News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

You Need to Hold At Least 2,314 XRP. Here’s Why

TimesTabloid·2025/12/20 00:00

Bitcoin Recent Dips Reveal Market Structure Issue Not Coming From Selling Pressure

Newsbtc·2025/12/19 23:18

Top 5 Best Cryptos to Trade In as the Altcoin Market Trades at 40%+ Discounts

Cryptonewsland·2025/12/19 23:18

Building venture-backable companies in heavily regulated spaces

TechCrunch·2025/12/19 23:18

Rocket Lab wins another defense-related space contract

TechCrunch·2025/12/19 23:18

3 Altcoins To Watch This Weekend | December 20 – 21

BeInCrypto·2025/12/19 23:18

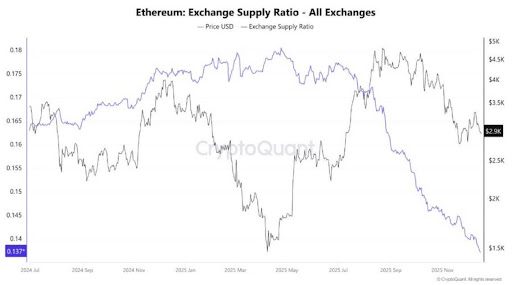

Ethereum Exchange Supply Just Crashed To New Lows, Why This Is Bullish For Price

Newsbtc·2025/12/19 22:21

Where are investors placing their bets next year? AI, AI, AI.

TechCrunch·2025/12/19 22:18

Former Patagonia CEO Rose Marcario resigns from Rivian’s board

TechCrunch·2025/12/19 22:18

XRP ETFs surpass $60m in assets as token price declines

Crypto.News·2025/12/19 22:06

Flash

18:42

IMF praises El Salvador's economic growth and bitcoin-related progressEl Salvador's economy is expected to grow by 4% this year, and the IMF has expressed approval of its better-than-expected economic growth and the progress of discussions related to bitcoin. Despite previous recommendations from the IMF, El Salvador continues to increase its bitcoin holdings, adding more than 1,000 BTC during the market downturn in November.

18:15

Data: 4.1811 million MORPHO transferred out from Ethena, worth approximately $4.89 millionAccording to ChainCatcher, Arkham data shows that at 02:03 (UTC+8), 4,181,099.9999999995 MORPHO (worth approximately $4,891,887) were transferred from Ethena to an anonymous address (starting with 0x6930...).

18:07

Whale sell-offs slow down, new whales' realized losses stabilizeThe whale selling trend appears to be slowing down, and the realized losses of new whales have stabilized, after previously driving the price down from $124,000 to $84,000. (Cointelegraph)