News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ripple (XRP) Still Down Even With Major ETF Inflow, but Analysts Predict Geefi (GEE) Will Deliver Over 2200% ROI

TimesTabloid·2025/12/20 18:03

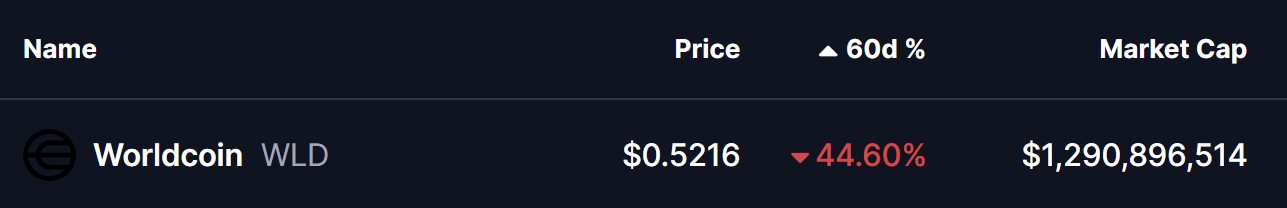

Worldcoin (WLD) Following Potential Reversal Setup – Will It Rise Further?

Coinsprobe·2025/12/20 17:57

LISTA Price Stalls Below $0.166 Resistance While Stability Forms Near $0.15

Cryptonewsland·2025/12/20 17:39

From $620 to $6 Million: Dormant Ethereum Whale Wakes Up After 10 Years

UToday·2025/12/20 17:03

$660 Million in XRP Shifts as Price Heads for Rebound

UToday·2025/12/20 17:03

$3,530,000,000 in 24 Hours, Midnight (NIGHT) Breaks Rare Milestone

UToday·2025/12/20 17:03

Top Traders Recommend GeeFi (GEE) Over Solana (SOL) as Its Potential Can Reach Life-Changing ROI

BlockchainReporter·2025/12/20 17:00

Shiba Inu Stalls Below Resistance as $0.000014 Breakout Level Draws Market Focus

Cryptonewsland·2025/12/20 16:39

HBAR Price Looks Closely Tried to Bitcoin, What’s Next?

BeInCrypto·2025/12/20 16:39

Flash

10:18

Call of Duty Co-Creator Vince Zampella Dies in Car Accident at Age 55PANews, December 23 – According to NBC Los Angeles, Vince Zampella, co-founder of Call of Duty, founder of Respawn, and head of the Battlefield series, has passed away in a car accident in Los Angeles at the age of 55. He was one of the most influential developers in the field of shooter games. Zampella's career began with Medal of Honor: Allied Assault. He then co-founded Infinity Ward with his team, launching the Call of Duty series and, under his leadership, developing Modern Warfare. Due to a dispute with Activision, he left in 2010 and founded Respawn, releasing well-known games such as Titanfall and Apex Legends. In 2021, he was commissioned by EA to reboot the Battlefield series, and this year's release of Battlefield 6 achieved great commercial success. TGA founder Geoff Keighley stated: "Vince was not only a visionary game producer but also a leader who valued player experience and was honest and transparent. His passing is a tremendous loss to the gaming industry." Zampella's works have profoundly influenced the development of shooter games worldwide, and his departure is deeply regrettable.

10:11

APRO prediction market oracle launches sports data and introduces a subscription-based OaaS platformBlockBeats News, December 23, according to official sources, APRO now provides verifiable, near real-time sports data for prediction markets, covering basketball, football, boxing, rugby, badminton, and other events. The first batch includes the NFL (National Football League). At the same time, APRO has launched the Oracle-as-a-Service (OaaS) subscription platform, productizing oracle capabilities to better adapt to scenarios such as prediction markets, offering standardized data access and x402 payment support. Currently, APRO’s multi-source data already covers crypto assets, social media, and sports, and will continue to expand into areas such as esports and macroeconomics in the future. On the network layer, it already supports over 40 public blockchains including Ethereum, BNB Chain, Base, and Solana. APRO stated that it will accelerate the large-scale development of prediction markets with verifiable data.

10:11

Market buying pressure continues to weaken, and the number of active on-chain addresses is decreasingMarket buying pressure continues to weaken, and on-chain data shows a decline in the active address metric. Analysis points out that active addresses are closely related to over-the-counter trading activity, and this slowdown indicates that overall market participation and vitality are decreasing. (CryptoQuant)