News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

Pi Network Speeds Up KYC by 50% Ahead of 190M Token Unlock

Coinpedia·2025/12/06 16:21

Coinpedia Digest: This Week’s Crypto News Highlights | 6th December, 2025

Coinpedia·2025/12/06 16:21

Top Crypto Analysis: ETF Flows Highlight Mixed Signals for XRP, ETH, and DOGE

Coinpedia·2025/12/06 16:21

Solana Price Prediction: How High Can SOL Price Go in 2025

Coinpedia·2025/12/06 16:21

Bitcoin Drops Below $90K as National Bank of Canada Makes Surprise Crypto Move

Coinpedia·2025/12/06 16:21

Top 3 Crypto Predictions for 2026: Ozak AI, Bitcoin, and XRP Set for Massive Upside

Cryptodaily·2025/12/06 16:00

Bitcoin Cool Off is Normal, Claims Analyst: US to Push BTC Higher?

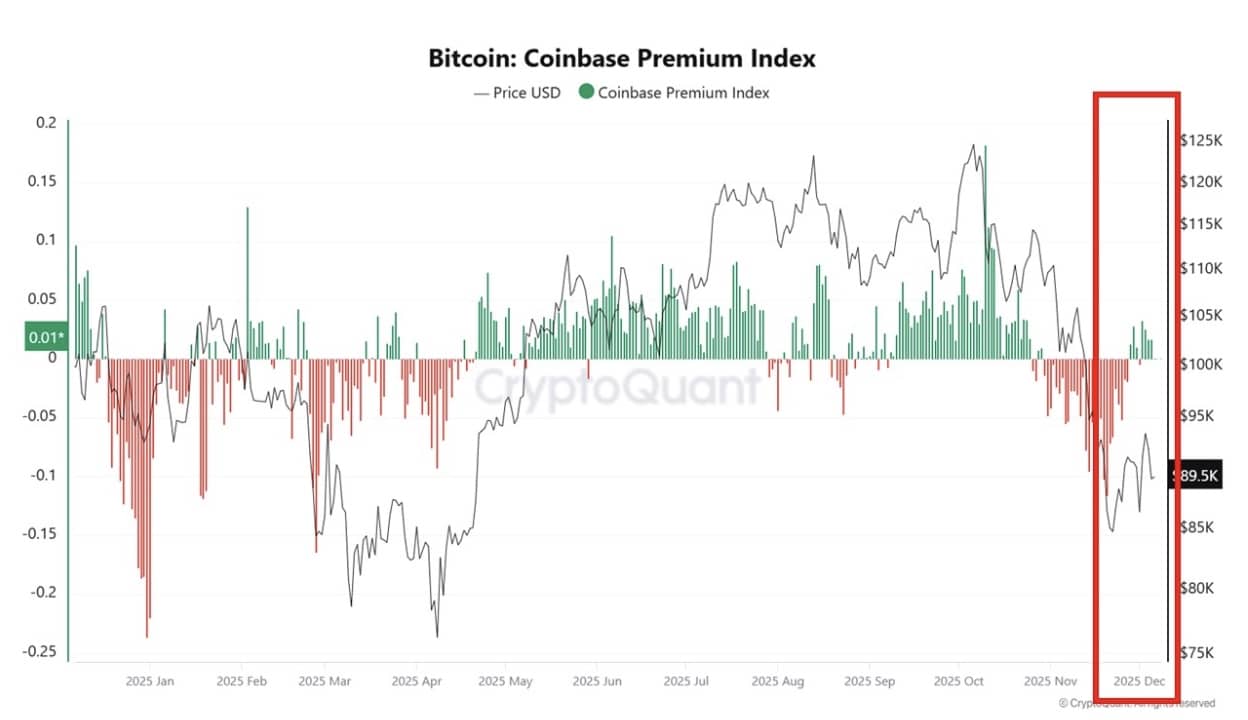

Bitcoin holds near $89,000 as analysts claim that the latest correction indicates cooling rather than a full-blown bear market.

Coinspeaker·2025/12/06 16:00

MSCI’s Bitcoin Blacklist Is A Crypto Horror Story or Just a Bad Idea?

Kriptoworld·2025/12/06 16:00

Indian Crypto Investors Are Breaking Up with Bitcoin (And Loving Ethereum)

Kriptoworld·2025/12/06 16:00

Flash

08:26

The South Korean National Assembly has passed the Tokenized Securities Act, allowing compliant issuers to directly issue tokenized securities using blockchain.BlockBeats News, January 15th. According to Yonhap News Agency, the South Korean National Assembly today passed amendments to the Capital Market Act and the Act on the Electronic Registration of Stocks and Bonds, institutionalizing Security Token Offerings (STOs). The amendments introduce the Issuer Custodian Institution system, allowing eligible issuers to directly issue security tokens using blockchain technology, enhancing the security and utility of securities through blockchain technology, and providing a legal basis for the issuance and circulation of new digital securities.

08:25

London Stock Exchange Group launches blockchain-based digital settlement serviceChainCatcher news, according to Bloomberg, the London Stock Exchange Group (LSEG) has launched a new blockchain-friendly digital settlement service. This service, called "Digital Settlement House," will enable instant settlement between independent payment networks, whether they are blockchain-based or use traditional technologies.

08:24

Both "An" and "BIG DON" surged to a market cap of tens of millions immediately after launch, with the backing funds concentrated in bulk wallet purchases.BlockBeats News, January 15, according to GMGN monitoring, possibly due to the launch of the "USD1 Trading Competition" by BNB Chain, two meme coins with market caps in the tens of millions of USD1 pools have recently emerged. As the community generally believes that the winning projects are likely to be listed on top exchanges, the event has attracted significant capital into the related token pools. Among them, "安" and "BIG DON" have performed prominently, but the sources of buying funds are questionable. "安": Launched two days before the event announcement, its market cap once surpassed $30 million, and surged again this morning, with the current market cap reported at $45.2 million, current price about $0.045, and a 24-hour increase of about 16%. Possibly due to the operator buying through dispersed wallets, the top 100 addresses only account for 11.1% of holdings, while for most meme coins across chains, the top 100 addresses usually account for over 50% of holdings; "BIG DON": Opened trading today and quickly surged, with more than 90 suspected related addresses buying in synchronously within about 10 minutes, pushing the market cap rapidly past $34 million, currently reported at $39.9 million, with a current price of about $0.0398, and the top 100 addresses only account for 7% of holdings. Notably, during a slight market cap pullback, several suspected related wallets continued to buy in at 6:05 (UTC+8), 7:05 (UTC+8), and 11:00 (UTC+8) this morning. An analyst on platform X pointed out that the operators behind these two major meme coins may belong to the same institution as the previous WLFI project. In addition, on-chain data shows that a certain wallet made concentrated purchases after transferring out via CiaoSwap (a batch distribution tool), with some related wallet addresses as follows: 0xD8b54De07e0eaDc00B760B352AeA59A13d385cbc; 0x6eFFa72a258907399d8DCe258232001A3FA609b9; BlockBeats reminds users that meme coin trading is highly volatile, mostly relying on market sentiment and hype, and lacks actual value or use cases. Investors should be aware of the risks.

News