Is the World Running Out of Bitcoin? The MicroStrategy ‘Reseller’ Theory

As institutional demand for Bitcoin rises, its limited supply may lead to a liquidity crunch. Major holders like Strategy or institutional miners might pivot to meet demand, raising concerns over decentralization.

Institutional demand for Bitcoin is growing exponentially. However, the supply needed to meet it is becoming increasingly limited.

In a conversation with BeInCrypto, SwissBorg Exchange Chief Wealth Officer Christophe Diserens said that massive Bitcoin holders like Strategy (formerly MicroStrategy) or Marathon Holdings may need to step up to provide liquidity.

The Scarcity Paradox: Demand vs. Supply

Bitcoin’s central attraction has always been its scarcity, which is designed by its self-limiting supply. However, as its popularity grows among retailers and institutional investors, this raises the question of whether there’s enough Bitcoin in the market to meet its increasing demand.

— Junaid Dar (@JunaidDar85) July 2, 2025

𝗕𝗜𝗧𝗖𝗢𝗜𝗡 𝗦𝗨𝗣𝗣𝗟𝗬 𝗖𝗥𝗜𝗦𝗜𝗦 𝗟𝗢𝗔𝗗𝗜𝗡𝗚

Only 14.5% of all $BTC is now sitting on exchanges —

The lowest level since August 2018!This 7-year low hints at one thing:Smart money is HODLing hard

Less BTC available to buy =

Massive supply shock… pic.twitter.com/tQOWbmuhUN

With a finite supply and an increasing number of companies expected to follow the lead of early adopters, the available Bitcoin on exchanges may soon prove insufficient.

“For over a year, the amount of BTC held on exchanges has steadily declined, and there are growing signs that OTC desks may also be starting to run dry,” Diserens told BeInCrypto, adding, “Data shows that institutional demand is outpacing new mining supply by a factor of ten, making Bitcoin one of the most asymmetric trades in the market today.”

This potential supply crunch could have significant implications for institutions that have yet to enter the market.

The Scramble for Liquidity

Institutional investment in Bitcoin grew after Bitcoin exchange-traded funds (ETFs) launched in 2024. These funds fundamentally changed the market dynamic, giving financial advisors a simple way to access the wealth of retail investors.

This shift created a unique “banana zone,” a crypto term for a parabolic market driven by institutional demand and retail fear of missing out.

“Institutional players connected to ETFs are expected to have a significant influence in this stage, given that approximately 75% of Bitcoin ETF buyers are retail investors,” Diserens said.

This data point suggests that most of the capital flowing into these new, regulated products comes from individual investors. As institutional money flows in, it competes with other institutions and an emotionally driven retail audience.

— André Dragosch, PhD

First-ever BitcoinTreasuries<.>net report is out – and the numbers are huge:• 17% of all BTC is in institutional treasuries• 3.64M BTC ($428B) held by governments, companies, ETFs exchanges• July alone: +166K BTC bought – MicroStrategy leads with +31,466 BTC•… pic.twitter.com/c7t2ZzYK0H

(@Andre_Dragosch) August 9, 2025

The result could be a self-reinforcing cycle of price increases, where the limited supply meets an overwhelming surge in institutional and retail demand. This looming crunch could create an opportunity for an entity with a massive Bitcoin treasury to become a liquidity provider.

Could MicroStrategy Pivot from “Hodler” to “Reseller”?

Amidst the potential for a Bitcoin supply shortage, a key question arises about the role of institutional holders like Strategy, which is globally renowned for its aggressive accumulation playbook.

“The company currently holds approximately 3% of Bitcoin’s total supply, a position financed through $7.2 billion in convertible debt since 2020, with an average purchase price of roughly $70,982 per Bitcoin,” Diserens noted.

While Strategy co-founder Michael Saylor envisions the company as a long-term holder, a strategic pivot to becoming a reseller or liquidity provider for other institutions is not entirely out of the question.

“Such a shift could open new revenue streams; however, a change of this magnitude could also affect investor confidence, influence the company’s share price, and potentially impact the broader Bitcoin market,” Diserens added.

If Strategy were to take such a step, it would need to meet all relevant compliance requirements and operational processes. Given the company’s scale and resources, these obligations are unlikely to pose significant challenges.

If it passes on the opportunity, other entities could also take on a reseller role.

Institutional Miners: The New Market Makers?

Beyond Strategy, the search for large-scale Bitcoin liquidity providers extends to the network’s foundation: institutional miners.

These companies are uniquely positioned to meet increasing demand with their substantial mining capacity and sizeable BTC reserves.

This phenomenon highlights a broader trend in which Bitcoin’s original infrastructure could evolve to serve as key financial intermediaries.

“Large institutional miners could also serve as significant sources of Bitcoin liquidity. With their substantial mining capacity and sizeable BTC reserves, companies such as Marathon Digital Holdings and Iris Energy are well positioned to help meet increasing demand,” Diserens told BeInCrypto.

Though a potential supply gap could force the Bitcoin ecosystem to reinvent itself, the prospect of major corporations buying from a handful of providers inevitably raises concerns over centralization.

The Decentralization Dilemma

Bitcoin’s decentralization rests on two pillars: the distribution of ownership and the dispersion of mining power.

A scenario where investors must buy Bitcoin directly from Strategy or Marathon Digital rather than on open exchanges could significantly affect popular opinion.

“If major corporations controlled most mining capacity and a large share of holdings, it could shift public perception from viewing Bitcoin as decentralized to seeing it as dominated by a few powerful entities,” said Diserens.

Bitcoin’s underlying technology is designed to be distributed.

However, the concentration of ownership and mining power could paint a different picture. As Bitcoin’s popularity continues to grow, the greater community will need to confront these considerations sooner rather than later.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Critical Bitcoin 2026 Forecast: Fidelity Executive Predicts Market Struggles

Revolutionary Move: Forward Industries to Tokenize Its Shares, Unlocking 6.8M SOL Treasury

Digital Euro Breakthrough: ECB Completes Crucial Technical Preparations, Lagarde Reveals

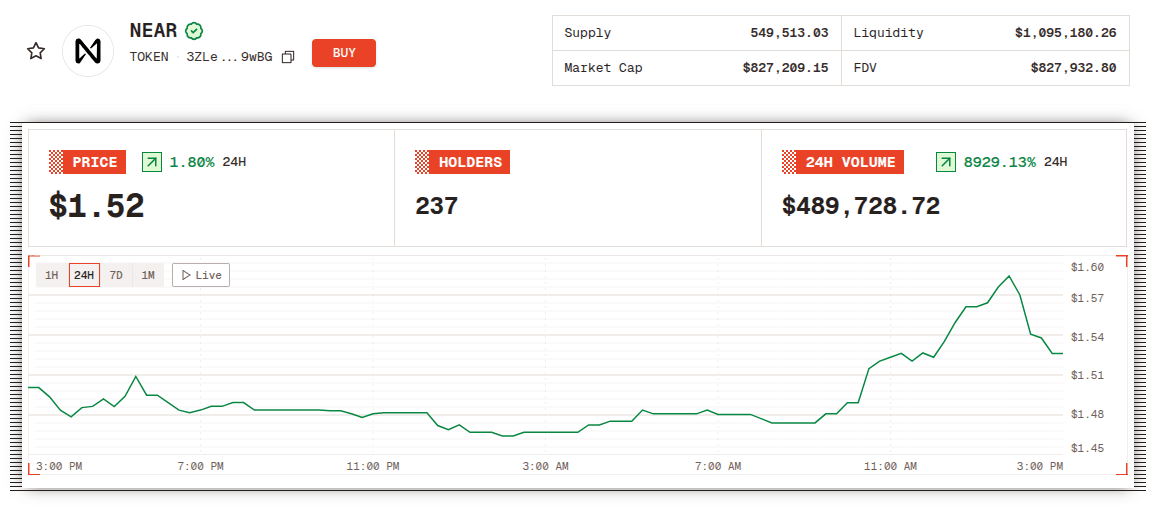

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral