News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low2Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)3Review of Major Institutions' Bitcoin Price Predictions for 2025: Almost All Failed

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

Bitcoinworld·2025/12/18 03:06

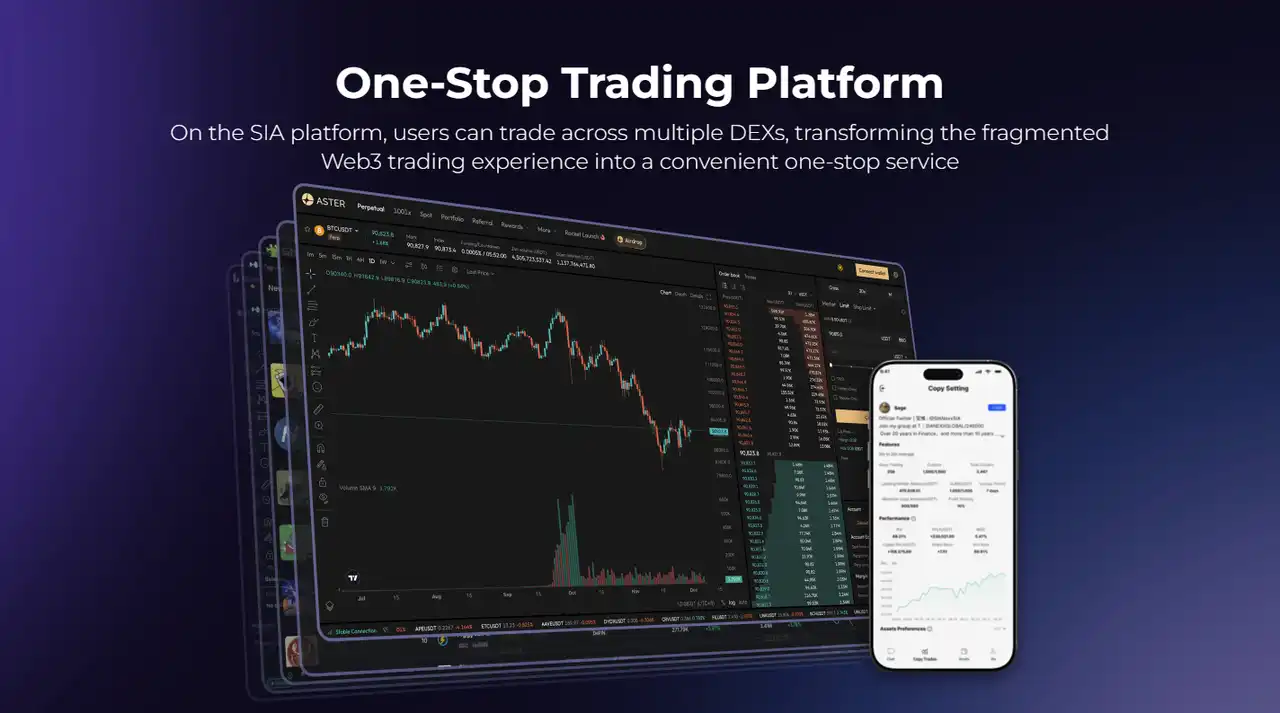

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

BlockBeats·2025/12/18 03:02

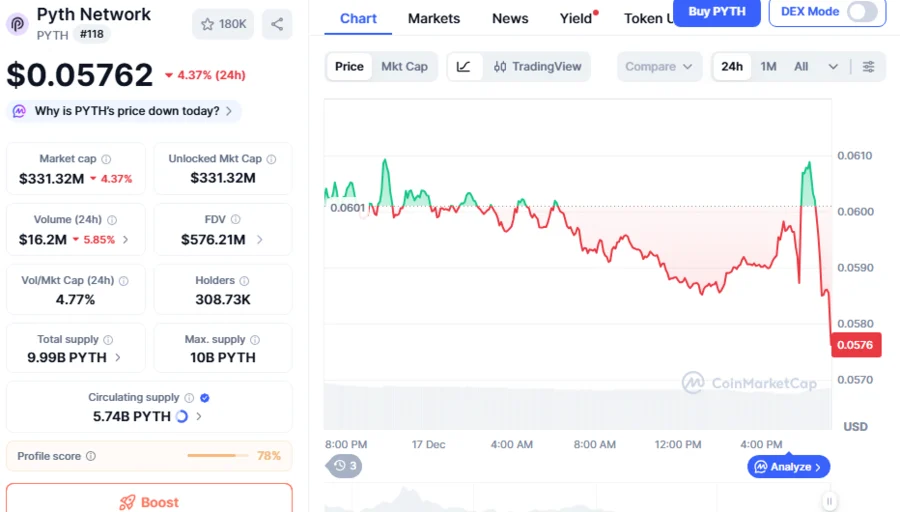

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

BlockchainReporter·2025/12/18 03:00

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day

Bitcoinworld·2025/12/18 02:57

Pieverse Opens a New Chapter: Agentic Neobank

Chaincatcher·2025/12/18 02:22

Cronos Labs launches Cronos One, a comprehensive solution for web3 beginners

币界网·2025/12/18 02:11

SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

The Block·2025/12/18 02:06

Unleash X402 with Yooldo: Revolutionizing the Web3 Gaming Experience

TechFlow深潮·2025/12/18 02:05

Flash

14:07

Kalshi: Prediction markets outperform Wall Street consensus in inflation forecastingBlockBeats News, December 22, according to Coindesk, a study by the prediction market platform Kalshi found that prediction markets outperform Wall Street consensus expectations in inflation forecasting. Over 25 months of data, its average error was 40% lower than consensus forecasts. The study points out that the advantage of prediction markets lies in their ability to aggregate diverse information from numerous traders based on economic incentives, creating a "wisdom of the crowd" effect, which enables them to respond more sensitively to changing environments. These findings suggest that market-based forecasts can serve as a valuable supplementary tool for institutional decision-makers, especially during periods of high uncertainty. By comparing inflation forecasts on its platform with Wall Street consensus expectations, Kalshi found that market-based traders had higher forecasting accuracy than traditional economists and analysts during the 25-month observation period, with this advantage being particularly significant during periods of economic volatility. Specifically, the study found that from February 2023 to mid-2025, the average error of prediction markets' estimates of year-on-year changes in the Consumer Price Index (CPI) was 40% lower than consensus forecasts. When actual data deviated significantly from expectations, the advantage of prediction markets became even more pronounced, with their accuracy exceeding consensus expectations by up to 67%.

14:06

Layer 1 blockchain Flare jointly launches XRP yield product earnXRPForesight News reported, according to The Block, that Layer 1 blockchain Flare has announced the joint launch of the XRP yield product earnXRP with DeFi platform Upshift Finance, which provides yield vault infrastructure, and on-chain risk management company Clearstar. This product allows users to deposit FXRP (the wrapped version of XRP on Flare) into a single vault, which will deploy funds into various on-chain strategies to generate yield denominated in XRP.

13:52

Circle has just minted 500 million USDC on the Solana network.BlockBeats News, December 22, according to monitoring by Onchain Lens, Circle has just minted 500 million USDC on the Solana network. Since October 11, Circle has minted a total of 18 billions USDC on the Solana network.

News