News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.25)|Mt. Gox Hacker May Have Sold 1,300 BTC Within 7 Days; Metaplanet Plans to Accumulate 210,000 BTC by End-2027; U.S. Initial Jobless Claims Come in at 214,0002Where Did the Funds Go After the Meme Craze? Deep Dive into the Prediction Market Track and the Top 5 Dark Horses on the BNB Chain3 BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

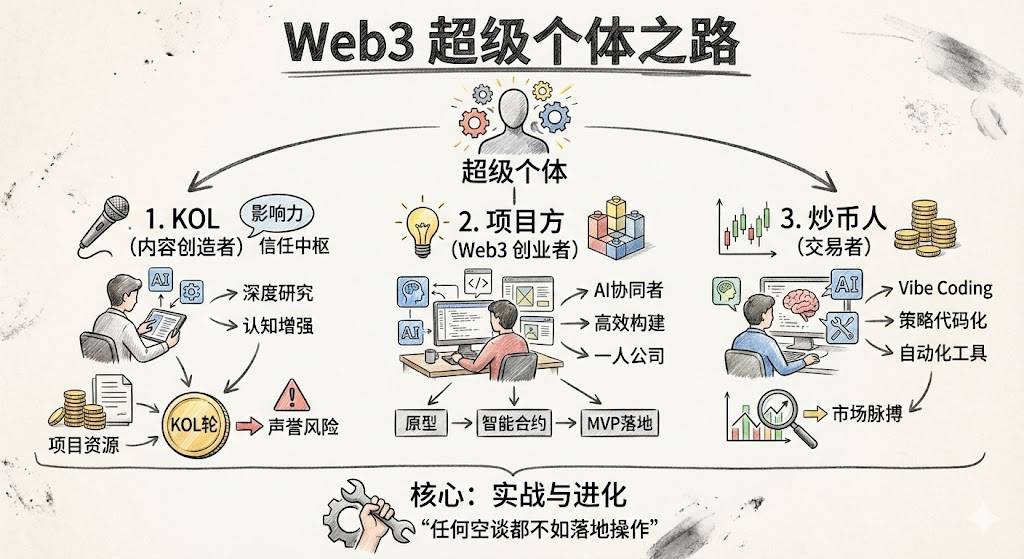

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.

深潮·2025/12/12 02:36

Big Short Burry warns: Fed's RMP aims to cover up banking system vulnerabilities, essentially restarting QE

Michael Burry warned that the Federal Reserve has effectively restarted quantitative easing under the guise of "reserve management purchases," exposing that the banking system is still reliant on central bank liquidity for survival.

ForesightNews·2025/12/12 02:12

Bitcoin just exposed a terrifying link to the AI bubble that guarantees it crashes first when tech breaks

CryptoSlate·2025/12/12 02:00

Crypto : Trading Volumes Collapse as the Market Stalls, According to JPMorgan

Cointribune·2025/12/12 01:57

Bitcoin : After the Rate Cut, Traders Prepare for an Explosive 2026

Cointribune·2025/12/12 01:57

Crucial Bitcoin Options Worth $3.67 Billion Expire Today: What Traders Must Know

BitcoinWorld·2025/12/12 01:51

Revealing the Stagnant Signal: Altcoin Season Index Stuck at 17 – What’s Next for Crypto?

BitcoinWorld·2025/12/12 01:51

Crucial US Senate Vote on CFTC and FDIC Chairs: A Defining Moment for Crypto Regulation

BitcoinWorld·2025/12/12 01:51

Unlock DeFi: Hex Trust Launches Secure wXRP Issuance and Custody Services

BitcoinWorld·2025/12/12 01:51

Flash

06:52

The "Altcoin Bears Leader" shifts to a defensive stance before the holiday, closing most short positions and increasing HYPE hedging positions.BlockBeats News, December 25, according to Coinbob Hot Address Monitoring, the "Altcoin Short Army Leader" has recently been continuously adjusting short positions, shifting from a focus on shorting to a more defensive stance. In recent days, it has successively closed short positions in several tokens such as ASTER, UNI, and PUMP, and used the released margin to buy HYPE spot and open corresponding short positions for hedging. The hedged position has now increased to about $7.8 million. In addition, this address has completely cleared its holdings in MON, ZEC, TRUMP, and other tokens within this week, and withdrew about $2 million 24 hours ago. Currently, its total position size is about $23.08 million. Besides the HYPE hedging portfolio, it mainly still holds ETH short positions (about $4.94 million), ASTER short positions (about $3.78 million), and UNI short positions (about $3.04 million). This address has recently focused mainly on shorting, having fully closed 10 short positions since the beginning of this month, and is skilled at capturing altcoin volatility opportunities. Data shows that it has realized a profit of about $7.1 million in the past 30 days, with a historical cumulative profit of $82.85 million.

06:50

XRP ETF inflows surpass $1.25 billion, price remains range-boundThe total assets of the XRP ETF have increased to $1.25 billion, with institutional investors recently adding $8.19 million in capital inflows, indicating a preference for structured products. Although demand for spot ETFs remains stable, the price of XRP continues to fluctuate within the $1.85 to $1.91 range. There is strong selling pressure near $1.90 and persistent buying interest around $1.86, suggesting the market may be facing a critical breakout.

06:48

Analysis: L1 tokens have generally performed poorly this year, with ETH down over 15% and SOL down over 35%According to ChainCatcher, statistics from Castle Labs show that L1 tokens have generally performed poorly this year: TON dropped by 73.8%, AVAX fell by 67.9%, SUI decreased by 67.3%, SOL declined by 35.9%, ETH dropped by 15.3%, and HYPE fell by 6.5%. Only BNB and TRX recorded positive gains of 18.2% and 9.8%, respectively.

News