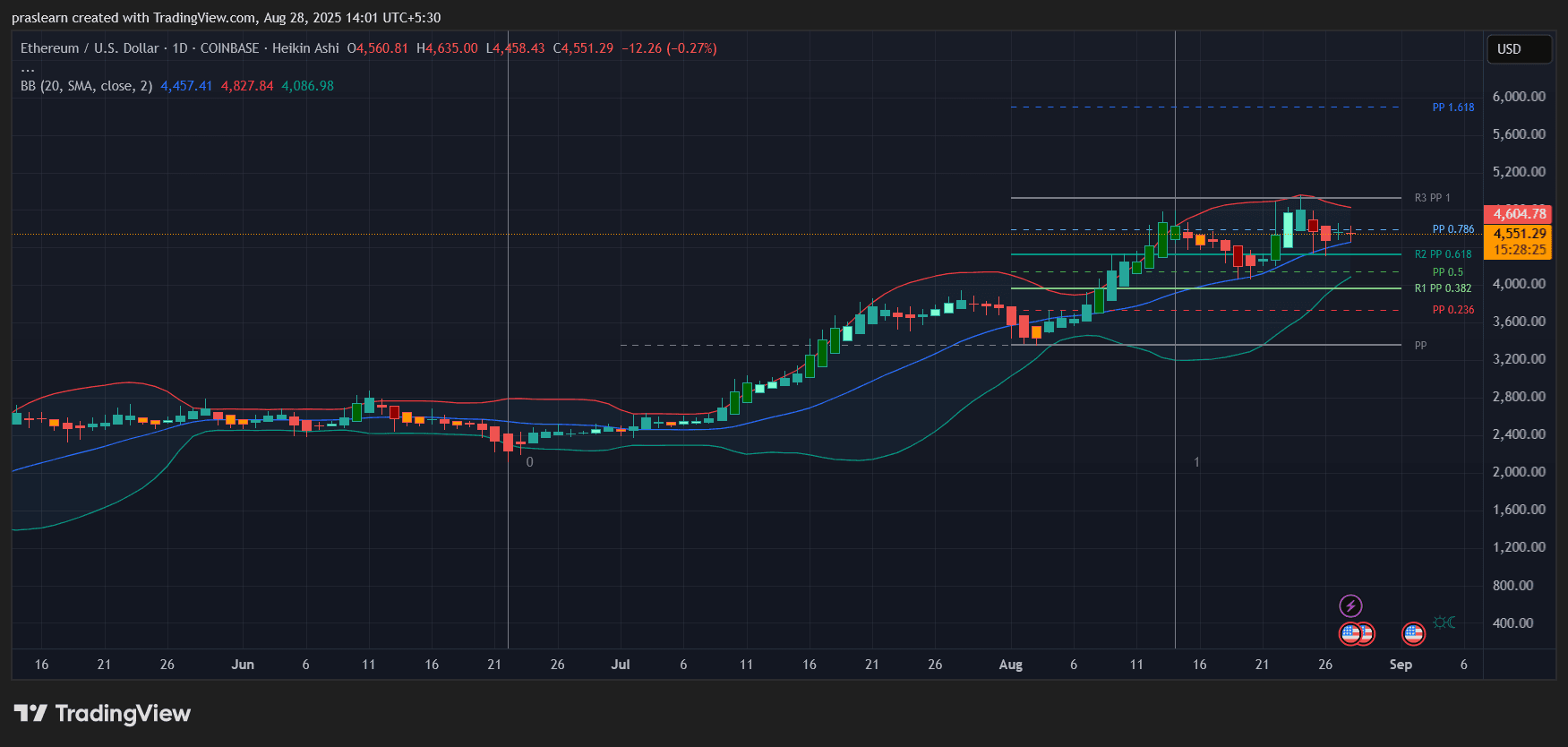

- Ethereum's dynamic deflationary model, driven by EIP-1559 and institutional buying, is challenging Bitcoin's dominance by creating engineered scarcity. - BitMine's weekly ETH purchases and staking strategy reduced supply by 45,300 ETH in Q2 2025, boosting staking yields and institutional confidence. - Ethereum ETFs attracted $9.4B in Q2 2025, outpacing Bitcoin, as institutions view ETH as a utility asset with compounding value. - Analysts project Ethereum's market cap to overtake Bitcoin by 2025, driven

- INJ surged 217.72% in 24 hours to $13.62 on Aug 28, 2025, followed by a 747.79% seven-day drop. - Analysts attribute volatility to on-chain activity, tokenomics changes, and shifting market sentiment. - Despite a 310.61% monthly gain, INJ fell 3063.2% annually, highlighting speculative momentum over intrinsic value. - Technical indicators confirm high volatility, with sharp spikes and reversals typical of leveraged crypto assets.

- Fed's dovish pivot boosts risk assets as rate cuts loom, with 50% chance of September 2025 easing. - Ethereum's 41% August surge and Dencun upgrades drive altcoin momentum, with S Coin (S) emerging as strategic play. - S Coin's $650M TVL surge, FeeM model, and Ethereum alignment position it for capital inflows amid macro-driven crypto reallocation. - Institutional ETFs holding 8% ETH supply and S Coin's $0.3173 price consolidation highlight market structure shifts. - Technical indicators suggest S Coin c

- Solana (SOL) surges past $208, hitting 13.8% weekly gains with $112.66B market cap and record $13.08B open interest. - Technical indicators (RSI 57.93, positive MACD) and DEX volume spikes ($7.1B) signal strong bullish momentum and ecosystem growth. - Robinhood micro futures and Pantera's $1.25B Solana-focused fund drive retail/institutional liquidity and price stability. - Bulls target $213-$250+ as key resistance, but risks include potential pullbacks below $200 and delayed SEC ETF approvals.

- 02:29Data: The crypto market saw a broad decline, with the Layer2 sector leading the drop by 3.59%, and BTC briefly falling below $88,000.ChainCatcher News, according to SoSoValue data, the entire crypto market has declined, with the Layer2 sector leading the drop by 3.59%. Celestia (TIA) fell by 4.83%, Mantle (MNT) dropped by 5.67%, but Movement (MOVE) bucked the trend and rose by 8.16%. In addition, Bitcoin (BTC) fell by 1.36%, once dropping below $88,000, but has now rebounded above $89,000. Ethereum (ETH) declined by 0.31%, falling to $3,000 before rebounding above $3,100. In other sectors, the Layer1 sector fell by 1.25% over 24 hours, but TRON (TRX) rose by 2.38%. The CeFi sector dropped by 1.37% in 24 hours, with Canton Network (CC) relatively resilient, up by 1.64%. The PayFi sector fell by 1.52%, with Trust Wallet (TWT) surging by 1.84% during trading. The Meme sector dropped by 2.00%, with PIPPIN (PIPPIN) up by 2.21%. The DeFi sector fell by 2.39%, while MYX Finance (MYX) bucked the trend and rose by 3.67%. The crypto sector indices reflecting historical sector performance show that the ssiLayer1, ssiCeFi, and ssiLayer2 indices fell by 0.75%, 1.33%, and 3.93% respectively.

- 02:29MetaPlanet to hold a special shareholders' meeting on December 22 to discuss the preferred stock issuance proposalChainCatcher News, MetaPlanet will hold a special shareholders' meeting on December 22 (Monday), with the main agenda focusing on an important proposal regarding the future issuance of preferred shares. This proposal is of critical significance to the company's medium- and long-term strategy. The company urges all shareholders to actively participate in the vote. Previous reports indicated that MetaPlanet will issue a new class of shares, similar to Strategy's $STRC.

- 02:20MoonPay President: Meme Coins Will Revive in New FormsChainCatcher news, according to Cointelegraph, MoonPay President Keith Grossman believes that meme coins have not disappeared; their core innovation lies in tokenizing attention at a low cost, breaking the platform monopoly in the attention economy. He pointed out that before crypto technology, only platforms, brands, and a few influencers could monetize attention, while the value created by ordinary users—such as likes and trends—was captured by centralized platforms. According to CoinGecko data, meme coins were once the best-performing crypto asset class in 2024, but suffered heavy losses in Q1 2025 due to multiple collapses. The meme coin issued before Trump’s inauguration plummeted from $75 to $5.42, a drop of over 90%; the Libra token endorsed by Argentine President Milei collapsed, with 86% of holders losing more than $1,000 per transaction, triggering investigations and calls for impeachment. Grossman compared the current pessimistic forecasts to the misjudgments after the social media bubble burst in the early 2000s, believing that meme coins will revive in new forms.