News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

You can offer services in this "world crypto capital," but you might only see this world from behind bars.

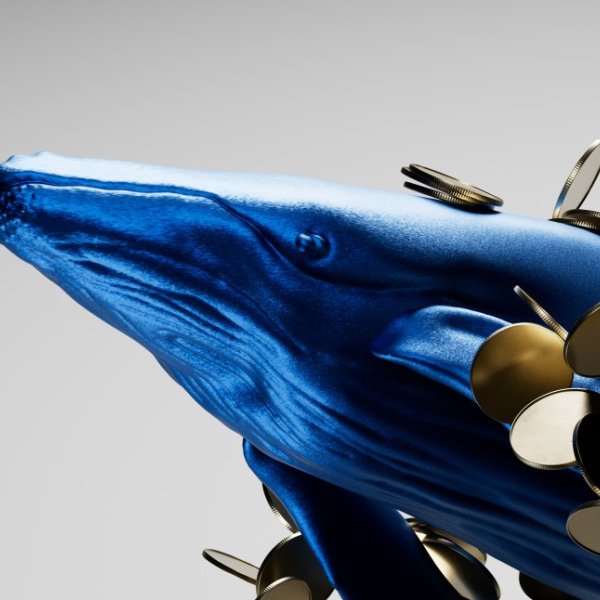

Wealthy investors almost never sell cryptocurrencies directly; instead, they use methods such as collateralized lending, immigration strategies, and offshore entities to protect their profits.

- JASMY surged 19.61% to $0.01542 after completing a key phase in its decentralized data marketplace infrastructure. - The blockchain-based platform enables secure data ownership and monetization through expanded partnerships and technical upgrades. - A new data indexing module improves scalability, while community-driven governance strengthens decentralization and trust. - Analysts highlight long-term potential despite volatility, citing 138.89% 30-day gains and strategic ecosystem expansion.

- Female founders in Europe are securing funding despite venture capital slowdowns, showcasing resilience in climate tech and AI sectors. - They face societal pressures to conform to "girlboss" ideals, risking backlash when deviating from perfectionist expectations. - Startups like Wallround and Seabound highlight women-led innovation in energy efficiency and maritime decarbonization. - Investors increasingly prioritize business results over labels, signaling growing acceptance of authentic female leadersh

- Major crypto firms consider $1B investment in Solana (SOL), potentially boosting demand and price to $240–$260. - Technical analysis highlights $210 resistance level; a weekly close above $215 could confirm a breakout. - SOL shows relative strength against ETH and BTC, with key support levels at 0.043 and 0.0015 indicating potential outperformance. - Analysts warn of potential pullback to $170–$150 if $210 resistance fails, though $150 support could maintain long-term bullish trends.

- Stellar Lumens (XLM) forms an inverse head-and-shoulders pattern, suggesting potential breakout to $0.71 if it stays above $0.33, supported by cross-border payment partnerships and ETF inclusion prospects. - Dogecoin (DOGE) shows RSI normalization and a 4-hour inverse head-and-shoulders pattern, indicating possible rise to $0.32, though dependent on sustained volume and market sentiment. - Cold Wallet (CWT) distinguishes itself with a utility-driven cashback model, offering gas fee refunds and attracting

- Algorand partners with XBTO to boost ALGO liquidity via institutional-grade market-making. - Enhanced liquidity aims to stabilize markets and support enterprise adoption in sectors like healthcare and finance. - Algorand’s PPoS consensus enables 10,000+ TPS, driving growth in tokenization and DeFi use cases. - Institutional confidence rises as 83% of investors plan increased crypto allocations by 2025. - Despite 2025 roadmap advancements, ALGO’s price dropped 10% post-announcement.

- DeFi protocols like Aave and Uniswap are rebundling through vertical integration to enhance control, security, and user retention. - Aave launched its GHO stablecoin and internal MEV capture tools, reducing reliance on third-party services while expanding platform value capture. - Uniswap introduced a native wallet, Uniswap X, and its own Layer-2 chain (Unichain) to retain users and optimize trading efficiency. - Automated token validation tools are accelerating this shift by improving security, aligning

- XRP's 2025 strategic breakout stems from SEC lawsuit resolution, ETF approvals, and institutional adoption, redefining its role as a foundational infrastructure token. - Legal clarity post-SEC dismissal enabled ProShares Ultra XRP ETF to attract $1.2B AUM, with 300+ institutions using RippleNet for cross-border payments. - Product innovations like EVM compatibility, MPTs, and on-chain lending tools expanded XRP's utility in DeFi and traditional finance, reducing transaction costs by 70% for banks. - Whal

- CFTC faces regulatory limbo with only one confirmed commissioner, delaying crypto market oversight and creating compliance uncertainty. - Brian Quintenz's controversial nomination, linked to CFTC-regulated Kalshi, risks politicizing crypto regulation and deepening enforcement gaps. - Investors face dual risks: delayed rulemaking and enforcement weaknesses, but also opportunities for DeFi firms and RegTech providers in regulatory gray areas. - Bipartisan fragmentation threatens policy divergence, while st