Shiba Inu’s Holding Time Halves, Pushing Token Towards New Lows

SHIB’s holding time drops, signaling bearish sentiment, as the token risks falling below $0.00001295.

Buy-side pressure among Shiba Inu holders has weakened since its price hit an intraday high of $0.00001406 on Saturday.

Trading at $0.00001304 at press time and hovering just above a critical support level of $0.00001295, SHIB appears poised for further declines in the near term.

SHIB Investors Shift to Short-Term Profits

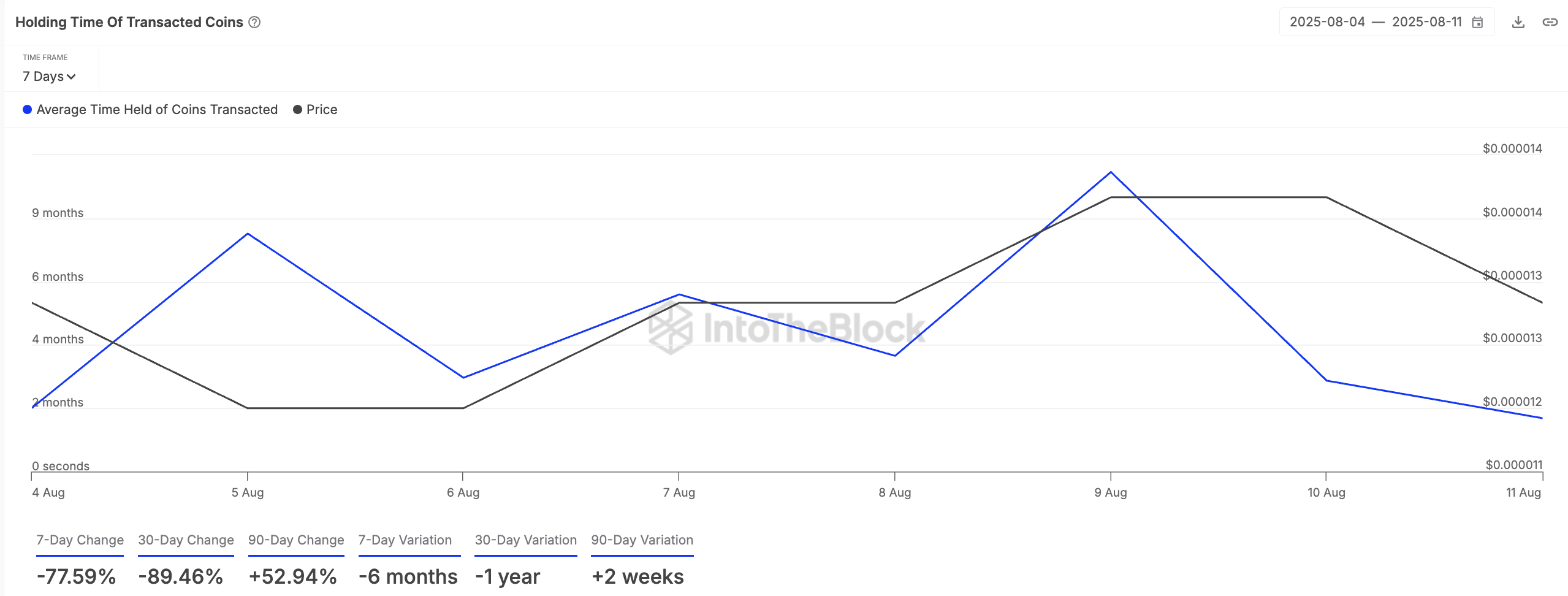

SHIB investors have reduced their holding time, a clear signal that bearish sentiment around the meme coin is growing. Data from IntoTheBlock shows that the average holding time for transacted SHIB tokens has plunged by 78% over the past seven days.

SHIB Holding Time of Transacted Coins. Source:

IntoTheBlock

SHIB Holding Time of Transacted Coins. Source:

IntoTheBlock

This sharp decline suggests that holders are increasingly opting to sell or move their SHIB tokens quickly to lock in recent gains rather than holding on for longer-term profit.

When an asset’s holding time falls, its investors are less confident about its future value and are more focused on short-term profits or minimizing losses.

In SHIB’s case, the trend confirms that many holders are reacting to recent price volatility by cashing out sooner, contributing to increased selling pressure in the market.

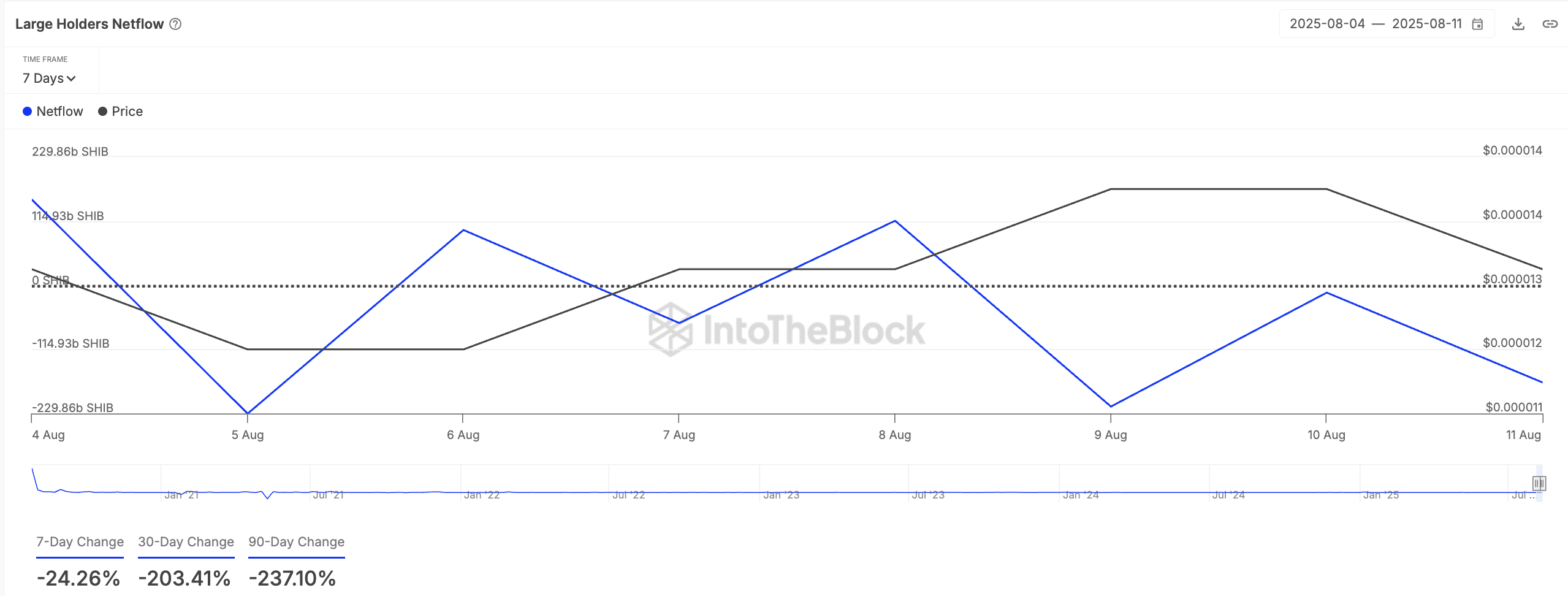

Further, the decline in SHIB whale activity during the review period compounds this bearish outlook. Per IntoTheBlock, the meme coin’s large holders’ netflow has plummeted 24% over the past seven days.

SHIB Large Holders Netflow. Source:

IntoTheBlock

SHIB Large Holders Netflow. Source:

IntoTheBlock

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow measures the difference between the amount of assets they buy and sell over a specified period.

When this grows, these large holders are accumulating the asset by buying more than they are selling.

Conversely, when whale net flow is negative, these holders are offloading their positions by selling more tokens than they are buying. Such behavior reduces the upward buying momentum that whales typically provide, leaving SHIB more exposed to market volatility and bearish trends.

SHIB Risks Sliding Toward $0.00001167

The falling support from SHIB key holders and the shorter holding times by average investors hint at a potential continuation of SHIB’s downward price movement. In this case, the meme coin risks falling under $0.00001295 to reach $0.00001167.

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

However, if new demand re-emerges, SHIB could reverse its decline and climb to $0.00001385.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?