Why Selling Crypto in August Could Be a Costly Mistake — Experts Explain

Despite August's crypto pullback, experts argue it's a healthy correction—not a collapse. Altcoins show promise, and sentiment remains stable.

The crypto market capitalization in August has not continued the streak of new highs like in July. The rally has stalled as long-dormant whales awaken and traders lean toward profit-taking.

This raises an important question: Should investors sell in August and wait for new lows? Recent expert analysis offers deeper insight.

Why Selling in August Might Be a Big Mistake

Compared to the $4 trillion market cap peak in July, the market has corrected by 6.7%, now at $3.67 trillion.

Although this isn’t a major correction, new developments in August have sparked concern. These include awakened whales, a slowdown in ETF inflows, renewed tariff pressure, and a rebound in the DXY (US Dollar Index). Together, these elements raise fears of a stronger August correction.

However, for Bitcoin, Swissblock’s latest report sees the recent price drop as a positive phase. It views the pullback as a necessary cooldown after the previous price surge.

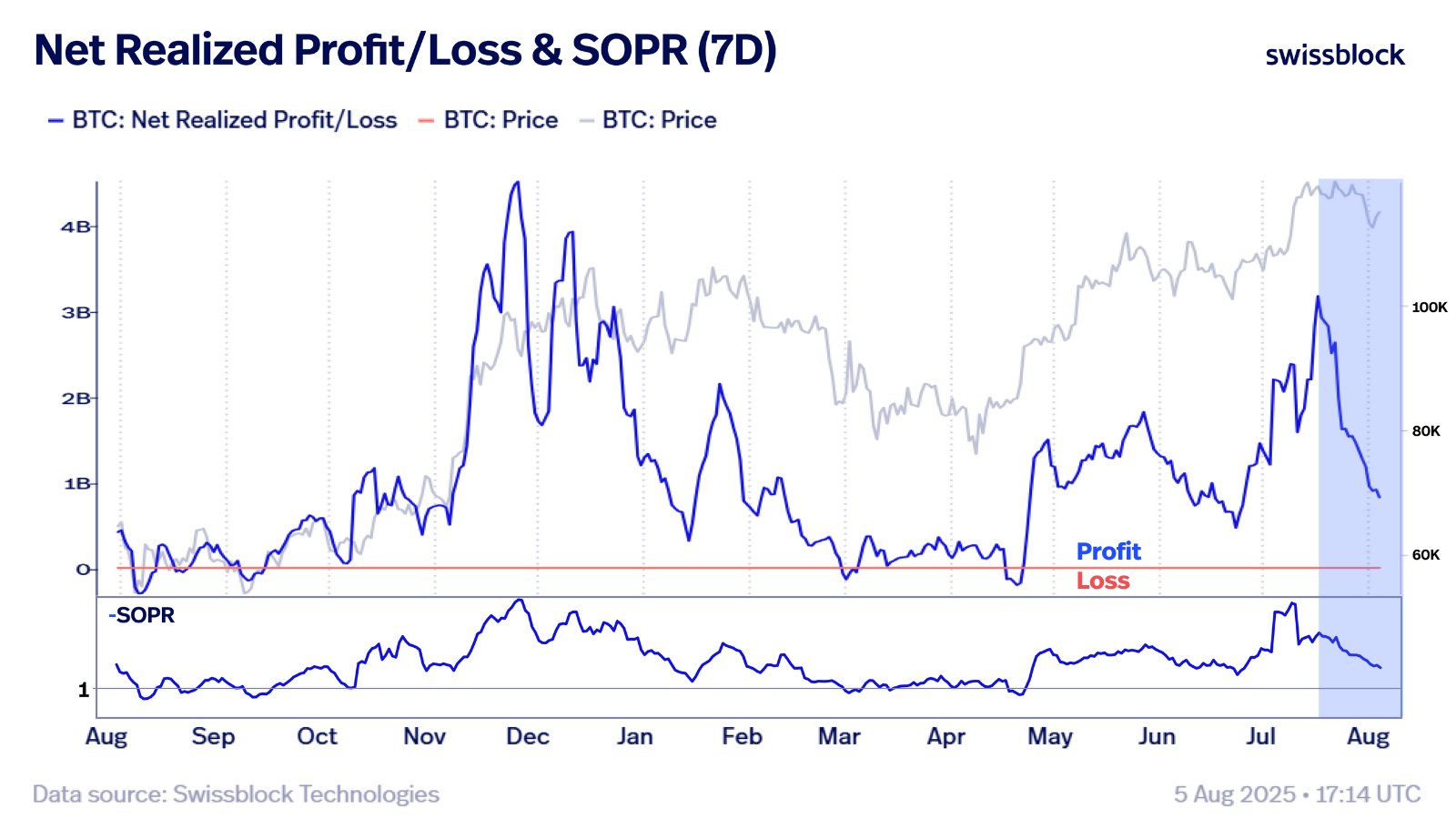

The report focuses on two key indicators: Net Realized Profit/Loss (PnL) and 7-Day SOPR (Spent Output Profit Ratio). Both metrics have been falling, but not alarmingly.

Bitcoin Net Realized Profit/Loss (PnL) vs 7-Day SOPR. Source:

Swissblock

Bitcoin Net Realized Profit/Loss (PnL) vs 7-Day SOPR. Source:

Swissblock

“This correction is a healthy cooldown, not structural weakness. Net Realized PnL is dropping sharply, selling intensity is low. SOPR is drifting lower, not collapsing. Investors are taking profits, not exiting in fear—they want to sell higher. This is a constructive reset,” Swissblock noted.

Although the report doesn’t predict a specific price level for a Bitcoin rebound, other analysts believe BTC might correct to around $95,000 before recovering.

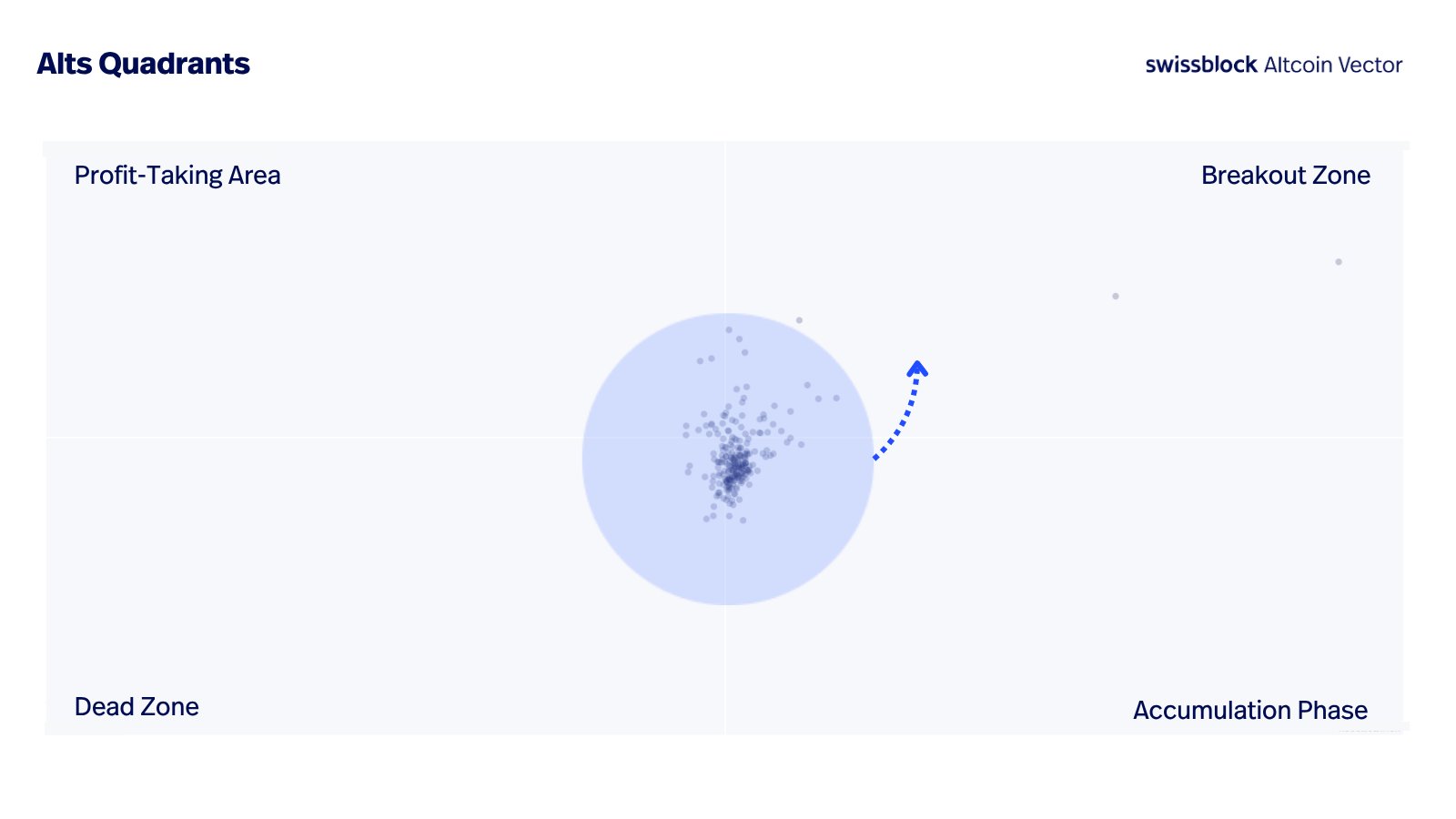

For altcoins, the altcoin market capitalization (TOTAL3) has dropped over 10%, falling from $1.1 trillion in July to $963 billion in August.

Yet a report from Altcoin Vector maintains that altcoins remain highly promising.

Altcoins Quadrants. Source:

Altcoin Vector

Altcoins Quadrants. Source:

Altcoin Vector

The report uses a quadrant chart that segments the altcoin cycle into four phases. Since July, the chart has moved counterclockwise and is now heading toward the “Breakout Zone.”

“Smart capital rotates here, before the crowd sees it. Momentum is turning, structure is stabilizing. This isn’t a breakout: now pre-positioning begins,” according to Altcoin Vector.

Crypto analyst VirtualBacon also explained why selling in August could be a costly mistake.

— VirtualBacon (@VirtualBacon0x) August 5, 2025

Why Selling in August is a Big Mistake

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.Here’s why I’m staying patient and what I’m doing instead

He acknowledged that while some events may seem concerning, there’s no need to panic because:

- The tariff announcement on August 7 might be nothing more than short-term noise, similar to past events.

- Weak labor data may increase the Fed’s chances of cutting interest rates.

- The US Treasury may withdraw $500 billion, causing short-term volatility, but not a full-blown liquidity crisis.

Moreover, market sentiment has cooled down. In July, it was firmly in the “Greed” territory, but now it has retreated to a “Neutral” zone. Since February, the market has not entered a state of “extreme greed,” which is generally regarded as the ideal time for making selling decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes