News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low2Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)3Review of Major Institutions' Bitcoin Price Predictions for 2025: Almost All Failed

Bitcoin's next move may fall short of most people's expectations

币界网·2025/12/17 06:53

Former Theta Executives Accuse Crypto Firm's CEO of Fraud, Retaliation

Decrypt·2025/12/17 06:52

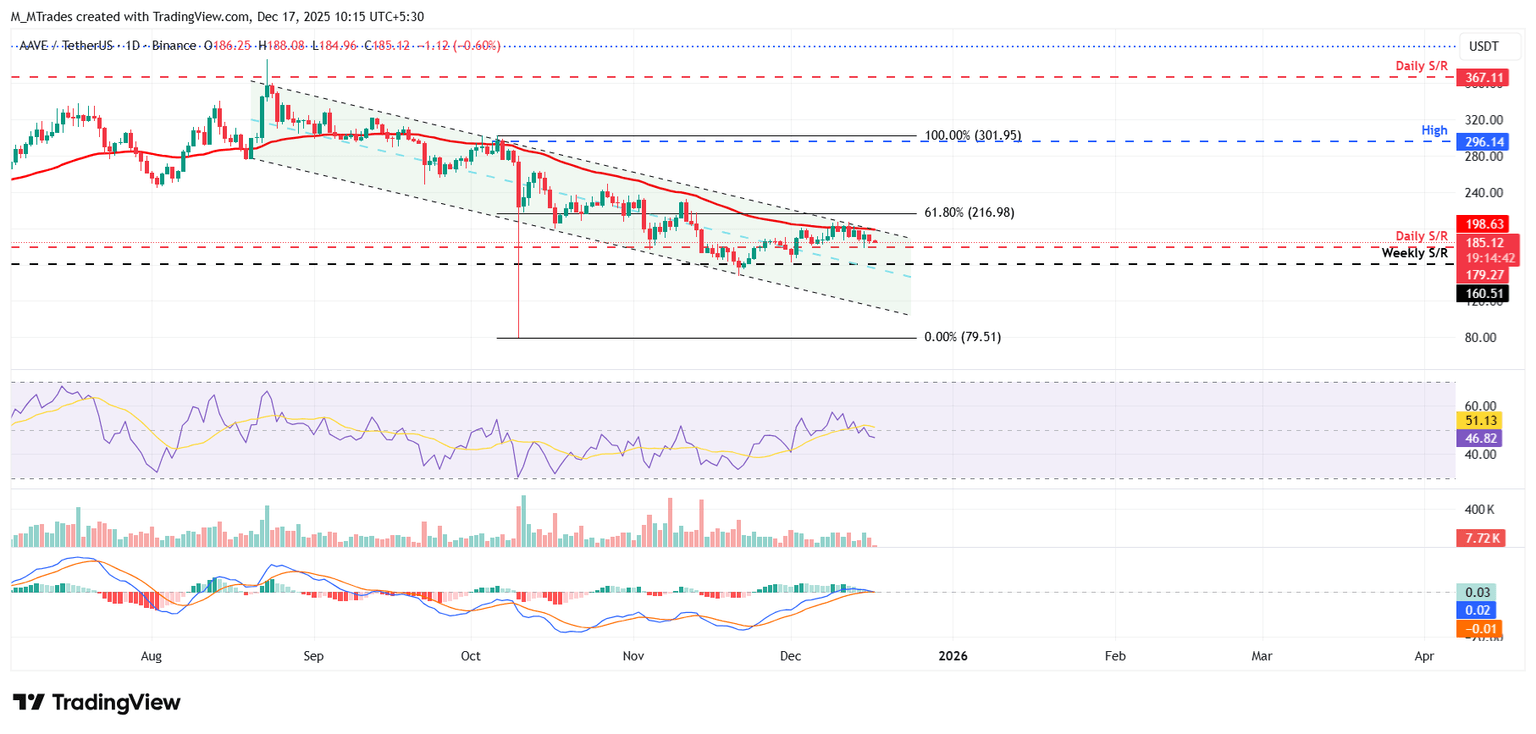

Bitcoin holds support but lacks confidence, daily momentum remains fragile.

币界网·2025/12/17 06:45

Visionary Bhutan Bets Big: 10,000 Bitcoin Fuels Groundbreaking Gelephu Economic Zone

Bitcoinworld·2025/12/17 06:36

Unstoppable: Why No Public Company Can Ever Catch MicroStrategy’s Massive Bitcoin Holdings

Bitcoinworld·2025/12/17 06:33

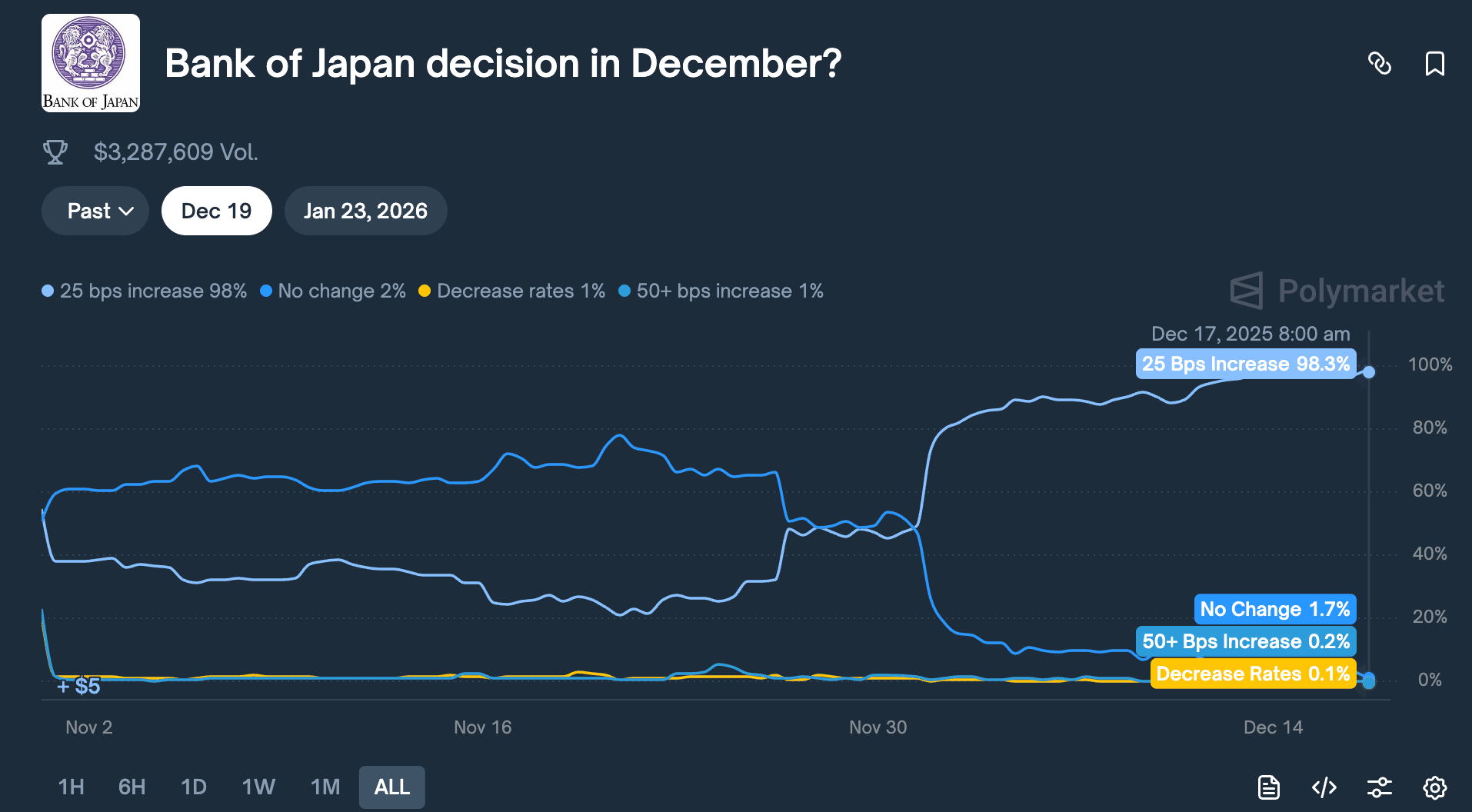

Why did bitcoin drop in advance on the eve of the Bank of Japan's interest rate hike?

TechFlow深潮·2025/12/17 06:30

Flash

03:58

Hong Kong plans to promote new regulations for cryptocurrency and infrastructure to guide insurance industry investmentsForesight News reported, citing Bloomberg, that Hong Kong plans to promote new regulations for cryptocurrency and infrastructure to guide insurance industry investments, with the insurance regulator imposing a 100% risk charge on crypto assets. According to the document, the risk charge for stablecoin investments will be determined based on the fiat currency to which the stablecoin is pegged under Hong Kong regulation. The regulator's proposal may still be adjusted and will be open for public consultation from February to April, after which it will be submitted to the legislative process.

03:49

Bitget has launched USDT-margined IR and ZKP perpetual contractsForesight News reported that Bitget has launched USDT-margined IR and ZKP perpetual contracts, both with a maximum leverage of 20x. Contract trading BOT will be opened simultaneously.

03:47

XRP spot ETF saw a net inflow of $82.04 million last weekForesight News reported, according to SoSoValue data, during last week's trading days (Eastern Time, December 15 to December 19), XRP spot ETFs saw a net inflow of $82.04 million. The XRP spot ETF with the highest weekly net inflow last week was 21Shares XRP ETF TOXR, with a weekly net inflow of $23.05 million and a historical total net inflow of $23.05 million; followed by Franklin XRP ETF XRPZ, with a weekly net inflow of $17.17 million, and XRPZ's historical total net inflow has reached $202 million. As of press time, the total net asset value of XRP spot ETFs is $1.21 billion, with the ETF net asset ratio (market cap as a percentage of Bitcoin's total market cap) reaching 0.98%, and the historical cumulative net inflow has reached $1.07 billion.

News