News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Cardano Founder Charles Hoskinson Defends Network Capabilities, Vision Without Compromise

Cryptonewsland·2025/12/21 11:39

US Lawmakers Propose PARITY Act to Overhaul Crypto Tax Regulations

BeInCrypto·2025/12/21 11:24

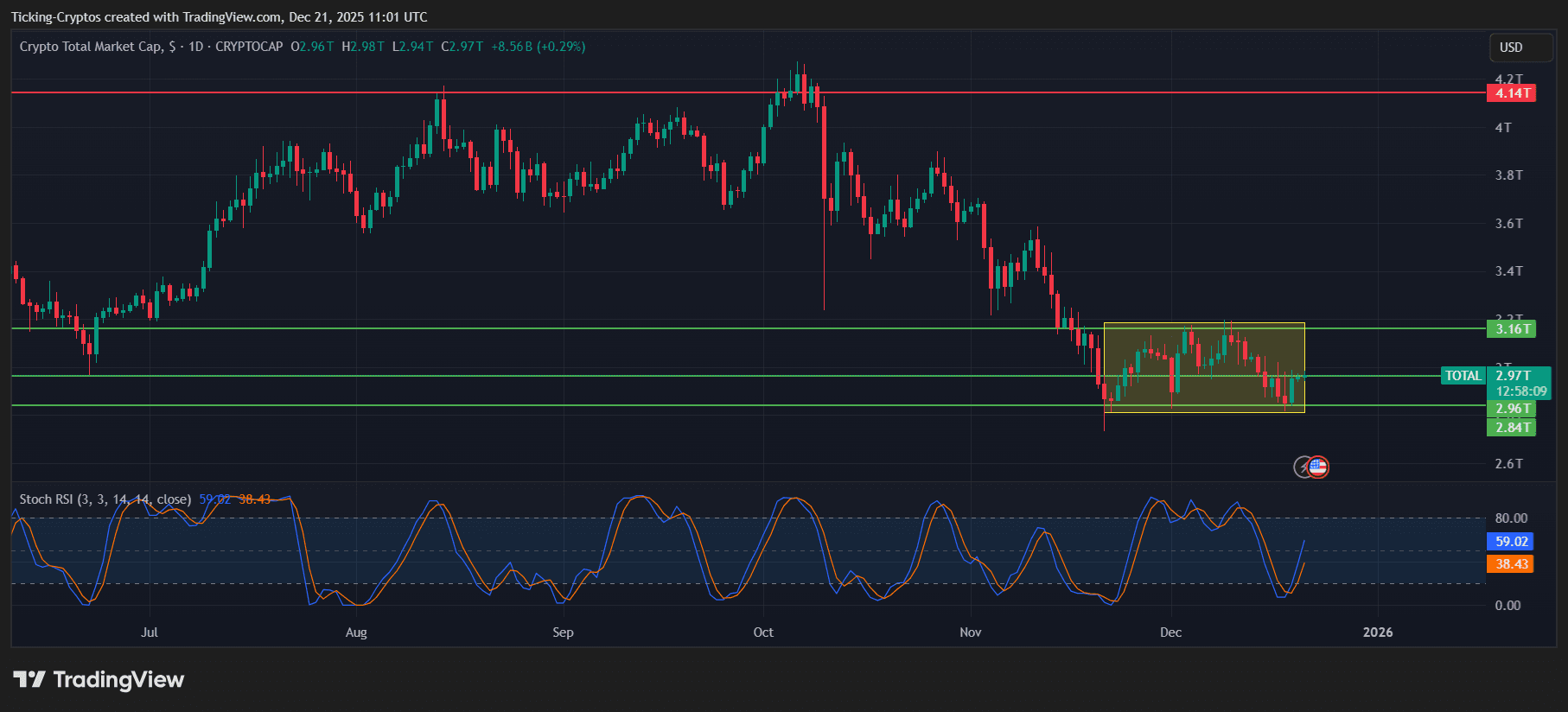

CryptoTicker News: Market Cap Stabilizes as Bitcoin, Ethereum, and XRP Headlines Shape Sentiment

Cryptoticker·2025/12/21 11:12

Cryptocurrency Fortunes: Seizing Opportunities in Every Market Cycle

Cointurk·2025/12/21 10:51

Husky Inu’s (HINU) Next Price Increase Will Take Token Value To $0.00024115

Cryptodaily·2025/12/21 10:48

Trump voorspelt economie 2026: XRP koers naar $100? Nu!

Newsbtc·2025/12/21 10:45

Popular Crypto Trader Confirms One of Many Bullish Price Trajectories for Ripple’s XRP

Cryptonewsland·2025/12/21 10:45

Stellar (XLM) Testing Key Support — Could This Pattern Trigger an Rebound?

Coinsprobe·2025/12/21 10:39

Flash

05:42

Offshore RMB breaks above 7.02 against the US dollarAccording to Sina Quotes, the offshore RMB/USD exchange rate has risen above 7.02, marking the first time since October 2024.

05:42

Matrixport: Gold Performs Exceptionally During Safe-Haven Cycles, Bitcoin Unlikely to Become an Official Reserve AssetMatrixport analysis points out that over the past year, gold prices have achieved nearly 80% excess returns relative to bitcoin, significantly outperforming bitcoin. In the current risk-off cycle, traditional hedging assets such as gold have benefited from falling interest rates, declining inflation, and rising market expectations that the Federal Reserve will turn dovish in 2026. Although BlackRock has reinforced the narrative of bitcoin as "digital gold," central banks around the world still primarily hold gold as reserve assets. Due to its high volatility and political sensitivity, bitcoin is difficult to include on a large scale in official reserves. U.S. policy direction remains a key long-term variable; a Trump administration may adjust gold reserves and marginally allocate bitcoin.

05:41

ZOOZ receives Nasdaq delisting warning due to stock price falling below $1Bitcoin reserve strategy company ZOOZ Strategy Ltd. announced that due to its stock price remaining below $1 for 30 consecutive trading days, the company received a delisting warning notice from Nasdaq on December 16, violating the minimum bid price requirement for continued listing. ZOOZ has been granted a 180-day remediation period (until June 15, 2026); if the stock price stays at or above $1 for 10 consecutive trading days, compliance will be restored. The company plans to consider solutions including a reverse stock split, and current operations remain unaffected. ZOOZ is dual-listed on Nasdaq and TASE, holds 1,036 bitcoins, and has announced a $50 million stock buyback plan.