News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

XRP and TRON Surge, But Apeing Takes the Lead as the Top Upcoming Crypto Nearing $0.0001

TimesTabloid·2025/12/20 23:18

Here’s how Euro stablecoins hit $1B despite weak hype

AMBCrypto·2025/12/20 23:03

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein

The Block·2025/12/20 23:03

Yuga Labs protects NFT royalties ahead of Magic Eden's Ethereum marketplace launch

The Block·2025/12/20 23:03

Crypto Market Surge – Canton Network Lands First in Top Gainers at Close to 40% Gain

BlockchainReporter·2025/12/20 23:00

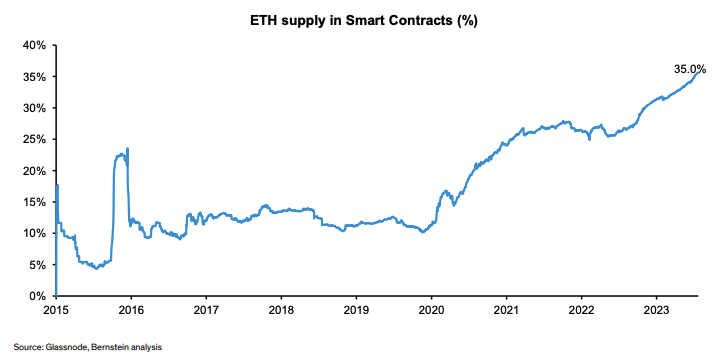

Major Ethereum Metric Just Hit A New All-Time High, Can Price Reclaim $3,000?

Newsbtc·2025/12/20 22:36

Google and Apple reportedly warn employees on visas to avoid international travel

TechCrunch·2025/12/20 22:21

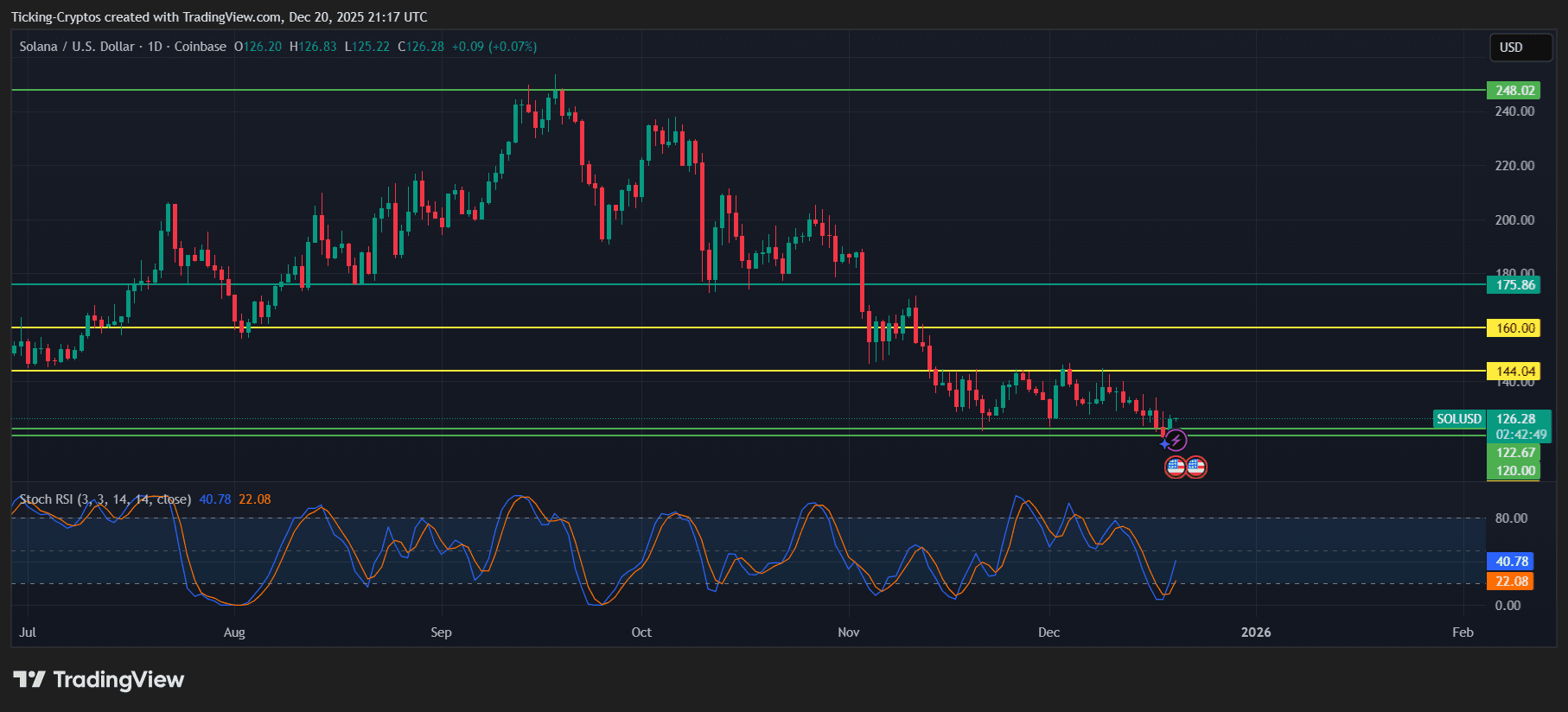

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

TimesTabloid·2025/12/20 22:03

Solana Price Depends On Existing SOL Holders, Here’s Why

BeInCrypto·2025/12/20 21:39

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Cryptoticker·2025/12/20 21:33

Flash

03:00

Matrixport: Due to its high volatility, high exposure, and certain political sensitivities, bitcoin is currently difficult to be widely included as an official reserve asset.Foresight News reported that Matrixport tweeted, "Gold prices have repeatedly reached new highs, achieving nearly 80% excess returns relative to bitcoin over the past year, with a particularly outstanding performance during this period. From a macro perspective, the weakening of the US dollar, diversified asset allocation, and the demand for store-of-value assets remain several main themes in the current market. However, in this round of the market, excess returns have been more concentrated in traditional hedging assets such as gold, driven by falling interest rates, declining inflation, and rising market expectations that the Federal Reserve will turn more dovish in 2026." Similar preferences can also be observed at the central bank level. Although BlackRock has continuously reinforced the narrative of bitcoin as 'digital gold' in recent years, central banks of various countries still mainly allocate gold as their reserve asset. Due to bitcoin's high volatility, high exposure, and certain political sensitivities, it is currently difficult to be widely included in official reserve assets. In the medium to long term, the direction of US policy remains the most critical uncertainty: in theory, a Trump administration might choose to revalue gold, sell part of its gold reserves, or marginally diversify some reserves into bitcoin. The probability of such scenarios occurring in the short term is not high, but it cannot be ruled out that in 2026 the market may amplify this possibility, turning it into a new focus of discussion."

02:55

IMF: The Salvadoran government has agreed at the policy level to no longer actively increase its BTC holdingsForesight News reported that the International Monetary Fund (IMF) issued a statement saying it will continue negotiations regarding El Salvador's bitcoin project and the sale of the government electronic wallet Chivo, noting that significant progress has been made in these discussions. The IMF stated that the El Salvadoran government has agreed at the policy level to no longer actively increase its BTC holdings and is advancing the phase-out of the Chivo wallet. However, the official El Salvador Bitcoin Office claims it is still "purchasing 1 BTC daily" and announced on December 22 that its holdings had increased to 7,509 BTC. The IMF requires El Salvador to fully comply with the agreement by the end of 2025 at the latest.

02:55

BitMine suspected of accumulating 29,462 ETH from BitGo and a certain exchange, worth approximately $88.1 millionForesight News reported, according to monitoring by Lookonchain, BitMine has reportedly accumulated an additional 29,462 ETH from BitGo and a certain exchange, valued at approximately $88.1 million.