News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

IMF Q2 2025 COFER Data Weakens Dedollarization Narratives Cited as Bullish Catalysts for Bitcoin

BeInCrypto·2025/12/21 20:33

Watch Out: Large Token Unlocks in 20 Altcoins This Week – Here’s the Day-by-Day, Hour-by-Hour List

BitcoinSistemi·2025/12/21 20:18

Is Ethereum undervalued? These 2 on-chain signals say…

AMBCrypto·2025/12/21 20:03

17 Altcoins Experience Trading Volume Surge in South Korea – Here’s the List

BitcoinSistemi·2025/12/21 20:00

CLARITY Act explicitly leaves DeFi rules blank, risking a total retail protection collapse if negotiations fail

CryptoSlate·2025/12/21 19:42

Watch Out: Numerous Economic Developments and Altcoin Events This Week! Here’s the Day-by-Day, Hour-by-Hour List

BitcoinSistemi·2025/12/21 19:39

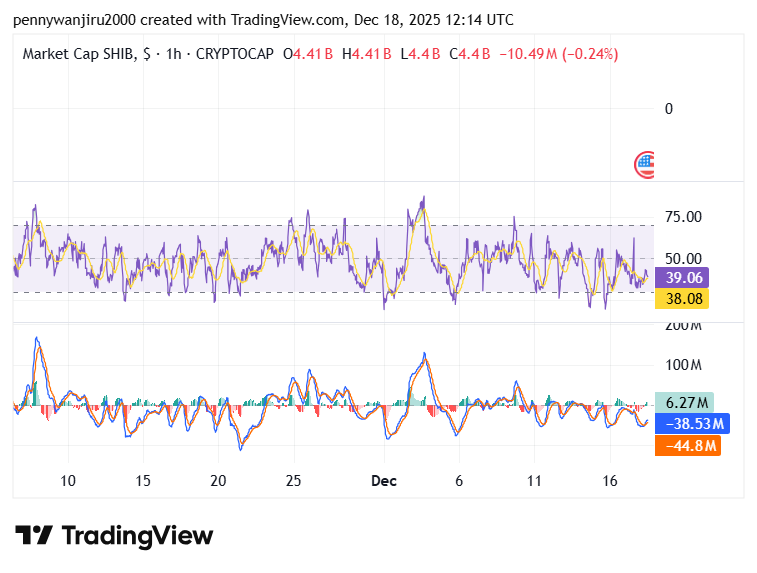

Shiba Inu Price Slips 2.9% as SHIB Defends $0.0574 Support Amid Tight Trading Range

Cryptonewsland·2025/12/21 19:39

The 15 Most Searched Altcoins in Recent Hours Have Been Revealed – Here’s the List

BitcoinSistemi·2025/12/21 19:24

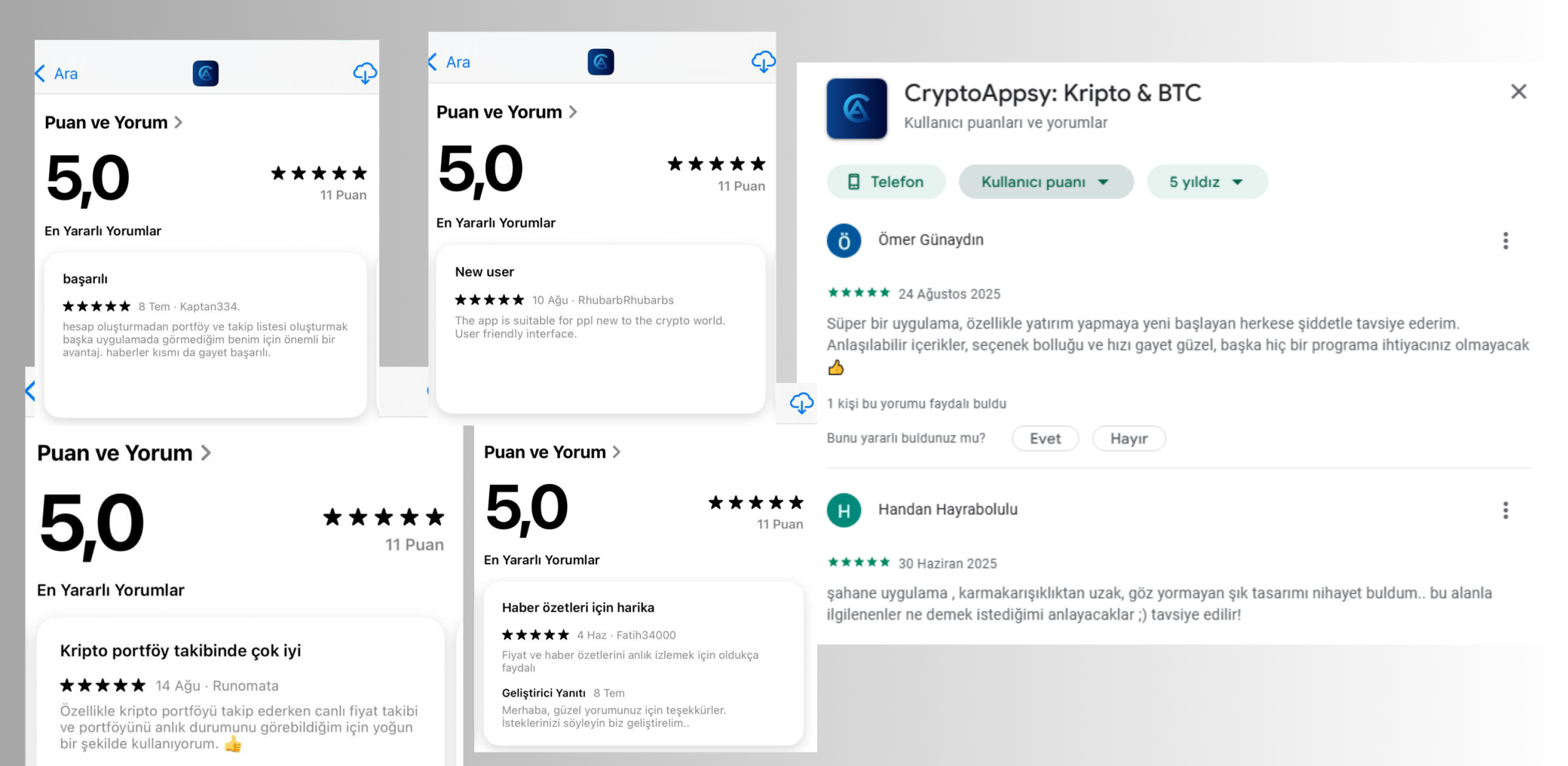

Discover What CryptoAppsy Can Do For Your Trading Strategies

Cointurk·2025/12/21 19:21

Best Crypto to Buy Now? Hedera Price Prediction, New Crypto Coins

Cryptonomist·2025/12/21 19:15

Flash

14:07

Kalshi: Prediction markets outperform Wall Street consensus in inflation forecastingBlockBeats News, December 22, according to Coindesk, a study by the prediction market platform Kalshi found that prediction markets outperform Wall Street consensus expectations in inflation forecasting. Over 25 months of data, its average error was 40% lower than consensus forecasts. The study points out that the advantage of prediction markets lies in their ability to aggregate diverse information from numerous traders based on economic incentives, creating a "wisdom of the crowd" effect, which enables them to respond more sensitively to changing environments. These findings suggest that market-based forecasts can serve as a valuable supplementary tool for institutional decision-makers, especially during periods of high uncertainty. By comparing inflation forecasts on its platform with Wall Street consensus expectations, Kalshi found that market-based traders had higher forecasting accuracy than traditional economists and analysts during the 25-month observation period, with this advantage being particularly significant during periods of economic volatility. Specifically, the study found that from February 2023 to mid-2025, the average error of prediction markets' estimates of year-on-year changes in the Consumer Price Index (CPI) was 40% lower than consensus forecasts. When actual data deviated significantly from expectations, the advantage of prediction markets became even more pronounced, with their accuracy exceeding consensus expectations by up to 67%.

14:06

Layer 1 blockchain Flare jointly launches XRP yield product earnXRPForesight News reported, according to The Block, that Layer 1 blockchain Flare has announced the joint launch of the XRP yield product earnXRP with DeFi platform Upshift Finance, which provides yield vault infrastructure, and on-chain risk management company Clearstar. This product allows users to deposit FXRP (the wrapped version of XRP on Flare) into a single vault, which will deploy funds into various on-chain strategies to generate yield denominated in XRP.

13:52

Circle has just minted 500 million USDC on the Solana network.BlockBeats News, December 22, according to monitoring by Onchain Lens, Circle has just minted 500 million USDC on the Solana network. Since October 11, Circle has minted a total of 18 billions USDC on the Solana network.