Fluid: The New Ruler of DeFi?

Will the overlooked DeFi strong contender Fluid be listed on major exchanges soon?

Is the overlooked DeFi powerhouse Fluid about to be listed on major exchanges soon?

Written by: Castle Labs

Translated by: AididiaoJP, Foresight News

The money market is at the core of DeFi, allowing users to gain exposure to specific assets through various strategies. Over time, this vertical has grown in both total value locked (TVL) and functionality. With the introduction of new protocols such as @MorphoLabs, @0xFluid, @eulerfinance, and @Dolomite_io, the range of functionalities that lending protocols can achieve has gradually expanded.

In this report, we focus on one of these protocols: Fluid.

Fluid has launched several features, the most interesting of which are Smart Debt and Smart Collateral. It cannot be regarded as an ordinary lending protocol, as it also integrates its DEX functionality, providing users with more services.

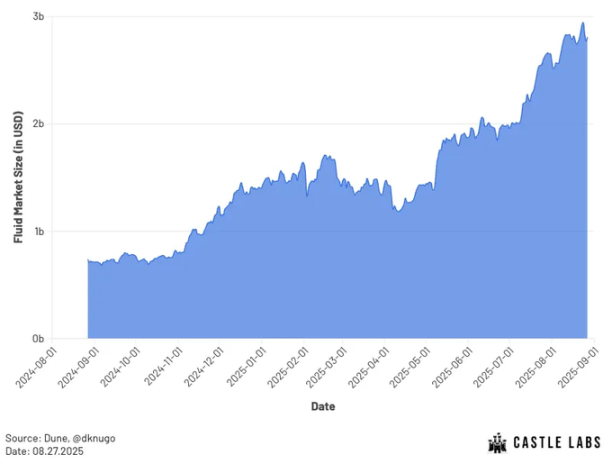

Fluid is showing significant growth trajectories in both the DEX and lending verticals, with a total market size (measured by total deposits) exceeding 2.8 billions USD.

Fluid market size, source: Dune, @dknugo

The Fluid market size represents the total deposits in the protocol. The reason for choosing this metric over TVL is that debt is a productive asset within the protocol and contributes to exchange liquidity.

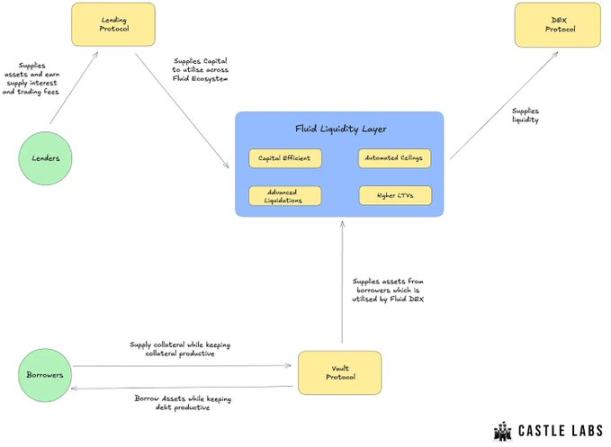

Overview of Fluid’s Components and How It Works

This section briefly outlines the components of the Fluid protocol and explains how it works, with a focus on why it is a capital-efficient protocol.

Fluid adopts a unified liquidity model, allowing multiple protocols to share liquidity, including Fluid Lending, Fluid Vaults, and the DEX.

Fluid Lending allows users to supply assets and earn interest. The assets provided here are used throughout the Fluid ecosystem, thereby increasing their capital efficiency. It also opens up long-term yield opportunities, as the protocol continuously adapts to changes in market lenders and borrowers.

Fluid Vaults are single-asset, single-debt vaults. These vaults are highly capital efficient because they allow for high LTV (loan-to-value) ratios, up to 95% of the collateral value. This figure determines the user's borrowing capacity, in contrast to the collateral deposited.

In addition, Fluid employs a unique liquidation mechanism, reducing liquidation penalties to as low as 0.1%. The protocol only liquidates the necessary amount to restore the position to a healthy state. The liquidation process on Fluid is inspired by the design of Uniswap V3. It categorizes positions by their LTV ticks or ranges and executes batch liquidations when the collateral value reaches the liquidation price. The DEX aggregator then uses these batches as liquidity: liquidation penalties are converted into discounts for traders during swaps.

Fluid DEX generates an additional yield layer for the liquidity layer through trading fees from swaps, which further reduces the interest on borrowers' positions while increasing the overall capital efficiency of the protocol. Different DEX aggregators, such as KyberSwap and Paraswap, utilize Fluid DEX as a liquidity source to access deeper liquidity and increase trading volume.

On Fluid, users can deposit their collateral into the DEX and simultaneously earn both lending fees and trading fees, making it Smart Collateral.

If users wish to borrow against their collateral, they can borrow assets or take on Smart Debt positions, making the debt productive. For example, users can borrow from ETH and USDC/USDT pools by depositing ETH as collateral and borrowing USDC/USDT. In exchange, they receive USDC and USDT in their wallets for free use, while trading fees earned from that liquidity pool are used to reduce outstanding debt.

Latest Developments and Expansion of Fluid

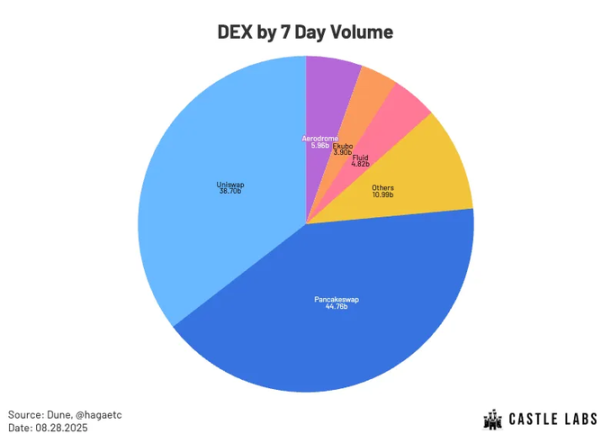

According to trading volume data from the past 7 days, Fluid DEX ranks 4th, behind only @Uniswap, @Pancakeswap, and @AerodromeFi. The collaboration between Fluid and Jupiter Lend has gone live, with the feature entering private testing earlier this month, and Fluid DEX Lite is now live.

Additionally, Fluid DEX v2 is about to go live.

DEXs ranked by 7-day trading volume, source: Dune, @hagaetc

Besides this, the protocol is also expected to conduct a token buyback, as its annual revenue has exceeded 10 millions USD. Fluid recently published related content on its governance forum; the post initiated a discussion on buybacks and proposed three methods.

See the different proposed methods here:

Upon governance approval (after discussion), the buyback will begin on October 1, with a 6-month evaluation period.

Jupiter Lend: Fluid Expands to Solana

Fluid’s expansion to Solana was accomplished in partnership with @JupiterExchange.

Jupiter is the largest DEX aggregator on Solana, with a cumulative trading volume exceeding 970 billions USD. It is also the leading perpetuals exchange and staking solution on Solana.

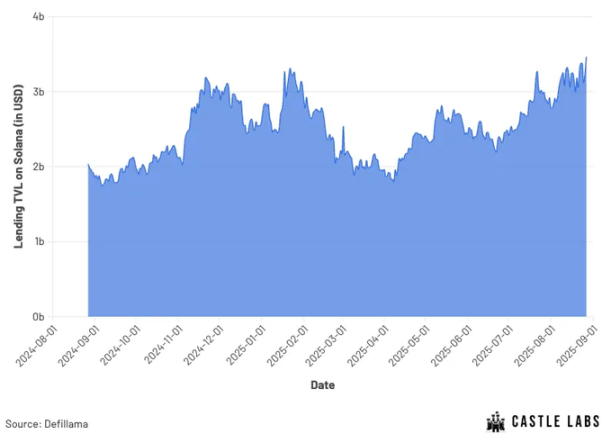

The TVL of Solana lending currently exceeds 3.5 billions USD, with @KaminoFinance as the main contributor. The lending vertical on Solana provides huge growth potential for Fluid.

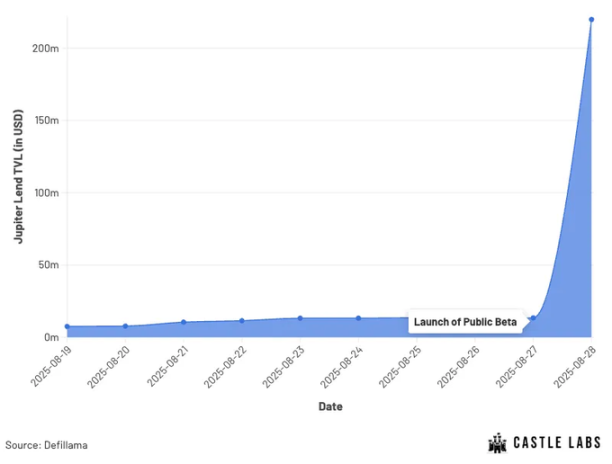

The public beta of @jup_lend went live recently after several days of private testing. Its TVL has now exceeded 250 millions USD, making it the second-largest money market on the Solana blockchain, behind only Kamino.

Jupiter Lend, launched in collaboration with Fluid, offers similar features and efficiency, with Smart Collateral and Smart Debt expected to launch on the platform later this year.

Additionally, 50% of the platform’s revenue will be allocated to Fluid.

Iterations of Fluid DEX

Fluid has already launched its DEX Lite and plans to launch V2 soon. This section will cover both and explain how these iterations will help Fluid develop further.

Fluid DEX Lite

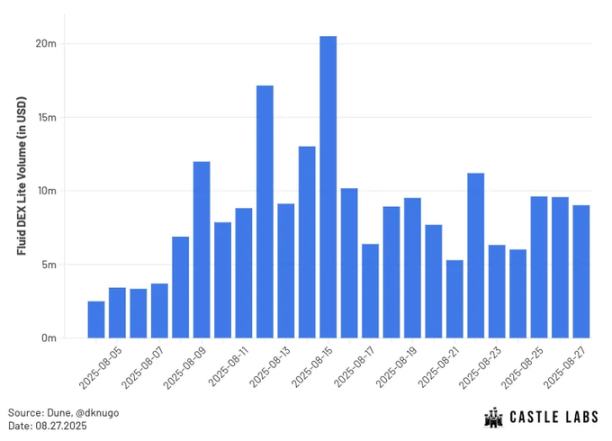

Fluid DEX Lite was launched in August and serves as the credit layer on Fluid, enabling it to borrow directly from the Fluid liquidity layer. It has started providing trading volume services for relevant trading pairs, starting with the USDC-USDT pair.

This version of Fluid DEX is highly gas efficient, reducing swap costs by about 60% compared to other versions. It was created to capture a larger share of trading volume in relevant pairs, where Fluid is already the dominant protocol.

In its first week after launch, Fluid Lite generated over 40 millions USD in trading volume, with initial liquidity of 5 millions USD borrowed from the liquidity layer.

Fluid DEX Lite trading volume, source: Dune, @dknugo

Fluid DEX V2

Fluid DEX V1 was launched in October 2024 and accumulated over 10 billions USD in trading volume on Ethereum in just 100 days, outpacing any decentralized exchange. To support this growth, Fluid is launching its V2 version, which is designed with modularity and permissionless expansion in mind, allowing users to create multiple custom strategies.

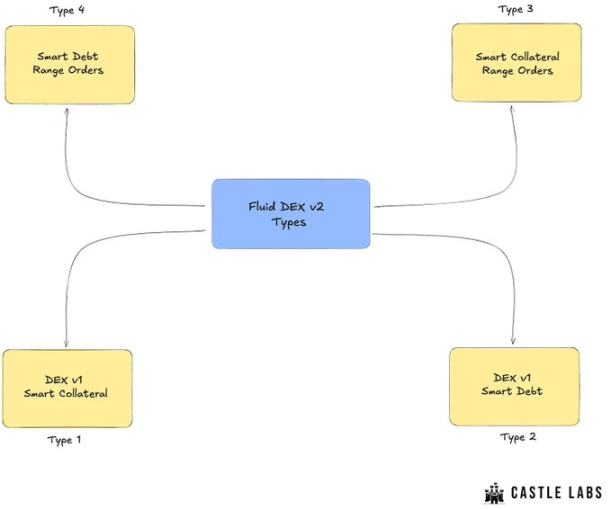

Initially, V2 will introduce four different types of DEXs within the protocol, two of which are continuations from its V1. The types of DEXs supported by Fluid will not be limited to these four, as more can be deployed through governance.

The two new types introduced are Smart Collateral Range Orders and Smart Debt Range Orders. Both allow borrowers to help improve their capital efficiency.

Smart Collateral Range Orders function similarly to Uniswap V3, allowing users to provide liquidity by depositing collateral within a specific price range while also earning lending APR.

Smart Debt Range Orders work similarly, allowing users to create range orders on the debt side by borrowing assets and earning trading APR.

Additionally, it introduces features such as hooks (similar to Uniswap V4) for custom logic and automation, flash accounting to improve fee efficiency for CEX-DEX arbitrage, and on-chain yield-accumulating limit orders, meaning limit orders can earn lending APR while waiting to be filled.

Conclusion

Fluid continues to grow and improve by offering a range of unique features to become more capital efficient.

Smart Collateral: Collateral deposited on the platform can be used to earn both lending interest and trading fees.

Smart Debt: Smart Debt reduces debt by using trading fees generated from the debt to pay down part of the debt, making the borrowed debt productive for users.

Unified Liquidity Layer: Fluid’s unified liquidity layer improves capital efficiency across the ecosystem by offering higher LTV, advanced liquidation mechanisms, and automated caps for better risk management.

Through its recent expansion to Solana in partnership with Jupiter, it has extended its market share in the lending category to non-EVM networks. Meanwhile, Fluid DEX Lite and DEX V2 are designed to enhance user experience and increase trading volume on EVM chains.

Additionally, DEX V2 is expected to launch on Solana later this year, enabling Fluid to enter both the lending and exchange verticals on Solana.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kraft Heinz drops over 3%, Buffett says Berkshire is disappointed with its spinoff

New Bitcoin thriller ‘Killing Satoshi’ expected to drop in 2026; Oscar-winner Casey Affleck in the lead