News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.29)|HYPE, SUI, and EIGEN tokens are set to undergo large unlocks this week; Bitcoin spot ETFs recorded a net outflow of $276 million in a single day, marking six consecutive days of net outflows2Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

Vanguard caves on crypto to retain clients as rivals win flows — opens $9.3T platform to crypto ETFs

CryptoSlate·2025/12/02 05:12

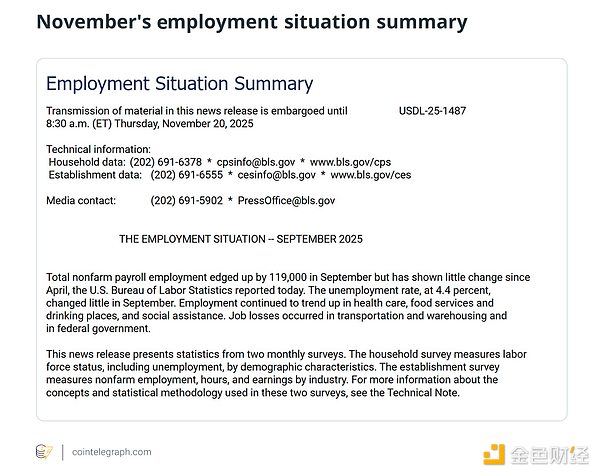

How a Weak U.S. Labor Market Puts Pressure on Bitcoin and Cryptocurrency Prices

金色财经·2025/12/02 04:31

BeatSwap's IP RWA, from Chart Topping Economy Monetization to BNB Chain DappBay RWA First

BeatSwap's patent has not only made IP rights the first RWA type that can truly trade securely in an AMM, but also provided a technical blueprint for a wider range of real-world assets in the future.

BlockBeats·2025/12/02 04:08

Musk: Energy is the real currency, AI and robots will bring deflation to the US within 3 years

Work will become optional within 20 years.

深潮·2025/12/02 04:03

Every country is heavily in debt, so who are the creditors?

Former Greek Finance Minister: "It's all of us."

深潮·2025/12/02 04:03

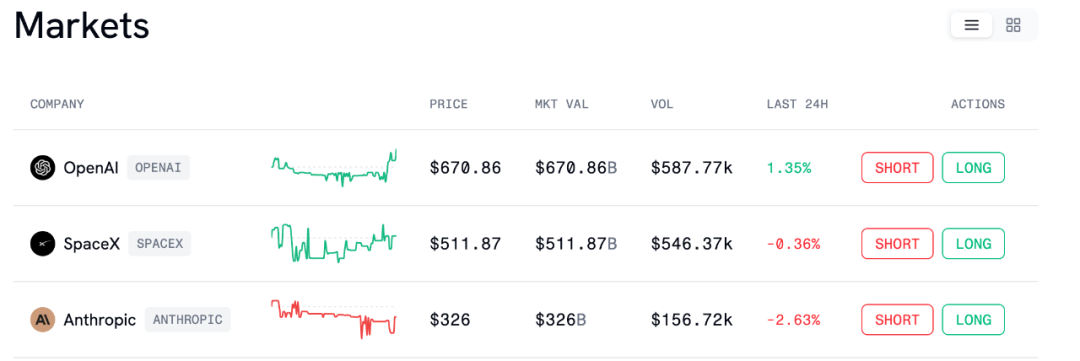

Everything Can Be "Contractualized": Lessons from Pre-IPO On-Chain Experiments

Decentralized infrastructure is now capable of supporting complex financial products, laying a technical and community foundation for the future large-scale tokenization of traditional assets.

深潮·2025/12/02 04:02

OpenEden Strategic Blueprint: Tokenizing Global Finance

CryptoSlate·2025/12/02 04:00

"Is the 'Big Pullback' Just Getting Started?"

The market is undergoing a repricing - a reassessment of what price true liquidity is willing to pay for Bitcoin.

BlockBeats·2025/12/02 03:33

Crypto : David Sacks calls the NYT accusations a "nothing burger"

Cointribune·2025/12/02 03:33

Bitcoin: Strategy Creates Historic Reserve of $1.4 B

Cointribune·2025/12/02 03:33

Flash

07:06

BlockSec Phalcon: Detected a suspicious transaction targeting MSCST on BSC, with an estimated loss of around $130,000.Foresight News reported, according to BlockSec Phalcon monitoring, a suspicious transaction targeting MSCST on BSC has been detected, with an estimated loss of approximately $130,000. The vulnerability stems from the lack of access control (ACL) in MSCST's releaseReward() function, allowing attackers to exploit this flaw to manipulate the price of GPC in PancakeSwap pool 0x12da.

07:06

Kong Jianping: The driving force behind Bitcoin's price is shifting from "cognitive diffusion" to "supply contraction"BlockBeats News, December 29, Kong Jianping, former Co-Chairman of the Board at Canaan and now founder and Chairman of Nano Labs, stated yesterday: "The logic behind bitcoin's handover is undergoing a fundamental change. The bull market path in the past was very clear: geeks → programmers → retail investors → mainstream finance, with each round of price increase resulting from the spread of awareness. But after 2024, ETFs and institutional holdings have changed the supply and demand structure. A portion of BTC is being transformed into dormant assets that do not participate in short-term cycles, just like gold entering the central banking system. When chips are locked up for the long term and there are fewer and fewer sellers willing to repeatedly enter and exit, the price driver will shift from 'awareness diffusion' to 'supply contraction'. The next round of price increases may no longer require new narratives and beliefs."

07:04

Kong Jianping: Bitcoin Price Driver is Transitioning from "Cognitive Diffusion" to "Supply Contraction"BlockBeats News, December 29th. Kong Jianping, former Co-Chairman of Canaan Inc., and current Founder and Chairman of Nano Labs, stated in a post yesterday: "Bitcoin's logic of taking over is undergoing a fundamental change. The past bull market path was very clear: Geek → Programmer → Retail Investor → Mainstream Finance, and each round of increase was the result of cognitive diffusion."

However, after 2024, ETFs and institutional holdings have changed the supply-demand structure. Some BTC is being transformed into silent assets that do not participate in short-term games, similar to when gold entered the central bank system. When chips are locked up for the long term, the number of willing sellers who repeatedly enter and exit will decrease, and the price momentum will shift from 'cognitive diffusion' to 'supply contraction'.

The next round of increase may no longer require a new narrative and belief."

News