News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

MicroStrategy’s Saylor Signals Imminent Bitcoin Buy Amid MSTR Stock YTD Decline

BeInCrypto·2025/12/21 18:09

Analysts Look Beyond Bitcoin’s Price As Tom Lee Flags a Structural Shift

BeInCrypto·2025/12/21 18:09

Christmas festivities go beyond gifts; Moon Hash is giving away BTC and ETH cryptocurrency rewards!

TimesTabloid·2025/12/21 18:03

Cardano (ADA) Updates Its Privacy, yet Top Traders’ Attention is on GeeFi (GEE) After It Sold 25M Tokens Fast

TimesTabloid·2025/12/21 18:03

ASTER Holds Near Support While $0.7834 Resistance Defines Trading Range

Cryptonewsland·2025/12/21 17:34

BlackRock’s IBIT Defies Bitcoin Slump to Beat Gold in 2025 ETF Flows

BeInCrypto·2025/12/21 17:27

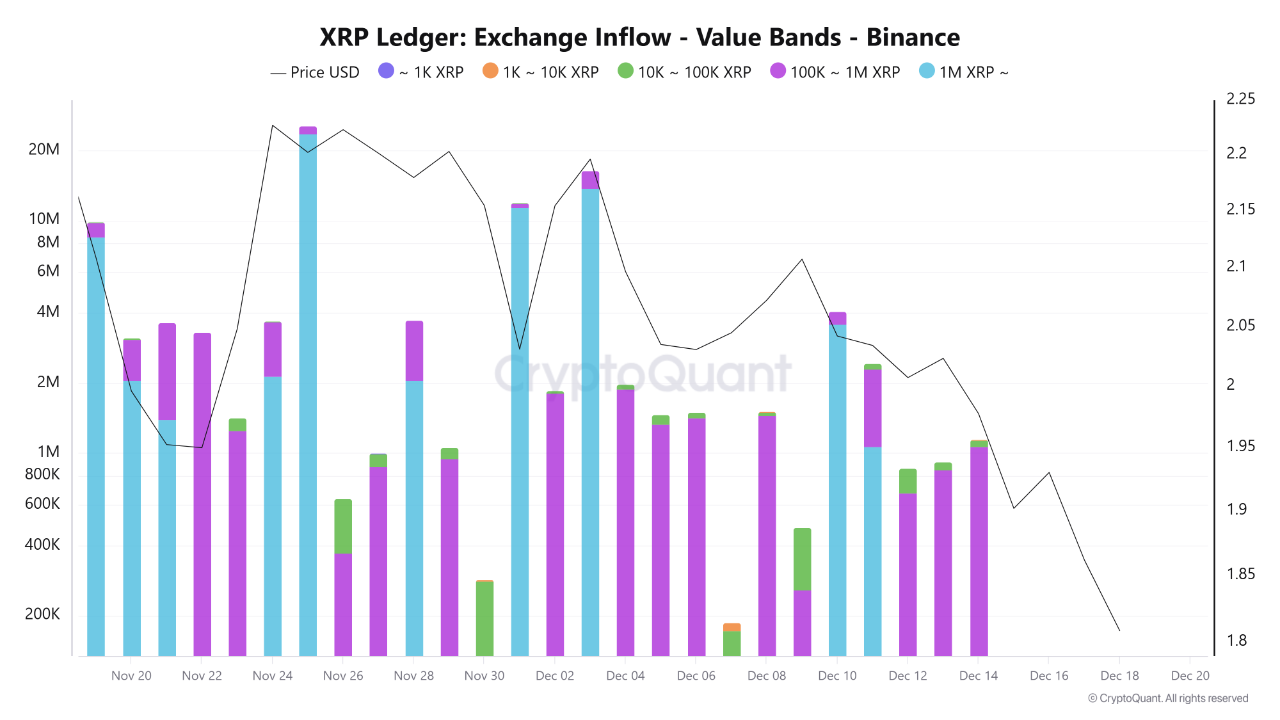

XRP Whales Sold ETF Approval News

UToday·2025/12/21 17:24

'Smartest Man Alive' Keeps Shilling XRP, Calls It 'Digital God'

UToday·2025/12/21 17:24

XRP Protection Against Quantum Threat Finally Revealed

UToday·2025/12/21 17:24

Cardano Founder Takes Dig at XRP and SOL

UToday·2025/12/21 17:24

Flash

16:57

Statistics: New Tokens in 2025 Commonly Fall Below Issue Price, Only 15% of Projects Have FDV Higher Than at TGEBlockBeats news, on December 23, according to statistics from Ash (@ahboyash), among the 118 new tokens with TGE in 2025, 84.7% (100/118) have a FDV lower than at the time of TGE. This means that for every 5 newly issued tokens, about 4 currently have a FDV below their initial valuation at issuance. The median FDV of these tokens has dropped by 71% compared to the time of issuance (the median market cap has dropped by 67%). Only 15% of the tokens have seen an increase in FDV compared to the time of TGE. Among the worst performers, there are 15 tokens that have dropped by more than 90%, including some high-profile projects such as Berachain (-93%), Animecoin (-94%), and Bio Protocol (-93%). Overall, the total FDV of this batch of tokens has shrunk from $139 billion at listing to the current $54 billion, which means that about $87 billion (59%) of the "on-paper" FDV has evaporated (this calculation does not include projects that have gone to zero). There are also outstanding performers, most of which were issued in the second half of 2025 with relatively low initial valuations, including Aster (+745%), Yooldo Games (+538%), and Humanity (+323%).

16:20

Sources: Trump may appoint a new Federal Reserve Chair in the first week of January 2026BlockBeats News, December 23, according to CNBC, sources familiar with the matter revealed that U.S. President Trump may appoint a new Federal Reserve Chair in the first week of January next year.

15:53

Trump Media spends $13.44 million to acquire an additional 150 BTCForesight News reported, according to Arkham monitoring, Trump Media has spent $13.44 million to purchase an additional 150 BTC. Trump Media now holds a total of 11,241 BTC, valued at approximately $1 billion.