Trump’s World Liberty Saw Token Sale Surge with 230% Price Hike Amid Massive Demand

Following what it described as “massive demand,” the platform has released an additional 5% of its token supply at a 230% price increase.

World Liberty Financial (WLFI), the decentralized finance platform backed by Donald Trump, has announced the completion of its initial token sale.

Following what it described as “massive demand,” the platform has released an additional 5% of its token supply at a 230% price increase.

In a Jan. 20 statement on X , World Liberty Financial confirmed it had sold 20% of its token supply as initially planned.

“Due to massive demand and overwhelming interest, we’ve decided to open up an additional block of 5% of token supply,” the post read.

Additional Tokens Sold at 230% Higher Rate

The additional tokens are priced at $0.05 each, up from the $0.015 per token during the initial sale.

Launched in September, the Trump-backed project originally aimed to sell 20 billion of its 100 billion WLFI tokens, raising $300 million.

The latest 5 billion token sale seeks to generate an additional $250 million. Despite its early struggles—partly due to excluding U.S. retail investors—the project has gained momentum in recent months.

Tron founder Justin Sun, who invested $30 million in WLFI in November, has now increased his stake with a further $45 million, bringing his total investment to $75 million.

WLFI tokens, which are non-transferable, serve as governance tokens for the platform’s forthcoming decentralized crypto trading platform.

Holders will gain voting rights on community proposals once the platform is operational.

In a related move, World Liberty Financial has announced a strategic partnership with TRUMP, a memecoin associated with the former president.

While TRUMP saw an initial price surge, it later dropped by 40% as Melania Trump introduced her own memecoin.

Trump Expected to Sign Executive Order on First Day

The timing of the posts is particularly notable, as Trump is expected to sign an executive order prioritizing cryptocurrency as a national focus shortly after taking office.

As reported, Trump is expected to prioritize executive orders addressing crypto de-banking and revising a controversial bank accounting policy.

The anticipated orders include a repeal of a policy introduced under the Biden administration, requiring banks holding cryptocurrency to list the digital assets as liabilities.

This policy stems from the Securities and Exchange Commission’s March 2022 Staff Accounting Bulletin, SAB 121, which has faced resistance from the crypto industry.

The Trump team has reportedly emphasized the urgency of reversing these measures, with sources close to the discussions confirming their high priority.

The crypto industry has long criticized the Biden administration for what it perceives as a targeted crackdown, often referred to as “Operation ChokePoint 2.0,” aimed at severing the sector’s access to financial services.

As reported, Trump’s official social media accounts have also created a stir by promoting a Solana-based meme coin called “Official Trump (TRUMP),” just days before his second presidential inauguration on Jan. 20.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Trends Capture Attention as Market Struggles

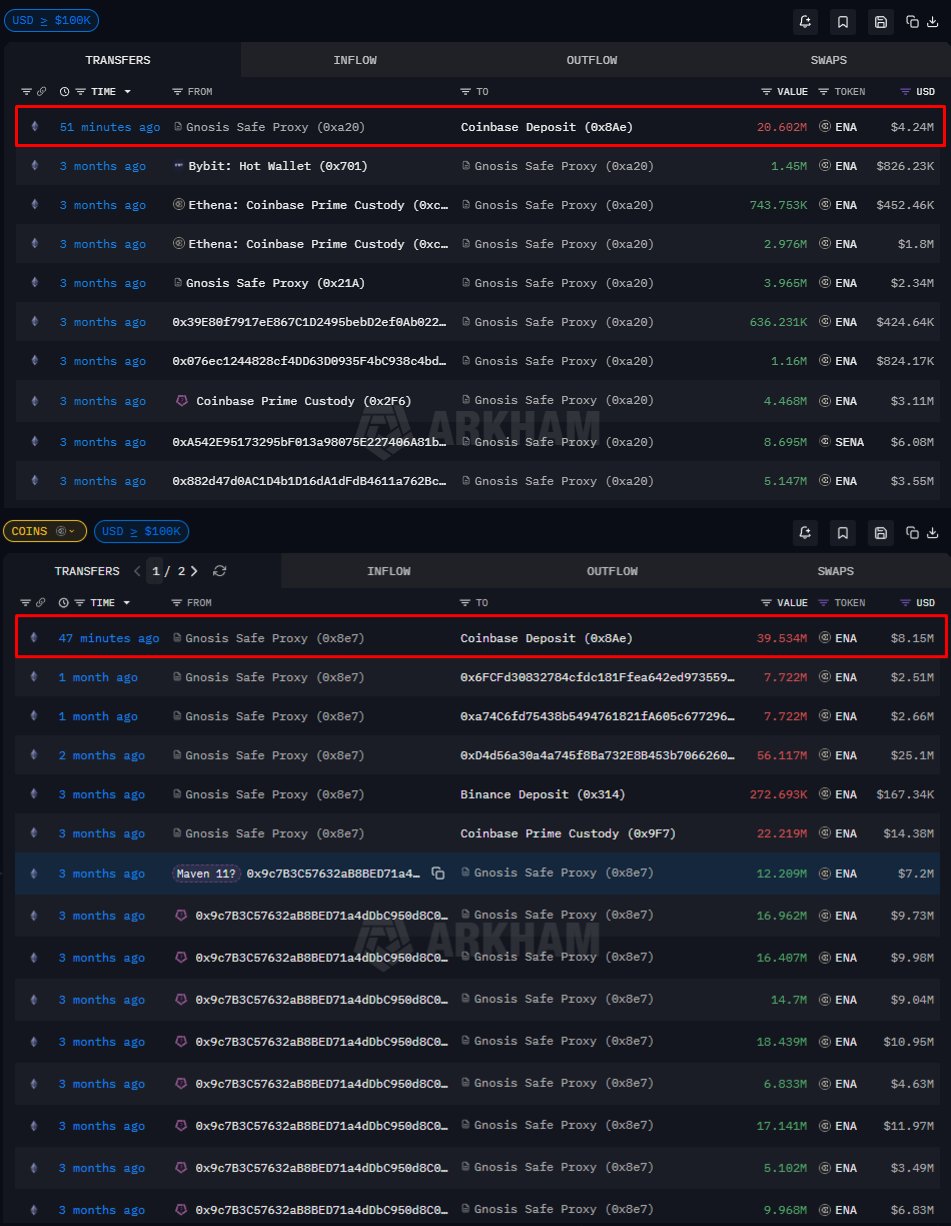

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

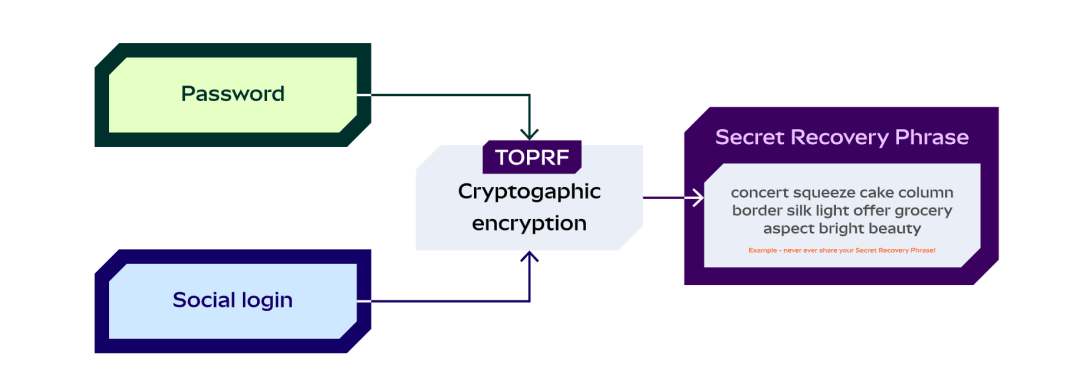

A Brief History of Blockchain Wallets and the 2025 Market Landscape