News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Spot XRP ETFs saw $38M inflows, outperforming BTC, ETH, and SOL. XRP price tests key $2.04 support, with potential downside toward $1.64-$1.73.

ONDO trading volume jumped 150% on Dec. 9 as the SEC officially closed its multi year investigation into the project.

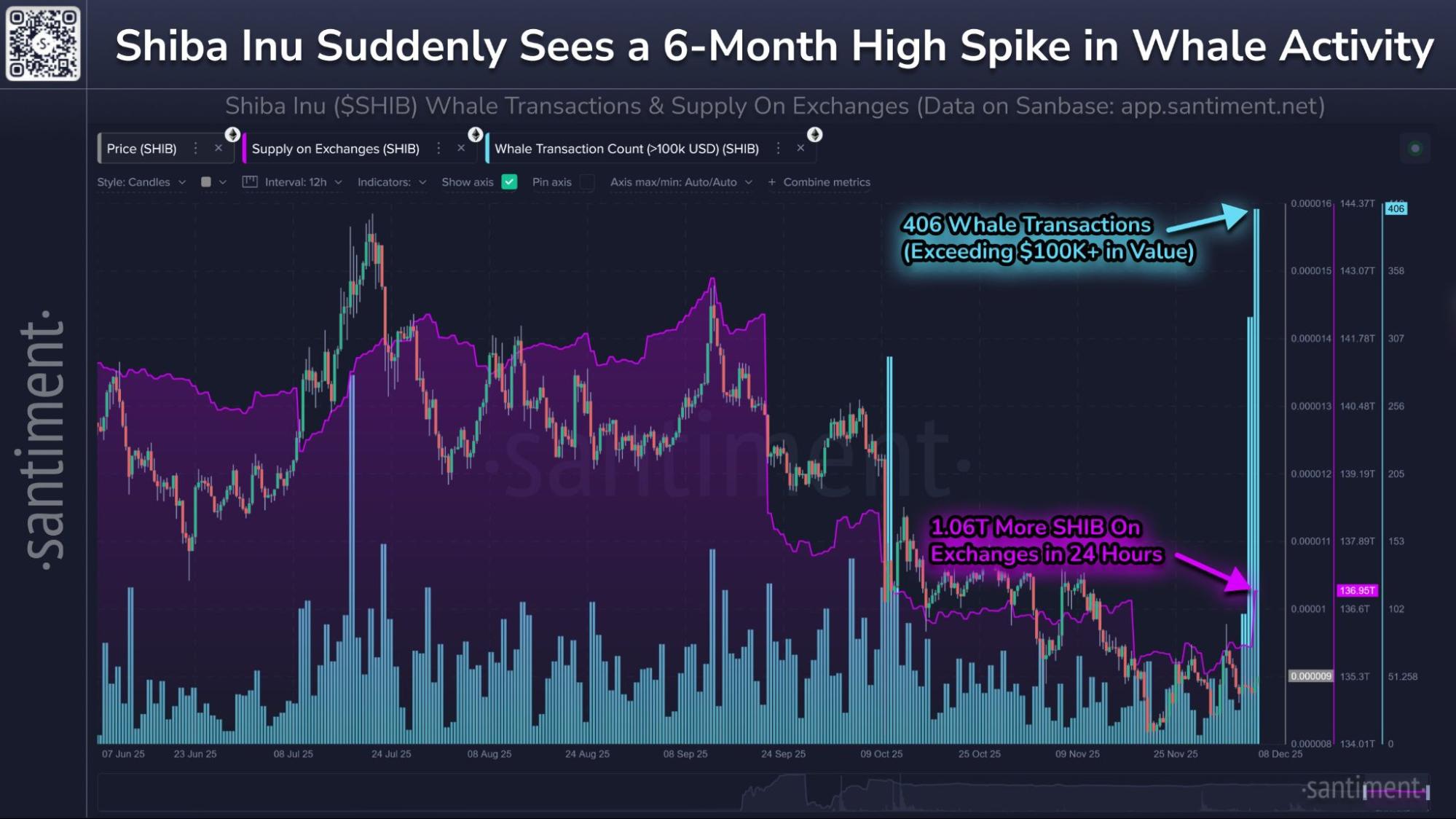

Shiba Inu recorded a major surge in whale activity, with over 1 trillion tokens sent to exchanges in 24 hours, as experts cite SHIB price volatility ahead.

Crypto liquidations fell by more than 50% as the market consolidated. Top whales on Hyperliquid are taking a U-turn on their bearish stance.

The OCC confirmed banks can facilitate riskless principal crypto transactions without prior approval, marking a regulatory shift toward integrating traditional finance with digital asset markets.

Stripe and Paradigm opened Tempo’s public testnet, inviting companies to build stablecoin payment apps with fixed 0.1-cent fees and predictable settlement.