News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Cantor Fitzgerald Discloses Major Stake in Solana ETF, Signalling Institutional Embrace

DeFi Planet·2025/12/02 19:03

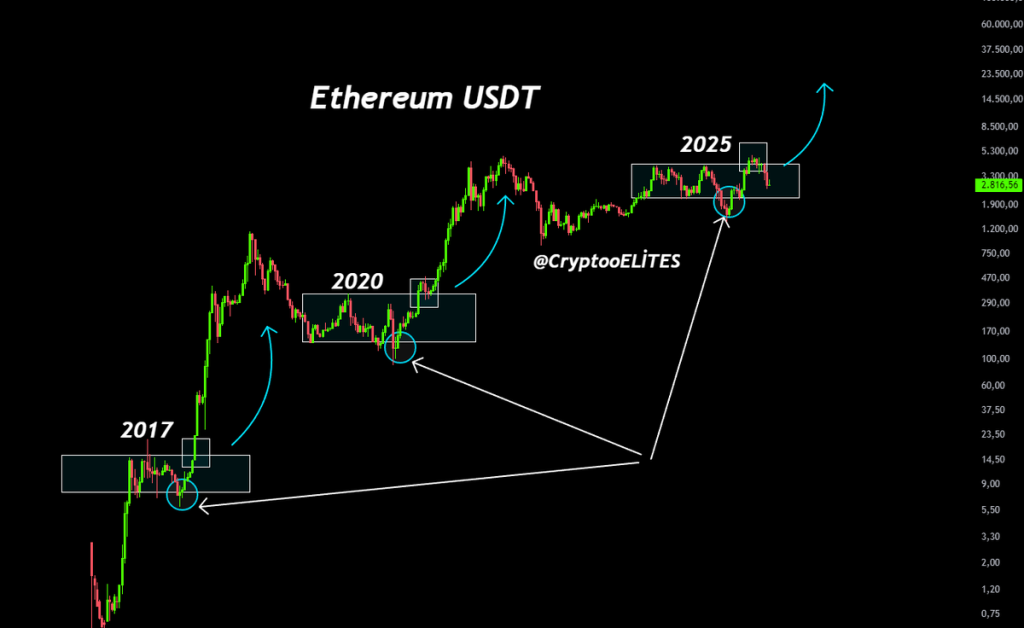

Ethereum (ETH) Price Slides; Mirrors 2017 & 2020 Patterns—Is a Breakout Ahead?

Coinpedia·2025/12/02 18:57

RootData launches exchange transparency evaluation system to promote new standards for information disclosure and compliance in the industry

Transparency has become the new battleground for compliance. RootData is joining forces with exchanges to build a trusted ecosystem, helping investors extend their lifecycle.

Chaincatcher·2025/12/02 17:40

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

Chaincatcher·2025/12/02 17:40

Sample Cases of Crypto Losses: A Map of Wealth Traps from Exchange Runaways to Hacker Attacks

Bitpush·2025/12/02 17:32

Musk calls Bitcoin an energy-based "physics currency"

Bitpush·2025/12/02 17:31

EU Banks Launch Coordinated Push for Euro-Pegged Stablecoin by 2026

Kriptoworld·2025/12/02 16:00

Best Crypto to Stock Up On Ahead of the Santa Rally 2025: REACT, SUI, and LINK

Cryptodaily·2025/12/02 16:00

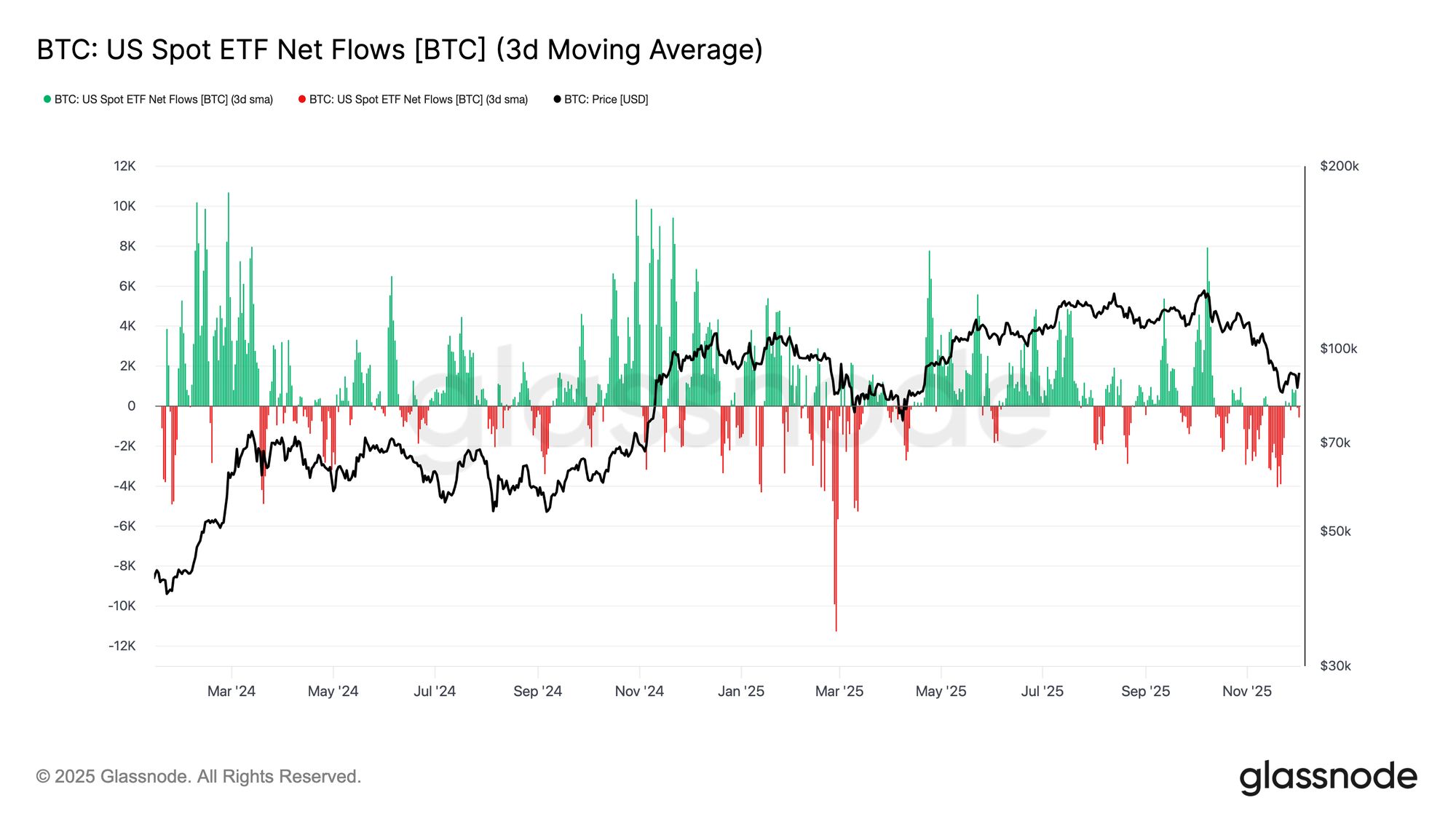

Echoes of Early 2022

Bitcoin stabilizes above the True Market Mean, but market structure now mirrors Q1 2022 with over 25% of supply underwater. Demand is weakening across ETFs, spot, and futures, while options show compressed volatility and cautious positioning. Holding $96K–$106K is critical to avoid further downside.

Glassnode·2025/12/02 16:00

Flash

10:50

Analysis: Cryptocurrency and precious metals markets show rare "divergent trends," possibly driven by more than just risk aversionPANews, December 27 — According to Forbes, since reaching an all-time high in October, bitcoin and the overall crypto asset market have experienced a significant pullback. The price of bitcoin is currently hovering around $90,000 per coin, down from its historical peak of $126,000. Meanwhile, gold, silver, and U.S. stocks have accelerated their upward movement toward the end of the year, resulting in a rare “divergent market.” This situation is not simply driven by risk aversion, but is more likely a “strategic response” by institutions and capital to the global monetary system. Ramnivas Mundada, Head of Economic Research and Corporate Research at GlobalData, expects that as global central banks continue to adjust their reserve structures and reduce reliance on dollar assets, the process of de-dollarization will accelerate. By 2026, gold could further rise by 8%-15%, while silver could increase by 20%-35%.

10:45

Exchange CEO: Firmly Opposes Any Attempt to Restart the GENIUS ActForesight News reported that the CEO of a certain exchange, Brian Armstrong, tweeted: "We will never allow anyone to restart the GENIUS Act. This is our bottom line. We will continue to safeguard the interests of our customers and the crypto industry. My prediction is that in a few years, once banks realize the huge business opportunities brought by stablecoins, they will change their stance and lobby the government to allow them to pay interest and returns. So, their current efforts are completely futile (and also unethical). The innovator's dilemma always exists."

09:44

Analysis: Strategy fundraising will prioritize paying dividends and debt interest over purchasing more BTC, signaling a shift to a defensive strategyPANews, December 27—According to CNBC, the latest analysis indicates that the stock price of a certain bitcoin treasury company’s exchange remains at a low level, and the bitcoin premium indicator is also declining. A key decision on whether the MSCI index will remove this exchange is expected in January next year. Against this backdrop, the exchange is drafting a “defensive mode” strategy. Recently, they have established a cash buffer of approximately $2.2 billion to withstand the test of bitcoin bets. This fund is expected to be used to pay preferred stock dividends and debt interest, rather than to purchase more bitcoin.

News