News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.25)|Mt. Gox Hacker May Have Sold 1,300 BTC Within 7 Days; Metaplanet Plans to Accumulate 210,000 BTC by End-2027; U.S. Initial Jobless Claims Come in at 214,0002Where Did the Funds Go After the Meme Craze? Deep Dive into the Prediction Market Track and the Top 5 Dark Horses on the BNB Chain3 BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

Exclusive: Expert Reveals How XRP Price Can Hit $10 And Above

Coinpedia·2025/12/11 02:09

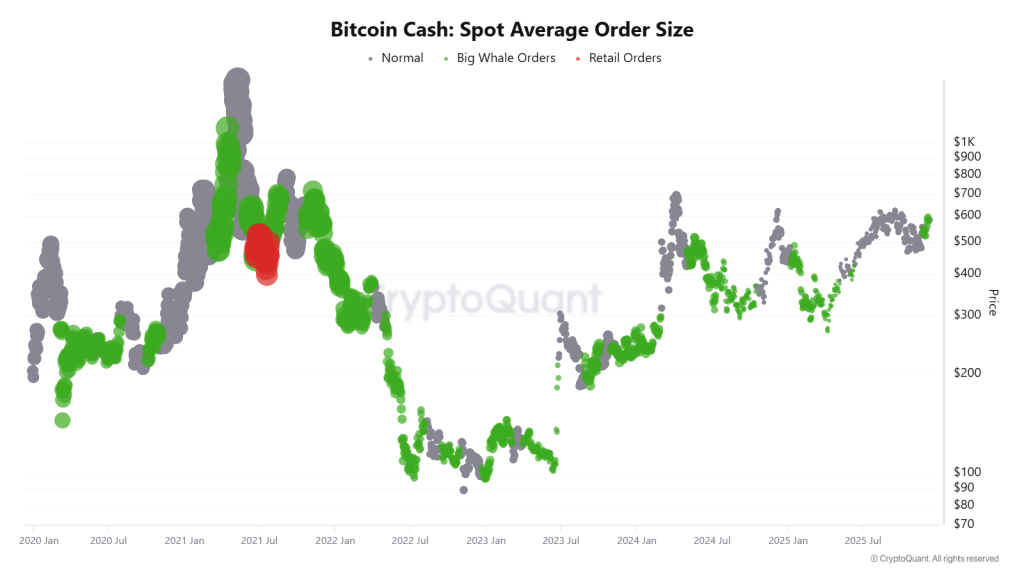

Bitcoin Cash Price Gains Momentum as Merchant Adoption Surges and Whales Accumulate

Coinpedia·2025/12/11 02:09

Pi Network News: Analyst Says $307 Pi Price Claim in Lawsuit Has ‘Zero Basis’ in Reality

Coinpedia·2025/12/11 02:09

FOMC Crypto Crash Alert: Why Bitcoin and XRP Prices Are Falling Today

Coinpedia·2025/12/11 02:09

Bitcoin Price Aims For $99k as Fed Initiates 25 Bps Rate Cut Amid Onset of QE

Coinpedia·2025/12/11 02:09

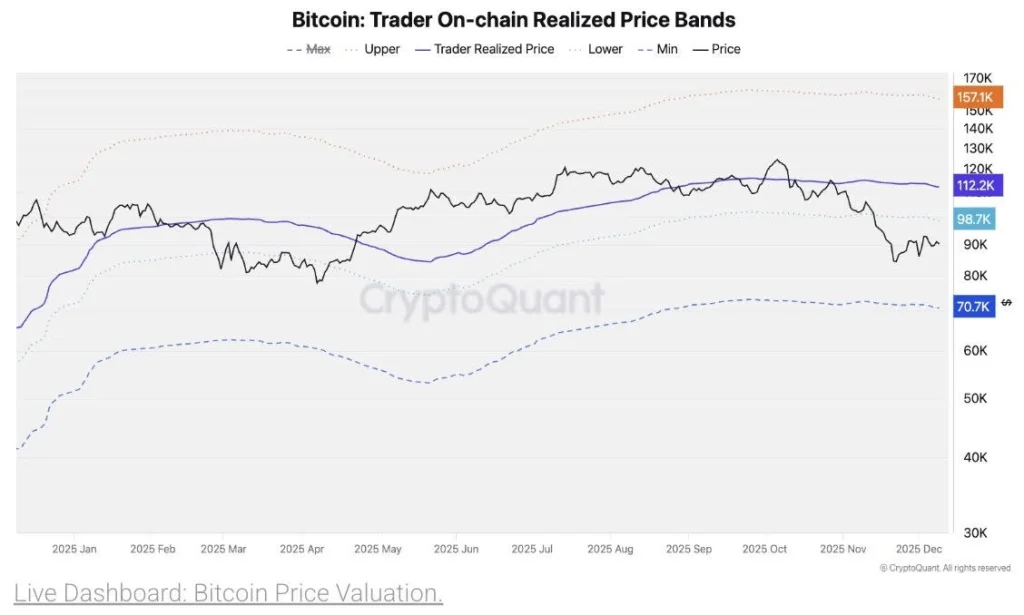

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Cointelegraph·2025/12/10 23:21

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

Cointelegraph·2025/12/10 23:21

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

ForesightNews 速递·2025/12/10 22:32

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

MarsBit·2025/12/10 21:24

Flash

10:18

PlanB: Now is the buy-the-dip opportunity in the ETH bottom range, with 2026 expected to be a strong bull market.BlockBeats News, December 25th, Liquid Capital (formerly LD Capital) founder Daniel organized a post on social media stating, "Paper losses are all short-term, and the long-term trend is a bull market. First, from bottom-fishing earlier this year, to selling before 1011, and then to bottom-fishing now, all actions have been transparent and consistent."

Second, Liquid Capital is not blindly confident in bottom-fishing on a large scale just because their previous moves were correct. The team's daily efforts and research results all indicate that the current range is the bottom, and 2026 will see a major bull market. We do not want to miss out on a few thousand dollars of gains due to a few hundred dollars of volatility. We are prepared to continue buying ETH on dips with a $1 billion allocation."

In a report today, it was revealed that Daniel's Trend Research currently holds 645,000 ETH at an average price of $3150, with a current unrealized loss of $143 million.

10:14

RWA becomes the best crypto track for 2025, Solana ecosystem suffers a major setbackAccording to Deep Tide TechFlow, on December 25, citing data from SolanaFloor and Coingecko, RWA (Real World Assets) has become the best-performing crypto sector in 2025, with an average return of 185.8% year-to-date. In stark contrast, the GameFi and DePIN sectors have performed poorly, declining by 75.2% and 76.7% respectively. Although Solana leads in terms of attention, its ecosystem still recorded the third largest decline in the market.

10:14

Yilihua: Floating losses are only temporary, 2026 will be a major bull market, and $1 billion will continue to be used to buy ETH on dips.According to Odaily, Liquid Capital founder Yi Lihua posted on X, stating: "Unrealized losses are all short-term; the long-term trend is a bull market. First, from bottom-fishing earlier this year, to selling at the top before 10/11, and now bottom-fishing again, we have always been transparent and consistent in our actions and words. Second, we are not blindly confident in large-scale bottom-fishing just because our previous operations were correct. The team's daily research and investment efforts all indicate that this is the bottom range, and 2026 will be a major bull market. Lastly, as always, we don't want to miss out on thousands of dollars in gains just because of a few hundred dollars of volatility. We will continue to buy ETH on dips with 1 billion USD."

News