News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

redphone 2026 prophecy: The Silicon Era arrives, crypto becomes the "last free harbor"

Odaily星球日报·2025/12/20 09:41

Pundit: This Update Is Huge for XRP

TimesTabloid·2025/12/20 09:24

Crypto Hedge Funds Hit Hard as ETF Growth Drains Trading Alpha

Cryptotale·2025/12/20 09:21

Ethereum vs. Bitcoin: What the usage–value split says about prices

AMBCrypto·2025/12/20 09:03

Zcash Price Prediction: ZEC Jumps 10%, Is It The Best Crypto to Buy Now?

Cryptonomist·2025/12/20 09:03

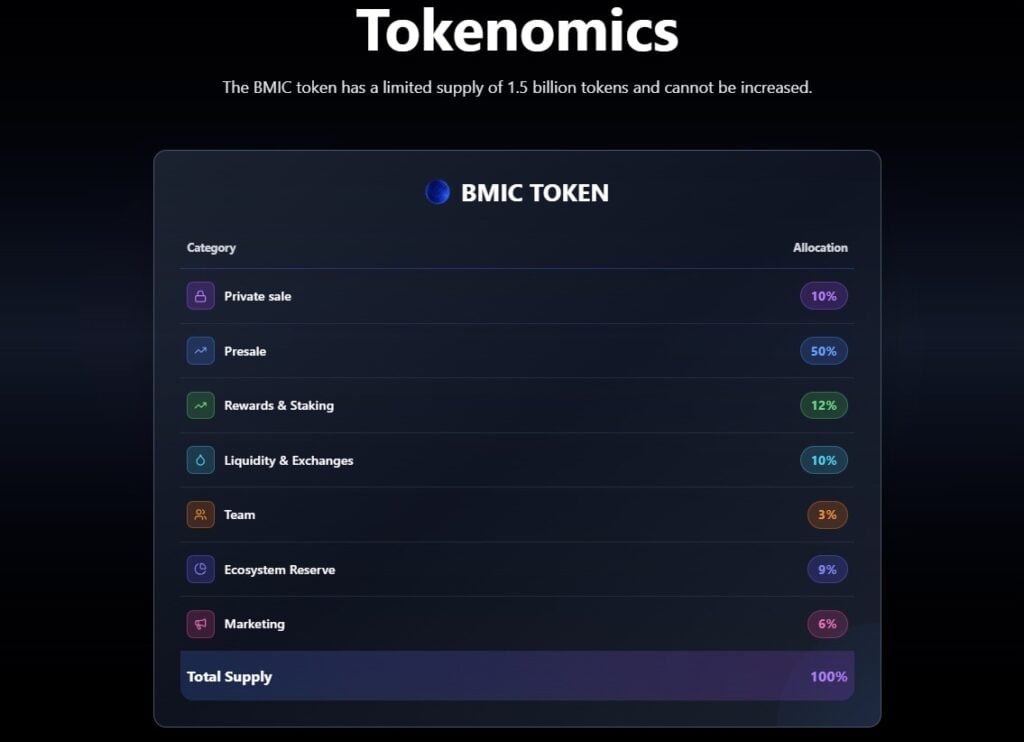

Why Platforms Like BMIC Matter More During Bear Market Conditions – Best Crypto Presale to Buy Now?

Cryptonomist·2025/12/20 09:03

CNBC: Why Investors Rotate Into XRP from BTC and ETH

TimesTabloid·2025/12/20 08:48

Critical Bitcoin Correction Forecast: Fundstrat Predicts $60K-$65K Range by H1 2026

Bitcoinworld·2025/12/20 08:42

Ripple (XR) in the Room With Senators

TimesTabloid·2025/12/20 08:12

Flash

09:48

SBF's Prison Transformation into "Legal Counsel," Providing Advice to Multiple InmatesBlockBeats News, December 20th, according to

The New York Times

, FTX founder Sam Bankman-Fried has embarked on a new "venture" as a "legal advisor" in prison. SBF has now provided advice to several individuals, including former Honduran President Juan Orlando Hernández and music producer Sean Combs. In an interview, he stated that he helps others in a way that some overwhelmed lawyers cannot.

SBF mentioned that the standards of federal defense are "shockingly low," and he believes he is not replacing lawyers but rather that the lawyers "weren't doing much to begin with." Many lawyers have too many cases to provide adequate attention to their clients.

Currently, SBF is serving time in a California prison, appealing his own case, and seeking a pardon from the President of the United States.

09:34

The New York Times: SBF Serves as a "Jailhouse Lawyer" in Prison, Providing Legal Advice to Multiple InmatesAccording to TechFlow, on December 20, The New York Times reported that Sam Bankman-Fried, the founder of the cryptocurrency exchange FTX who has been sentenced to more than 20 years in prison, has become a "jailhouse lawyer" while incarcerated, providing legal advice to several inmates. The report shows that SBF has offered legal consulting services to several inmates, including former Honduran President Juan Orlando Hernández, music producer Sean Combs (Diddy), and Chinese exiled businessman Guo Wengui. He advised Hernández to testify on his own behalf during the trial; although Hernández ultimately lost the case, his wife still expressed her gratitude to SBF. In an interview, SBF stated that the standard of federal defense is "shockingly low." He believes he is not replacing lawyers, but that the lawyers "weren't doing much to begin with." Many lawyers are unable to give their clients enough attention due to an excessive caseload. Currently, SBF is serving his sentence in a California prison while appealing his own case and seeking a presidential pardon.

09:33

Trending List: ZEC surges in popularity, up 9.99% in 24HAccording to the popularity ranking, ZEC's popularity has increased by 150,000 compared to yesterday, ranking first. The popularity ranking is as follows: ① ZEC ($452.28, 9.99%) ② BEAT ($2.12, -3.64%) ③ BCH ($596.60, 0.98%) ④ ETH ($2985.12, 1.07%) ⑤ SOL ($126.62, 1.62%). ZEC has strong buying power from major funds, with a net inflow of $30.9994 million in the past 24 hours and a 24-hour trading volume of $2.191 billion, of which the net inflow from major funds is $10.7191 million.

News