News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Only 589 million XRP sold in 24 hours: 10x gain ultimately shrinks to 4x

币界网·2025/12/17 12:05

Aave Founder: From DeFi King to the Financial Foundation, Our Next Decade-long Battle

Odaily星球日报·2025/12/17 12:04

PI Rebounds 5% From Key Support as Bearish Pressure Persists

Cryptotale·2025/12/17 12:00

Russia Reaffirms Ban on Bitcoin and Ethereum Payments

DeFi Planet·2025/12/17 11:51

The strengthening of the Chinese yuan may support bitcoin prices

币界网·2025/12/17 11:34

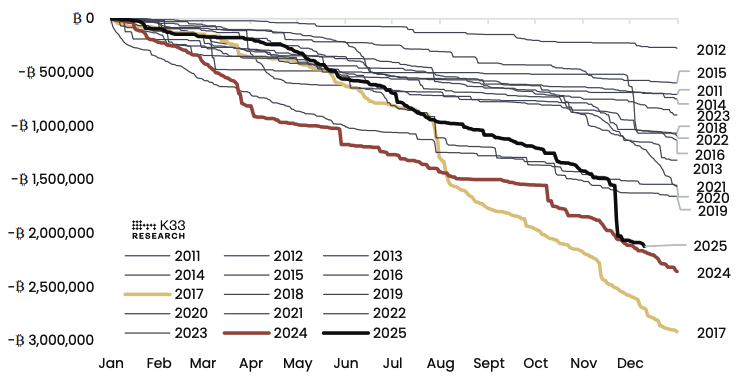

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

The Block·2025/12/17 11:21

Flash

05:24

Techub News clarifies that its founder Alma has no founding association with Central ResearchOn December 21, it was reported that in response to recent false information circulating on social media platforms, Techub News issued a clarification: Alma, the founder and CEO of Techub News, has never participated in the founding of Central Research, nor has she served as its "co-founder" or held any similar position; such statements are untrue. Big Demo Day is a public entrepreneurial roadshow brand event co-organized by multiple parties, which has previously received support from institutions such as Hong Kong Cyberport. Techub News has only participated in certain sessions of the event as a co-organizer or partner media, and is not involved in the internal governance, personnel appointments, or operational management of Central Research. Equating this event simply as an "internal event" of Central Research, or interpreting Alma's public appearances as involvement in its operations, are both misunderstandings. The platform has requested the relevant parties to correct the erroneous information and calls on all parties to base their citations on facts. For any subsequent deliberate falsehoods or malicious defamation, Techub News reserves the right to pursue legal responsibility in accordance with the law.

05:11

A certain whale has once again withdrawn 246,259 LINK from an exchange, worth $3.08 million.BlockBeats News, December 21, according to Onchainlens monitoring, a certain whale has once again withdrawn 246,259 LINK from an exchange, worth 3.08 million US dollars. This whale has accumulated a total of 445,775 LINK, worth 5.57 million US dollars.

05:10

UK fintech company Revolut faces dispute with former employees over stock award tax issuesAccording to TechFlow on December 21, citing the Financial Times, UK fintech company Revolut has become embroiled in a dispute with several former employees. The conflict arose after these employees faced significant tax burdens when exercising stock awards, and they believe the information previously provided to them was inconsistent with the final tax treatment, leading to a discrepancy between their tax expectations and reality. The dispute centers on Revolut's tax arrangements and communication methods regarding employees leaving the company or cashing out, and both sides currently disagree on how to handle the related tax payments.

News