News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

XRP ETF net inflows continue to rise, but on-chain performance remains concerning!

AIcoin·2025/12/20 07:30

ZEC Whale Withdrawal: The $88 Million Signal Shaking Crypto Markets

Bitcoinworld·2025/12/20 07:27

Federal Reserve policy triggers risk aversion—can Bitcoin make a comeback?

AIcoin·2025/12/20 07:15

Autumn stress test for the crypto market: A correction or a new market paradigm

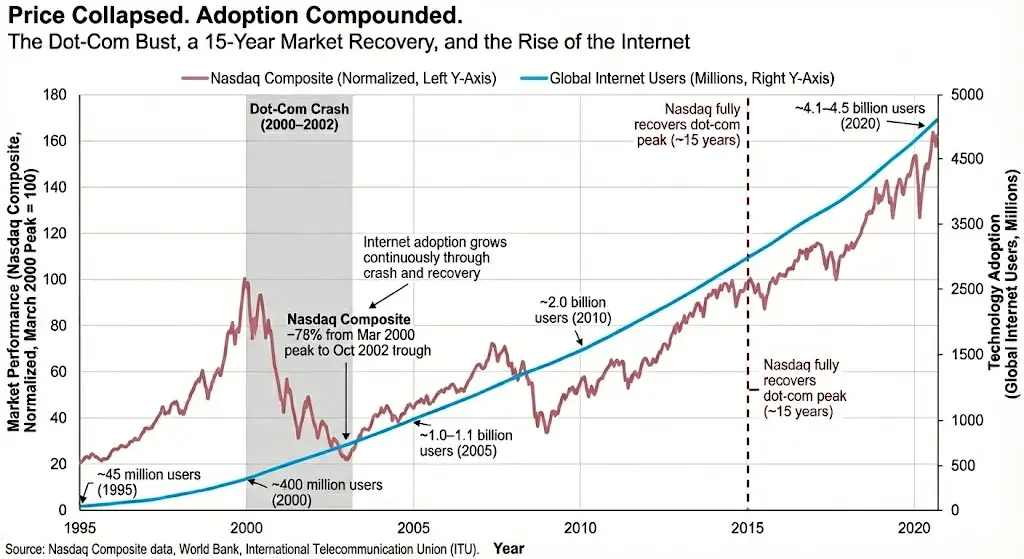

CryptoSlate·2025/12/20 07:12

Abandon illusions and prepare for the most challenging moments in the crypto market.

AIcoin·2025/12/20 07:02

Teucrium CEO States What’s Coming for XRP

TimesTabloid·2025/12/20 06:57

Arthur Hayes Reveals Altcoin Season Thrives Beyond Expectations

Cointurk·2025/12/20 06:51

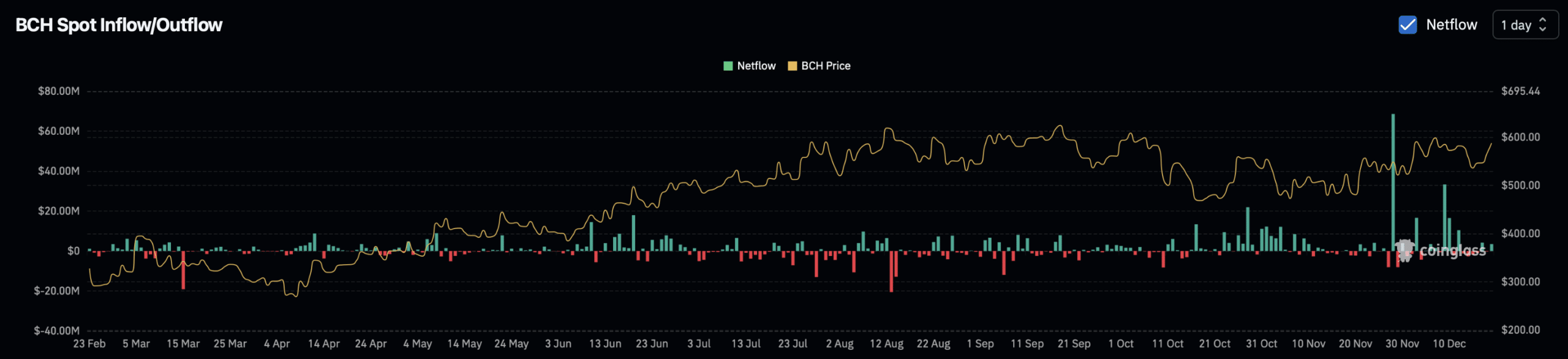

Understanding Bitcoin Cash’s 10% jump amid BCH’s spot–derivatives divide

AMBCrypto·2025/12/20 06:03

Spot ETH ETFs Suffer Seventh Straight Day of Net Outflows: $75.4M Bleeds Out

Bitcoinworld·2025/12/20 06:00

WINkLink and Klever Wallet Partner to Shape a More Practical Web3 Future

BlockchainReporter·2025/12/20 06:00

Flash

07:36

Institutions: If the unemployment rate rises by 0.1% per month, the Fed's room for interest rate cuts is underestimated. in November, the US inflation rate was far below economists' forecasts, while the unemployment rate unexpectedly rose that month. Due to information distortion and incompleteness caused by the 43-day federal government shutdown, investors have been reluctant to over-interpret this data. Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, said: "Even taking this into account, it highlights that the current inflation data has very limited room for a significant upside surprise. If the labor market continues on its current trajectory, with the unemployment rate rising by 0.1 percentage points per month, I think the potential for further rate cuts next year may be somewhat underestimated."

06:37

Michael Lorizio: If the unemployment rate rises by 0.1% each month, the Federal Reserve's rate cut potential is being underestimatedChainCatcher News, according to Golden Ten Data, Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, stated that the US inflation rate in November was significantly lower than economists' forecasts, and the unemployment rate unexpectedly rose. He pointed out that although the federal government shutdown caused some data distortion, there is limited room for current inflation data to significantly exceed expectations. If the labor market continues on a trajectory where the unemployment rate rises by 0.1 percentage points each month, the potential for further rate cuts next year may be underestimated.

06:30

Data: USDC circulating supply decreased by approximately 1.3 billions in the past 7 daysPANews reported on December 20 that, according to official data, in the 7 days ending December 18, Circle issued approximately 4.7 billion USDC and redeemed about 6 billion USDC, resulting in a decrease in circulation of around 1.3 billion tokens. The total USDC in circulation is 77.2 billion tokens, with reserves of about 77.5 billion US dollars. Of these reserves, overnight reverse repo agreements in US Treasuries account for approximately 53.3 billion US dollars; US Treasuries with maturities of less than 3 months account for about 14.3 billion US dollars; deposits at systemically important institutions are around 9.2 billion US dollars; and other bank deposits are about 700 million US dollars.

News