The Largest BTC Theft in History: After 5 Years of Silence, the Involved Amount Reached $14.5 Billion

LuBian Pool was hacked in December 2020, with over 127,000 BTC stolen, valued at $3.5 billion at the time, now worth approximately $14.5 billion.

Original Source: Arkham

Original Translation: Wenser, Odaily Planet Daily

Editor's Note: In the current turbulent bear market of the cryptocurrency world, the on-chain data platform Arkham yesterday released a lengthy article exposing a hacker event described as the "largest BTC theft in history", involving the well-known BTC mining pool LuBian. The platform once controlled 6% of the Bitcoin network's total hashrate but suffered a massive theft of over 127,000 BTC in December 2020, currently valued at around $14.5 billion. In this article, Odaily Planet Daily will summarize this almost 5-year-old hacker incident for readers' reference.

Largest BTC Theft in History: Over 127,000 BTC, Now Valued at $14.5 Billion

Recently, the on-chain data platform Arkham revealed in a post that the "largest BTC theft in history" has come to light, with the involved platform being the LuBian mining pool.

It is understood that the mining equipment of this pool is mainly deployed within China and Iran. According to on-chain data analysis, in December 2020, 127,426 BTC from the LuBian mining pool were stolen, with the assets valued at $3.5 billion at the time and now worth approximately $14.5 billion. As of the time of writing, LuBian and the hacker in this theft have not publicly admitted to this hack attack.

On-chain Data Analysis Visualization

Details of the "LuBian BTC Theft Case" are as follows:

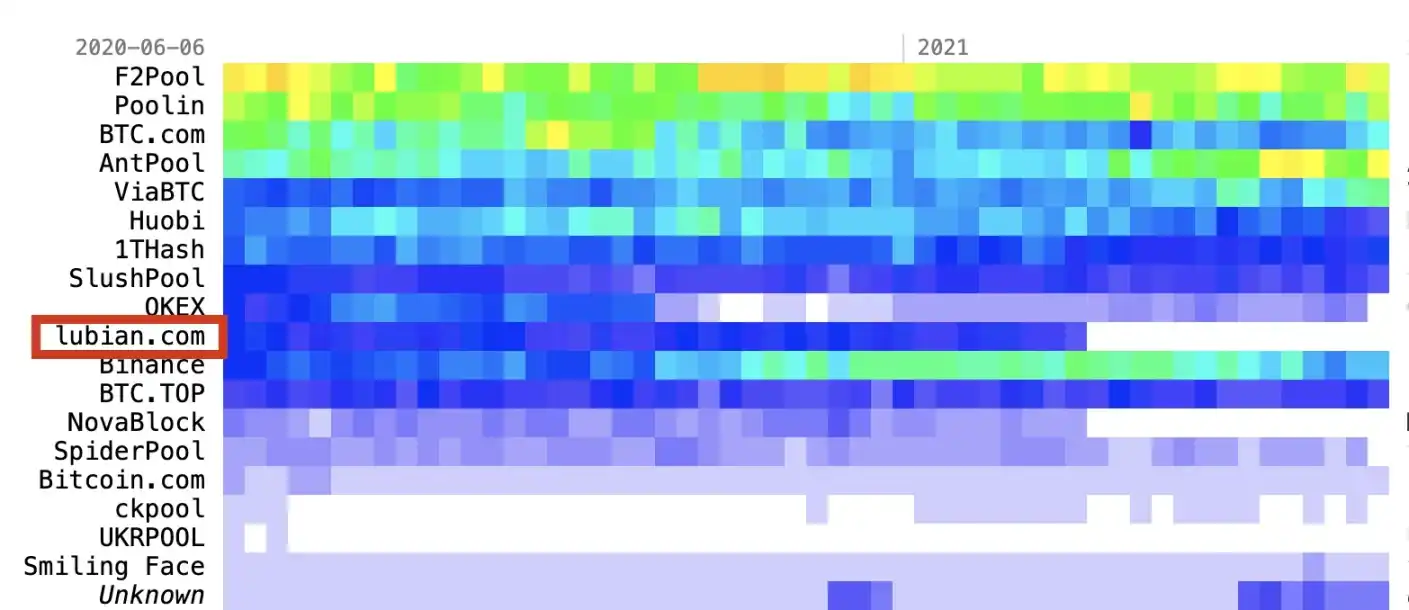

In 2020, as one of the world's largest BTC mining pools, LuBian officially started operating, with reports indicating that the pool was founded and managed by Chinese miners and was a private pool. According to Glassnode data, the pool began mining in March 2020, and BTC.com shows that LuBian pool first produced a block in April 2020. By May 2020, it had nearly 6% of the total Bitcoin network hashrate. However, after block 672,636 on February 28, 2021, the mining activity of this pool came to an end.

LuBian Mining Pool's ranking once reached the top 10 in the industry

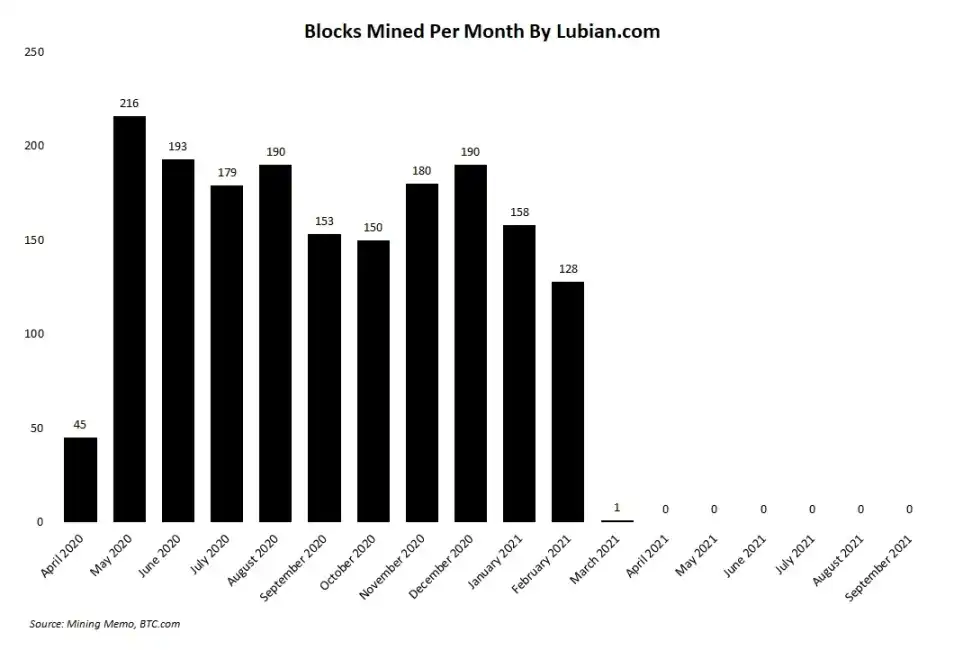

Number of Blocks Mined Monthly by Lubian.com

On December 28, 2020, the LuBian mining pool was first hacked, with over 90% of the bitcoins in the pool being stolen.

On December 29, 2020, approximately $6 million worth of bitcoins and USDT were once again stolen from an active address on the Bitcoin Omni layer owned by Lubian.

On December 31, 2020, LuBian transferred the remaining funds to another wallet.

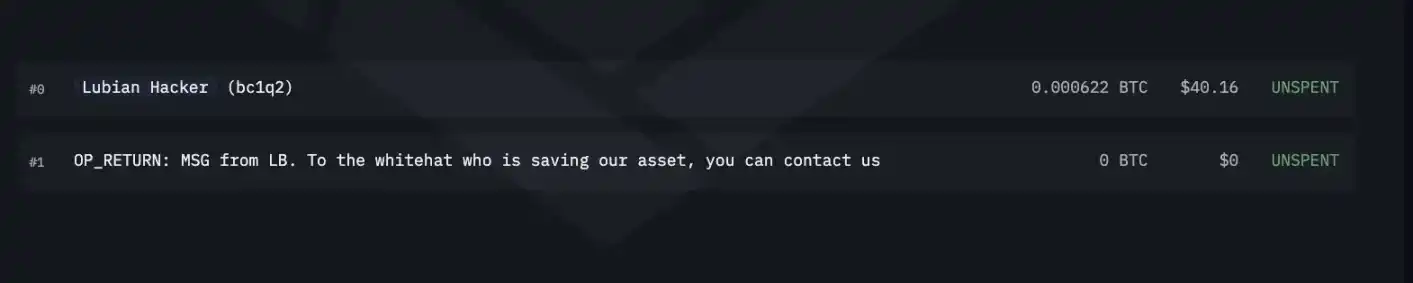

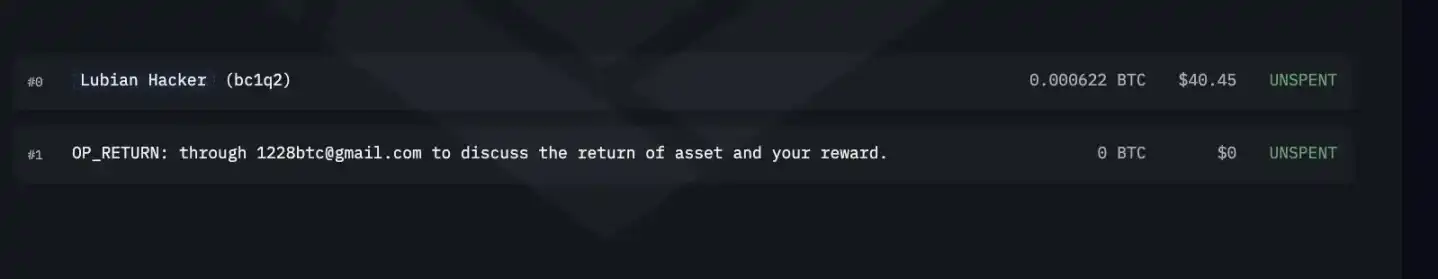

On-Chain Message Sent by Lubian to the Hacker

According to a screenshot, all hacker addresses received an OP_RETURN on-chain message from LuBian, begging the hacker to return the stolen funds.

According to on-chain information, LuBian used 1516 transactions, spending 1.4 BTC to send these messages. This phenomenon indicates that these on-chain message communications were not forged by other hackers through brute-forcing private keys (Note by Odaily: After all, few would send so many messages and incur such a high cost for on-chain communication unless forced).

Current information indicates that LuBian may have used an algorithm vulnerable to brute-force attacks to generate its private key, which became a loophole exploited by the hacker.

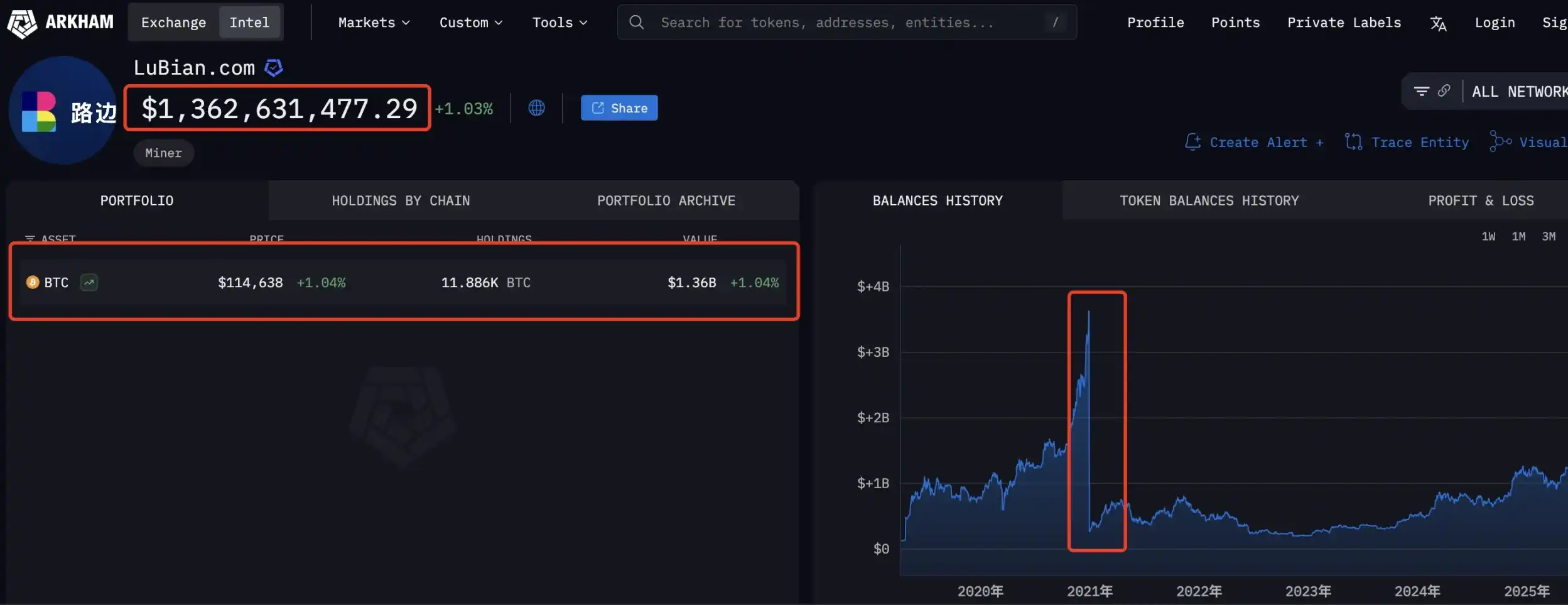

On-chain information shows that the LuBian mining pool-related address still holds 11,886 BTC, currently valued at $1.36 billion.

Lubian Address Asset Information

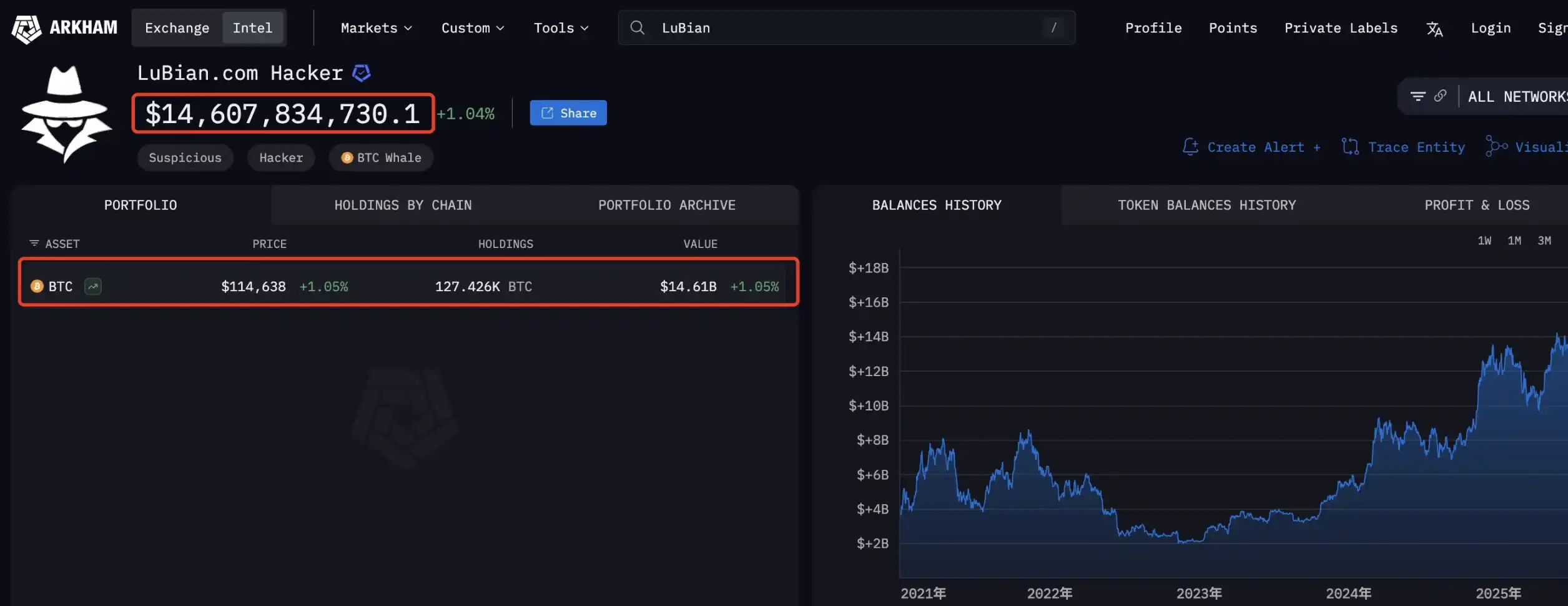

On the other hand, on-chain information shows that the hacker in the LuBian theft case still holds the stolen BTC, with the last on-chain activity being a wallet consolidation in July 2024.

LuBian Hacker Address Asset Information

At that time, LuBian's stolen assets were valued at a staggering $3.5 billion, making it the largest hacking theft in history.

Due to the continuous rise in Bitcoin's price since 2020, the 127,400 stolen BTC by LuBian is currently valued at approximately $14.5 billion. This asset has made the LuBian hacker the 13th largest individual holder of Bitcoin in Arkham platform's statistical data, surpassing even the hacker from the Mt. Gox theft case.

Additionally, according to information from the Compass Mining website, the LuBian mining pool has seemingly rebranded to Roadside Mining. Between May 2020 and February 2021, LuBian's mining pool operation appeared to be running at full capacity, with an average of 174 blocks mined per month. Through almost a year of mining, they accumulated over 16,200 BTC. At the peak price in April 2021, the asset value of these BTC exceeded $1 billion.

Today, the once-head mining pool has ceased operations, leaving only the history of this five-year-old "largest BTC theft in history," evoking a sense of sigh and regret.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin set for ‘promising new year’ as it faces worst November in 7 years

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.