News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

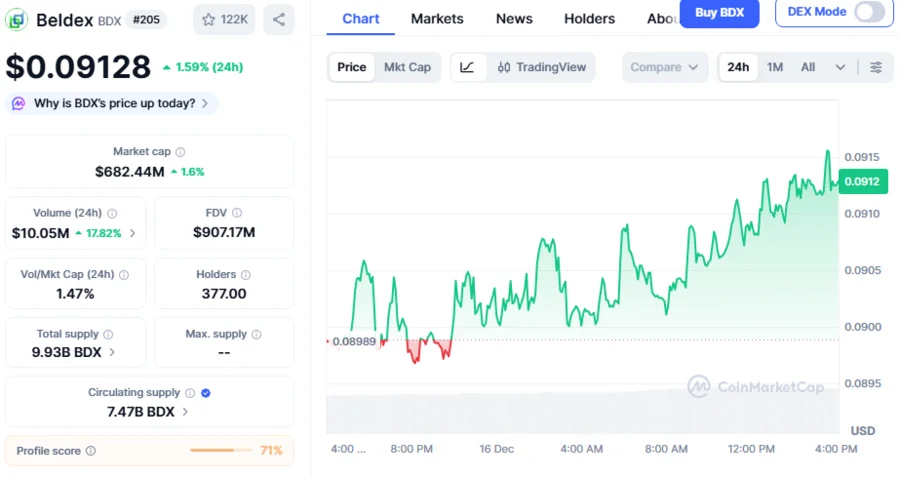

Beldex Price: BDX Token Gains Momentum with Stargate Integration via LayerZero’s OFT Standard

BlockchainReporter·2025/12/17 01:03

Altcoin Season Index Plummets: A Stark 4-Point Drop to 18 Signals Bitcoin’s Grip

Bitcoinworld·2025/12/17 00:57

Dark Defender Highlights Why XRP Will Pump, Sets Price Target

·2025/12/17 00:03

Massive Bitmain ETH Withdrawal: $141.8M Move Sparks Market Speculation

Bitcoinworld·2025/12/17 00:00

Why might Americans be unable to afford cryptocurrencies by 2026?

币界网·2025/12/16 23:53

Google Gemini Predicts XRP Could Hit $120 if This Happens

·2025/12/16 23:33

Revolutionary Blockchain Payment Consortium Forms to Unify Crypto Payments

Bitcoinworld·2025/12/16 23:27

Bitget Integrates Monad, Letting Users Trade Monad Assets Directly with USDC

BlockchainReporter·2025/12/16 23:00

Flash

15:53

IOSG Founding Partner: 2025 will be the "worst year" for the crypto market, but BTC may reach $120,000–$150,000 in the first half of 2026PANews, December 21 – Jocy, founding partner of IOSG, posted on X that 2025 will be the "worst year" for the crypto market. OG investors will experience three waves of sell-offs. From March 2024 to November 2025, long-term holders (LTH) will cumulatively sell about 1.4 million BTC (worth $121.17 billions): First wave (end of 2023 to early 2024): ETF approval, BTC rises from $25,000 to $73,000; Second wave (end of 2024): Trump is elected, BTC surges toward $100,000; Third wave (2025): BTC remains above $100,000 for an extended period. Unlike the single explosive distributions in 2013, 2017, and 2021, this time it will be a multi-wave, sustained distribution. Over the past year, BTC has been consolidating at its peak for a year, something that has never happened before. Since the beginning of 2024, the number of BTC unmoved for over two years has decreased by 1.6 million (about $140 billions). However, the other side of risk is opportunity. In terms of investment logic: Short term (3-6 months): Fluctuation between $87,000 and $95,000, institutions continue to accumulate positions; Mid-term (first half of 2026): Driven by both policy and institutions, target $120,000-$150,000; Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

15:53

Opinion: 2025 will be the "worst year" for the crypto market, but bitcoin may reach $120,000-$150,000 in the first half of 2026According to Odaily, IOSG founding partner Jocy posted on X stating that 2025 will be the "worst year" for the crypto market, with OG investors experiencing three waves of sell-offs. From March 2024 to November 2025, long-term holders (LTH) are expected to cumulatively sell about 1.4 million BTC (worth $121.17 billion): The first wave (end of 2023 to early 2024): ETF approval, BTC rises from $25,000 to $73,000; the second wave (end of 2024): Trump is elected, BTC surges towards $100,000; the third wave (2025): BTC remains above $100,000 for an extended period. Unlike the single explosive distribution seen in 2013, 2017, and 2021, this time features multiple sustained waves of distribution. Over the past year, BTC has been consolidating at its peak for an entire year, something that has never happened before. Since the beginning of 2024, the amount of BTC unmoved for over two years has decreased by 1.6 million (about $140 billion). However, the other side of risk is opportunity, and in terms of investment logic: Short term (3-6 months): Fluctuation in the $87,000-$95,000 range, institutions continue to accumulate positions; Mid term (first half of 2026): Driven by both policy and institutions, target of $120,000-$150,000; Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

15:42

The probability of the Fed cutting interest rates by 25 basis points in January next year has decreased to 22.1%.BlockBeats News, December 21st, according to CME's "FedWatch" data, the probability of the Fed cutting interest rates by 25 basis points in January next year is 22.1%, while the probability of keeping rates unchanged is 77.9%.

News