News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Analyst Analysis: XRP Faces Risk of Falling to $1

币界网·2025/12/17 09:47

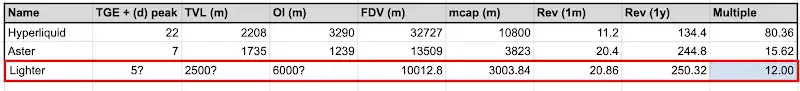

Opinion: Why Lighter Is Seriously Undervalued

BlockBeats·2025/12/17 09:39

Collably Network Partners with Flipflop to Revolutionize Fair Token Distribution

BlockchainReporter·2025/12/17 09:31

Bitcoin Exchange Netflow Signals Big Shift Ahead

UToday·2025/12/17 09:31

After Wasting Four Years, SEC Ends Yet Another Crypto Investigastion

UToday·2025/12/17 09:31

No Crystal Ball: VanEck Refuses to Release 2026 Crypto Predictions

UToday·2025/12/17 09:31

Flash

01:34

U.S. Lawmakers Draft New Bill to Exempt Stablecoin Transactions of $200 or Less from Capital Gains TaxBlockBeats News, December 21st, according to TheBlock, U.S. lawmakers are currently drafting a cryptocurrency tax bill draft called the Digital Asset PARITY Act, which will exempt capital gains tax on stablecoin transactions of $200 or less. Staking and mining rewards will also be eligible for a five-year tax deferral option.

01:30

A whale has accumulated $2.55 million worth of PENGU over the past two weeksBlockBeats News, December 21st, according to Onchain Lens monitoring, a whale withdrew 272,201,182 PENGU tokens worth $2.52 million from an exchange. Over the past two weeks, the whale has accumulated a total of 273.08 million PENGU tokens (worth $2.55 million) and 405.84 TRUMP tokens (worth $2,240).

01:27

Klarna partners with an exchange to allow institutions to make payments using stablecoinsAccording to TechFlow, citing a report from Fortune, Swedish digital bank and payment services company Klarna has announced a partnership with an exchange, planning to raise short-term funds denominated in stablecoins from institutional investors through the exchange's digital infrastructure. This will provide Klarna with a new funding channel denominated in USDC stablecoin, in addition to its existing traditional funding sources, which include user deposits, long-term loans, and short-term commercial paper. This approach will help Klarna directly access more institutional investors and obtain a stable funding source similar to the US dollar. Klarna stated that this move is the "first step" in exploring how digital assets and traditional financing channels can work together, and it will continue to advance its crypto and stablecoin-related business layout for consumers and merchants, with plans to continue this initiative through 2026.

News