Solana dropped 14% last week, yet on-chain metrics show long-term holders increasing accumulation, indicating a bullish shift and potential price stabilization near $158 support.

-

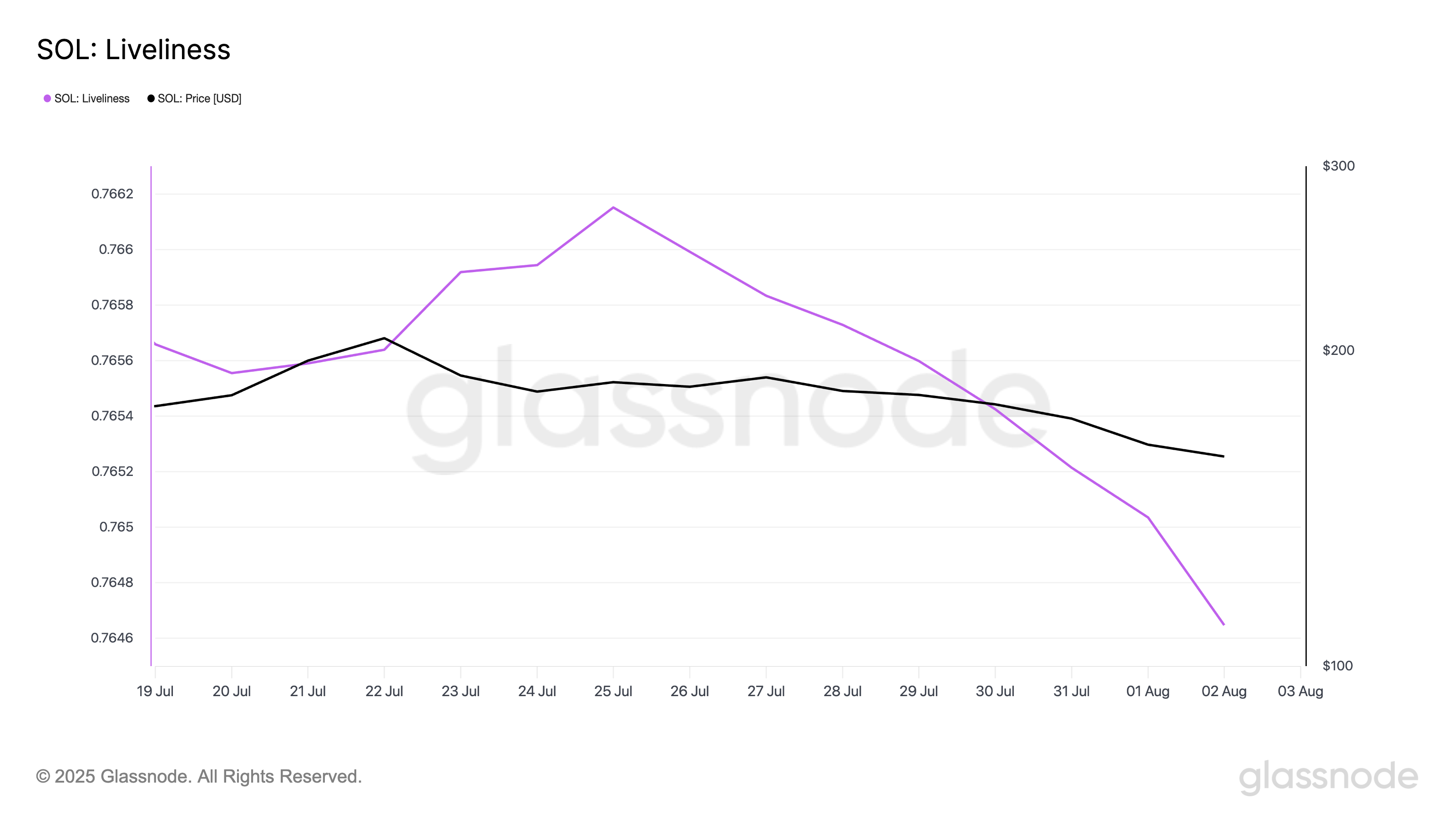

Solana’s Liveliness metric declined, signaling reduced movement of long-held tokens and stronger holder confidence.

-

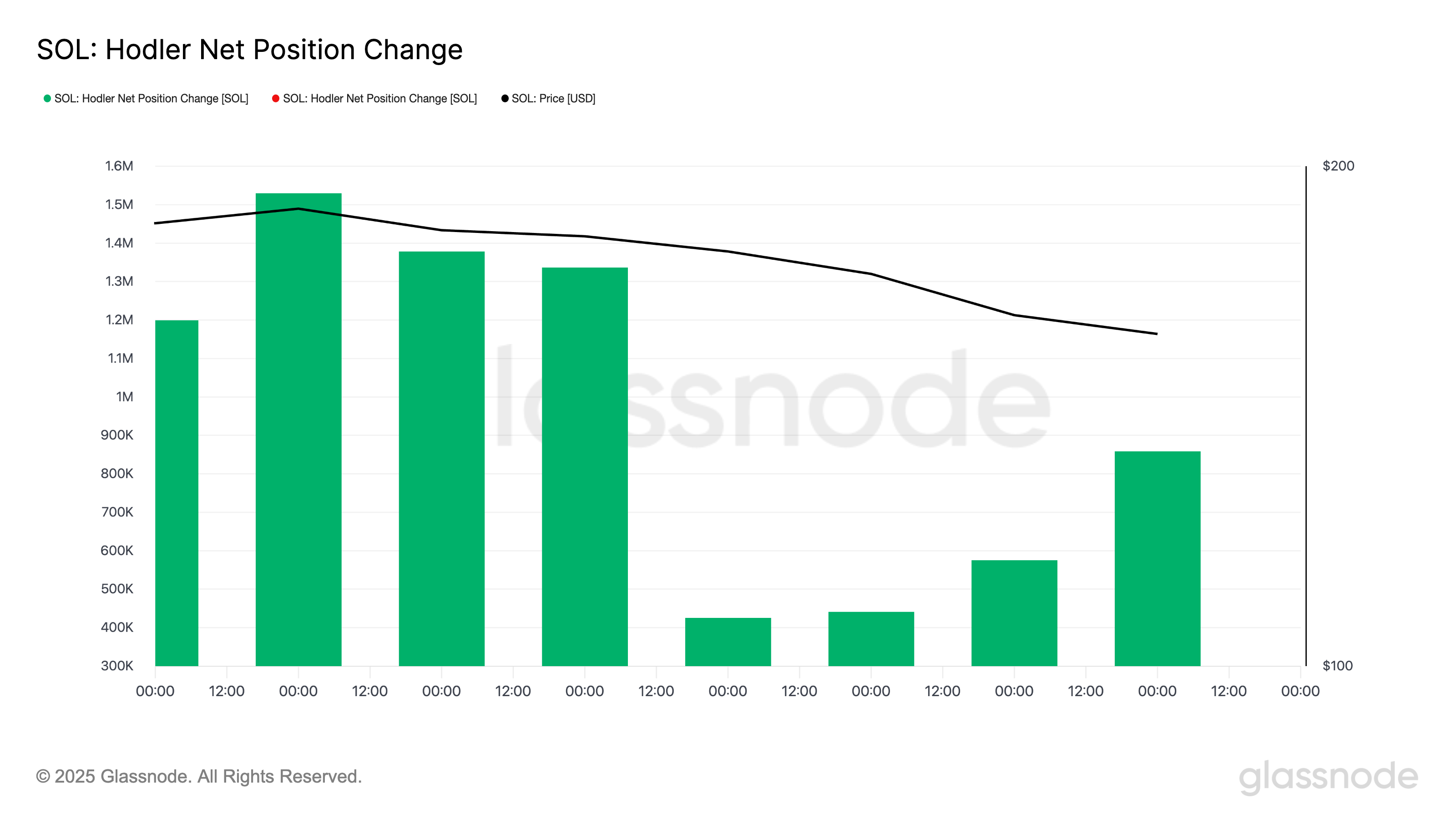

Hodler Net Position Change rose by 102% in four days, confirming increased long-term storage despite price weakness.

-

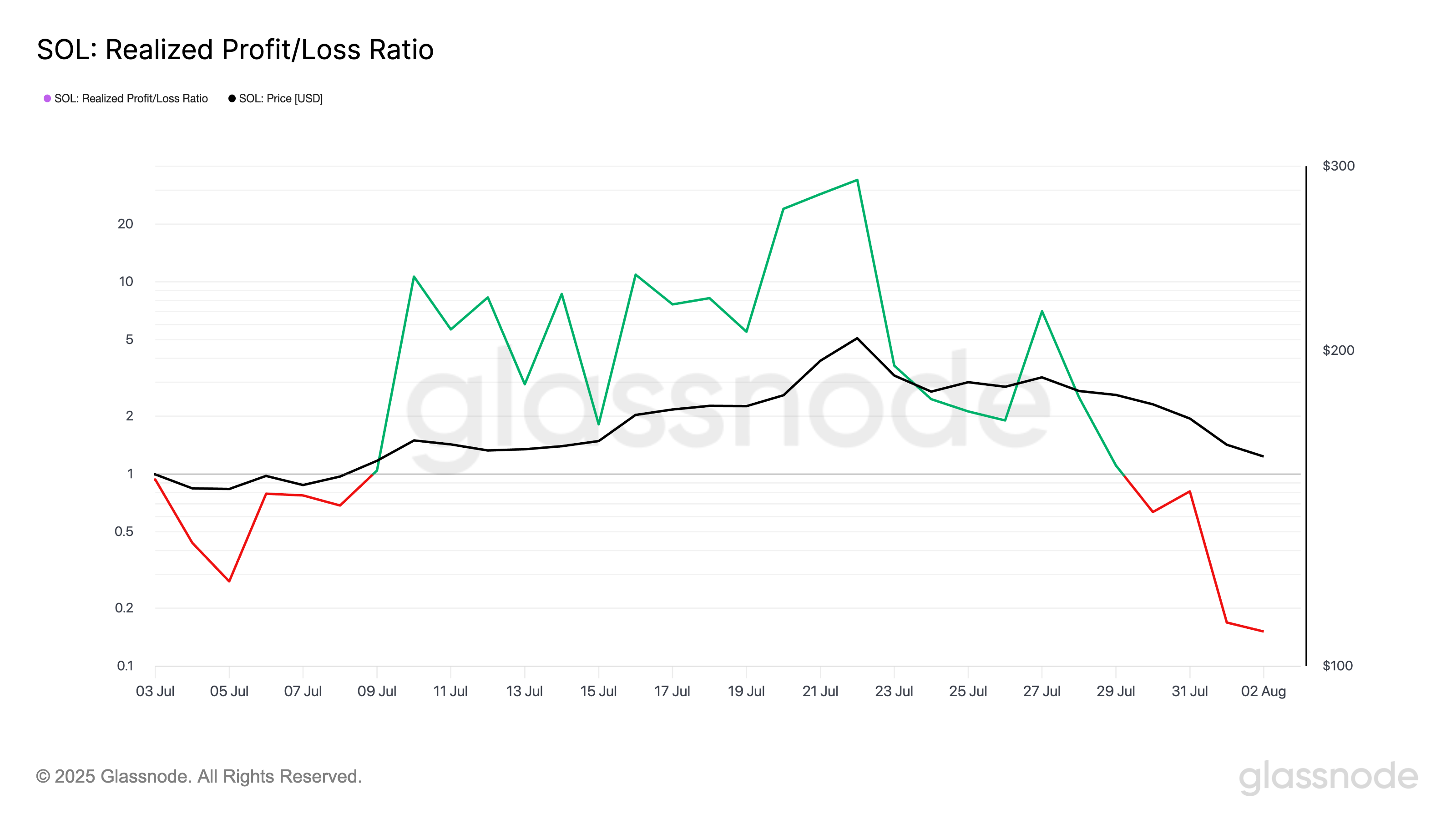

Realized Profit/Loss Ratio hit a 30-day low, showing many traders are selling at losses, which often precedes market bottoms.

Solana price fell 14% last week, but rising long-term holder accumulation signals potential rebound. Stay updated with COINOTAG’s expert crypto insights.

Why Are Long-Term Holders Increasing Solana Accumulation?

Long-term holders of Solana are accumulating more tokens despite recent price declines, as shown by key on-chain metrics. The Liveliness metric, which tracks the activity of dormant tokens, dropped to 0.76, its lowest weekly level since July 25. This decline suggests fewer long-term holders are selling, opting instead to hold their assets off exchanges.

What Does Solana’s Liveliness Metric Indicate About Holder Behavior?

Liveliness measures the ratio of coin days destroyed to coin days accumulated. A falling Liveliness, like Solana’s recent trend, indicates that long-term holders are moving tokens into storage rather than selling. This behavior often reflects confidence in the asset’s future prospects and can precede price stabilization or recovery.

SOL Liveliness. Source: Glassnode

How Is Hodler Net Position Change Reflecting Solana’s Market Sentiment?

Since July 30, Solana’s Hodler Net Position Change has increased by 102%, indicating a significant rise in coins moved into long-term storage. This metric tracks the 30-day supply change held by long-term holders, confirming that accumulation is intensifying even as prices remain subdued.

SOL Holder Net Position Change. Source: Glassnode

Is Solana’s Price Bottoming Out Amid Selling at a Loss?

On-chain data reveals that many Solana traders are currently selling at a loss, a condition often associated with market bottoms. The Realized Profit/Loss Ratio dropped to 0.15 on August 2, its lowest in 30 days. This suggests that selling pressure may be diminishing as fewer holders are willing to exit below cost, potentially setting the stage for price stabilization.

SOL Realized Profit/Loss Ratio. Source: Glassnode

What Are the Key Support and Resistance Levels for Solana?

Currently trading at $160.55, Solana is holding above a critical support level at $158.80. If buying momentum strengthens, SOL could rally toward the next resistance near $176.33. Conversely, sustained sell-offs might push the price down to $145.90, testing lower support zones.

SOL Price Analysis. Source: TradingView

Frequently Asked Questions

What is causing long-term holders to accumulate Solana despite price drops?

Long-term holders are accumulating Solana due to confidence in its future potential, as indicated by declining Liveliness and rising Hodler Net Position Change metrics, signaling reduced sell pressure.

How does selling at a loss affect Solana’s market bottom?

Selling at a loss often marks capitulation, reducing selling pressure and allowing prices to stabilize, which may lead to a market bottom and eventual recovery.

Key Takeaways

- Long-term holders are increasing Solana accumulation: On-chain data shows reduced token movement and rising storage.

- Selling at a loss may indicate a market bottom: Realized Profit/Loss Ratio is at a 30-day low, signaling capitulation.

- Critical support at $158 is holding: Price action near this level will determine Solana’s next trend direction.

Conclusion

Despite a 14% price drop, Solana’s growing long-term holder accumulation and declining sell pressure suggest a potential stabilization near key support levels. These on-chain indicators highlight a bullish sentiment shift, positioning SOL for a possible rebound in the near term. Investors should monitor long-term holder behavior and support levels closely for signs of recovery.