USDC expands reach with native launch on XDC Network

USDC continues to strengthen its position as the leading regulated stablecoin with a native launch on XDC Network.

- USDC is now live on XDC Network, enabling secure, bridge-free transfers backed 1:1 by Circle.

- Circle’s CCTP V2 powers cross-chain interoperability with a “burn and mint” mechanism.

USDC goes live on XDC Network

XDC Network ( XDC ) announced today that USD Coin ( USDC ), the stablecoin issued by Circle, is launching on its network. With this native launch, USDC on XDC is not a copy or derivative — it’s the same regulated, 1:1 redeemable digital dollar used on Ethereum ( ETH ) and Solana ( SOL ). This means users can hold and transfer real USDC on XDC with full backing from Circle, without relying on bridges or wrapped tokens , which makes transfers more secure, faster, and easier to integrate into apps.

Powering this integration is Circle’s Cross-Chain Transfer Protocol V2 (CCTP V2). Rather than wrapping tokens, CCTP uses a “burn and mint” mechanism. When a user transfers USD Coin from one chain to another, the tokens are burned on the source chain, verified by Circle’s attestation system, and freshly minted on the destination—in this case, XDC.

USDC cross-chain presence

The addition of XDC further expands USDC’s cross-chain presence, reinforcing its role as the most widely adopted regulated stablecoin across multiple ecosystems. USDC is already natively available on 24 networks —including Ethereum, Solana, Polygon, Avalanche, Base, Arbitrum, Stellar, and Polkadot.

The integration of USDC on XDC Network follows another milestone for the stablecoin. Earlier this month, Circle launched Gateway , enabling instant USDC transfers across seven major blockchains, namely Arbitrum, Avalanche, Base, Ethereum, OP Mainnet, Polygon PoS, and Unichain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Story of Brother Machi's "Going to Zero": Just Be Happy

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

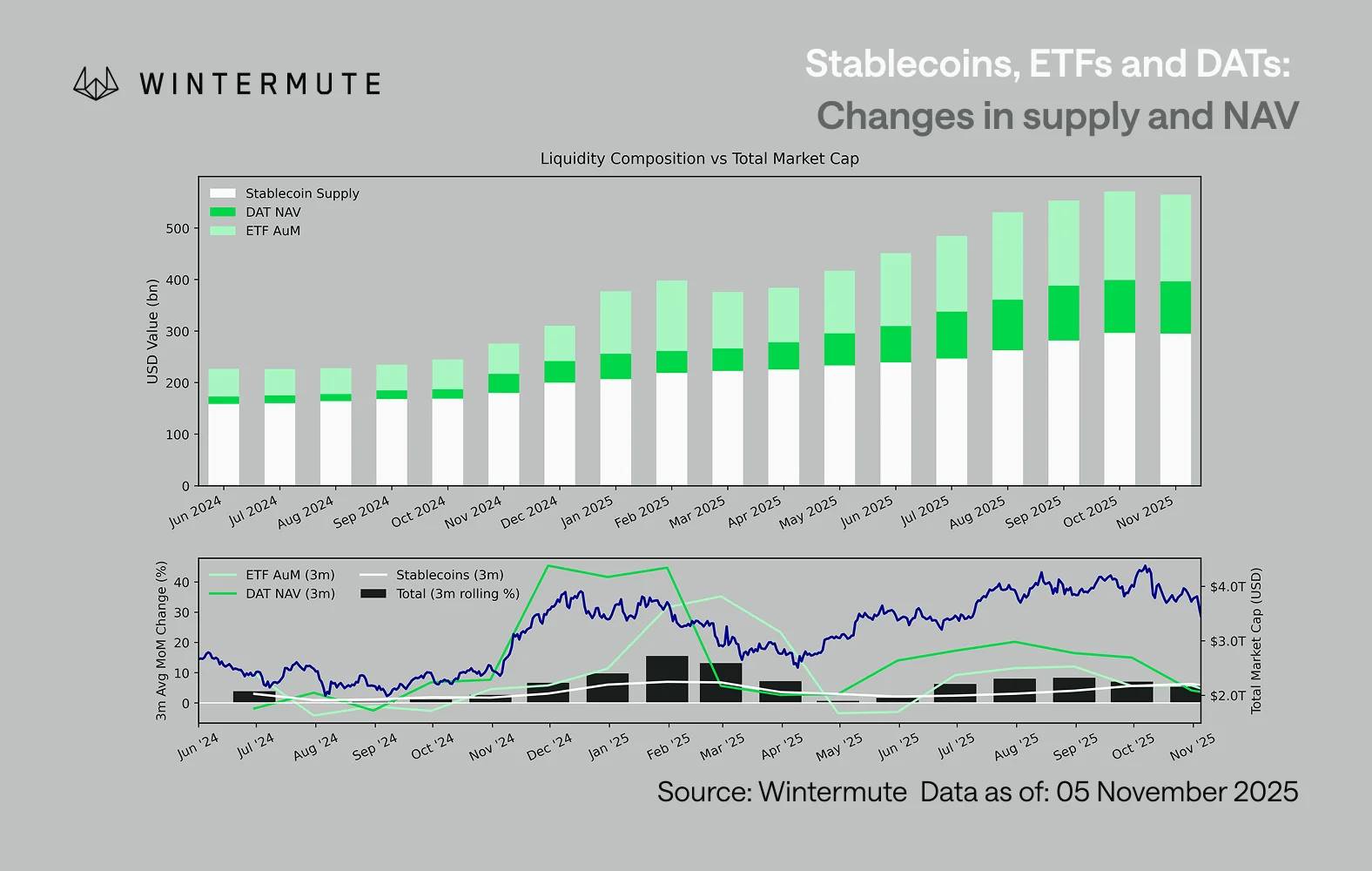

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.