Date: Fri, March 28, 2025 | 11:40 AM GMT

The cryptocurrency market is witnessing renewed bearish pressure, wiping out the recovery gains from earlier this week. Ethereum (ETH) has declined by over 5% in the last 24 hours, dipping below the $1,900 mark, which has added selling pressure across major altcoins .

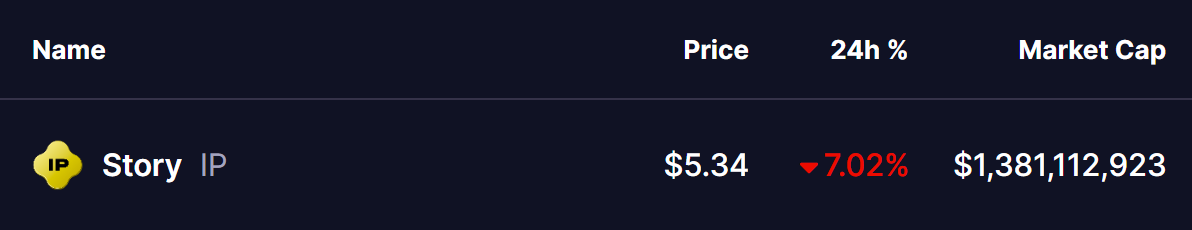

Among them, Story (IP) is also facing significant declines, dropping over 7% today. A deeper look at the technical setup suggests that further downside may be ahead as IP has failed to hold a critical support level.

Source: Coinmarketcap

Source: Coinmarketcap

Breakdown from Symmetrical Triangle

The daily chart of Story (IP) indicates that the price has lost momentum, confirming a bearish breakdown from a well-established symmetrical triangle pattern. This pattern had been forming since its rejection from the all-time high of $7.99 on February 28, creating a tightening range where both buyers and sellers battled for control.

Story (IP) Daily Chart/Coinsprobe (Source: Tradingview)

Story (IP) Daily Chart/Coinsprobe (Source: Tradingview)

Initially, the ascending trendline acted as a strong support, preventing deeper pullbacks. However, the recent market weakness led to a decisive break below this critical level at $5.74, signaling that sellers have gained control. This breakdown has triggered increased selling pressure, pushing IP toward the next immediate support zone at $5.34.

The symmetrical triangle pattern is known for its neutral stance, meaning a breakout could have gone in either direction. But since the breakdown has occurred on strong volume and with confirmation, it increases the probability of further downside movement. If IP fails to reclaim the broken trendline, it could extend losses toward its next major support levels at $4.64 and $3.64, which would represent a potential 31% decline from the current price.

However, if buyers step in and the price reclaims the support trendline, it could invalidate this breakdown and re-enter the previous consolidation zone. In such a scenario, the $5.74-$6.00 range would become a critical resistance zone to watch.

Final Thoughts

Story (IP) has confirmed a breakdown from a key pattern, indicating that sellers are in control for now. The next few days will be crucial, as the price action around the $5.35 support level will determine whether IP continues its downward trajectory or attempts a recovery. Traders should closely monitor volume and momentum indicators for confirmation of either scenario.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.