News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Pundit: This Update Is Huge for XRP

TimesTabloid·2025/12/20 09:24

Crypto Hedge Funds Hit Hard as ETF Growth Drains Trading Alpha

Cryptotale·2025/12/20 09:21

Ethereum vs. Bitcoin: What the usage–value split says about prices

AMBCrypto·2025/12/20 09:03

Zcash Price Prediction: ZEC Jumps 10%, Is It The Best Crypto to Buy Now?

Cryptonomist·2025/12/20 09:03

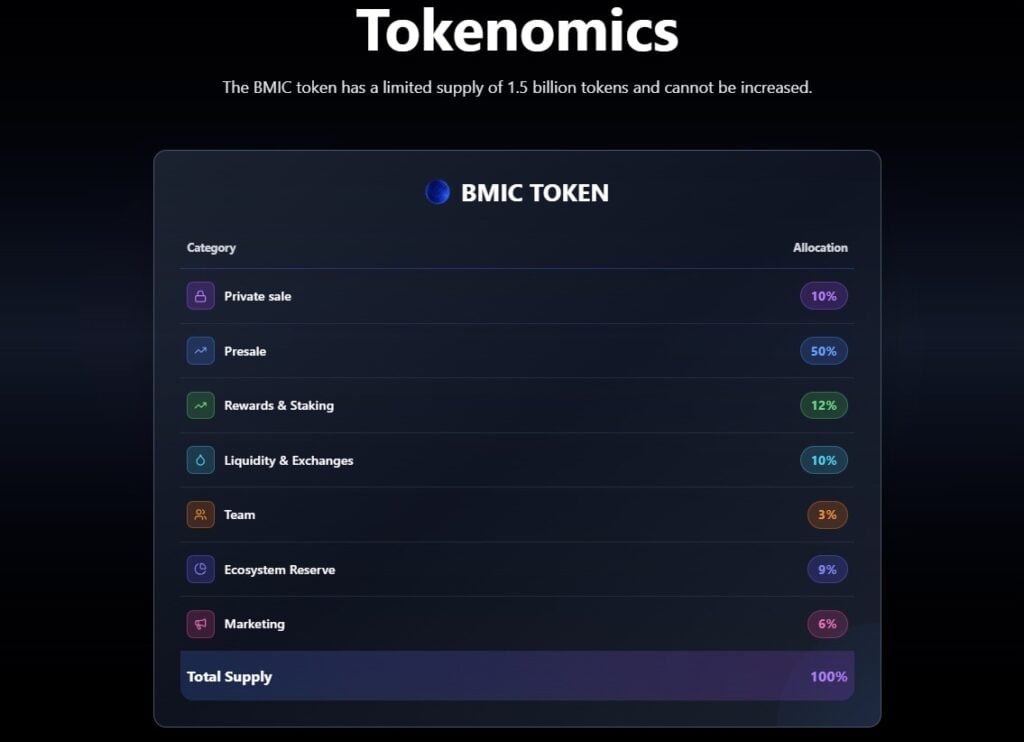

Why Platforms Like BMIC Matter More During Bear Market Conditions – Best Crypto Presale to Buy Now?

Cryptonomist·2025/12/20 09:03

CNBC: Why Investors Rotate Into XRP from BTC and ETH

TimesTabloid·2025/12/20 08:48

Critical Bitcoin Correction Forecast: Fundstrat Predicts $60K-$65K Range by H1 2026

Bitcoinworld·2025/12/20 08:42

Ripple (XR) in the Room With Senators

TimesTabloid·2025/12/20 08:12

XRP ETF net inflows continue to rise, but on-chain performance remains concerning!

AIcoin·2025/12/20 07:30

Flash

09:16

GIGGLE rebounds and surpasses 70 USDT, up 23.5% in 24HAccording to Odaily, market data shows that GIGGLE has rebounded and surpassed 70 USDT, currently trading at 72.3 USDT, with a 24-hour increase of 23.5%.

09:10

Two whales withdrew a total of 206,334 ZEC from a certain exchange, worth approximately $93.36 million.BlockBeats News, December 20, according to monitoring by Lookonchain, whales are accumulating ZEC. The address starting with t1dHhe withdrew 202,077 ZEC from an exchange 16 hours ago, worth approximately $91.43 million. The address starting with t1Nt2i withdrew 4,257 ZEC from an exchange 5 hours ago, worth approximately $1.93 million.

09:09

Two whales withdrew a total of 206,334 ZEC from an exchange, worth approximately $93.36 million.BlockBeats News, December 20th, according to LookIntoChain monitoring, whales are accumulating ZEC. The address starting with t1dHhe withdrew 202,077 ZEC from an exchange 16 hours ago, worth approximately $91.43 million.

The address starting with t1Nt2i withdrew 4,257 ZEC from an exchange 5 hours ago, worth approximately $1.93 million.

News