Date: Mon, July 28, 2025 | 05:45 AM GMT

The broader cryptocurrency market continues to ride a bullish wave, led by Ethereum (ETH), which has surged 62% over the past 30 days, climbing above $3,900. This wave of momentum is spilling into major altcoins , with Chainlink (LINK) now flashing strong signals of potential upside momentum.

LINK is extending its bullish streak, pushing its monthly gains to 48%. Beyond its price gains, LINK’s chart is painting a harmonic pattern that suggests a potentially significant move may still be ahead.

Source: Coinmarketcap

Source: Coinmarketcap

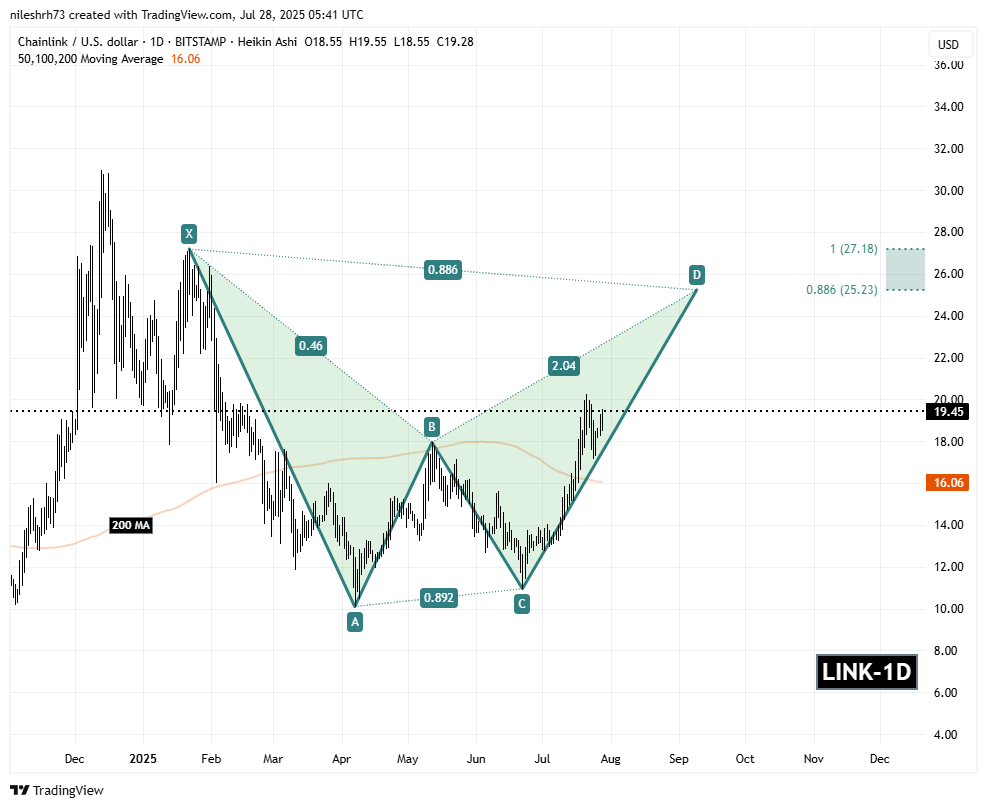

Harmonic Pattern Hints at Bullish Continuation

On the daily chart, LINK is shaping a Bearish Butterfly harmonic pattern — a setup that, despite its name, often leads to explosive rallies during the CD leg, the final and most powerful phase of the pattern.

This pattern started at point X near $27.18, dropped to point A, rebounded to point B, and then fell again to point C around $10.95. Since hitting that low, LINK has staged a sharp recovery, now trading near $19.45, reclaiming important ground and building momentum.

Chainlink (LINK) Daily Chart/Coinsprobe (Source: Tradingview)

Chainlink (LINK) Daily Chart/Coinsprobe (Source: Tradingview)

This CD leg is typically where rallies accelerate, and LINK’s price action suggests the next move upward could be significant.

What’s Next for LINK?

If the pattern continues to play out, the Potential Reversal Zone (PRZ) sits between $25.23 and $27.18, aligning with the 0.886 and 1.0 Fibonacci extensions. A move into this range would mark another 39% upside from current levels.

To maintain this bullish outlook, LINK needs to hold above its 200-day moving average (200 MA), currently near $16.06, which serves as a key support level.

With bullish sentiment across the market and LINK’s technicals lining up, the coming weeks could be pivotal for this DeFi-focused token.