U.S. Spot Bitcoin ETFs Record $2.3B Inflows in Strongest Weekly Rally in 3 Months

U.S. spot Bitcoin exchange-traded funds (ETFs) are flying high at the moment, pulling in investments totaling $2.3 billion over the past week. Following a five-day inflow streak from September 8 to September 12, BTC investment vehicles recorded their best weekly outing in the past three months.

In brief

- U.S. Bitcoin ETFs saw $2.3B inflows last week, the strongest performance in the past three months.

- BlackRock, Fidelity, and Ark Invest led the surge, drawing over $2B combined into BTC ETF products.

- Investors bet on Fed rate cuts, fueling optimism and institutional demand for Bitcoin exposure.

- BTC trades near $115,300, up 90% in a year, with strong bullish momentum.

Record Inflows Led by BlackRock, Fidelity, and Ark Invest

Data from Farside shows that BlackRock’s iShares Bitcoin Trust topped the inflow rankings with over $1 billion in investments. Fidelity’s Wise Origin Bitcoin Fund came in second, with inflows reaching nearly $850 million. Ark Invest also posted gains of about $181.7 million . Other issuers, including Bitwise, recorded positive outcomes.

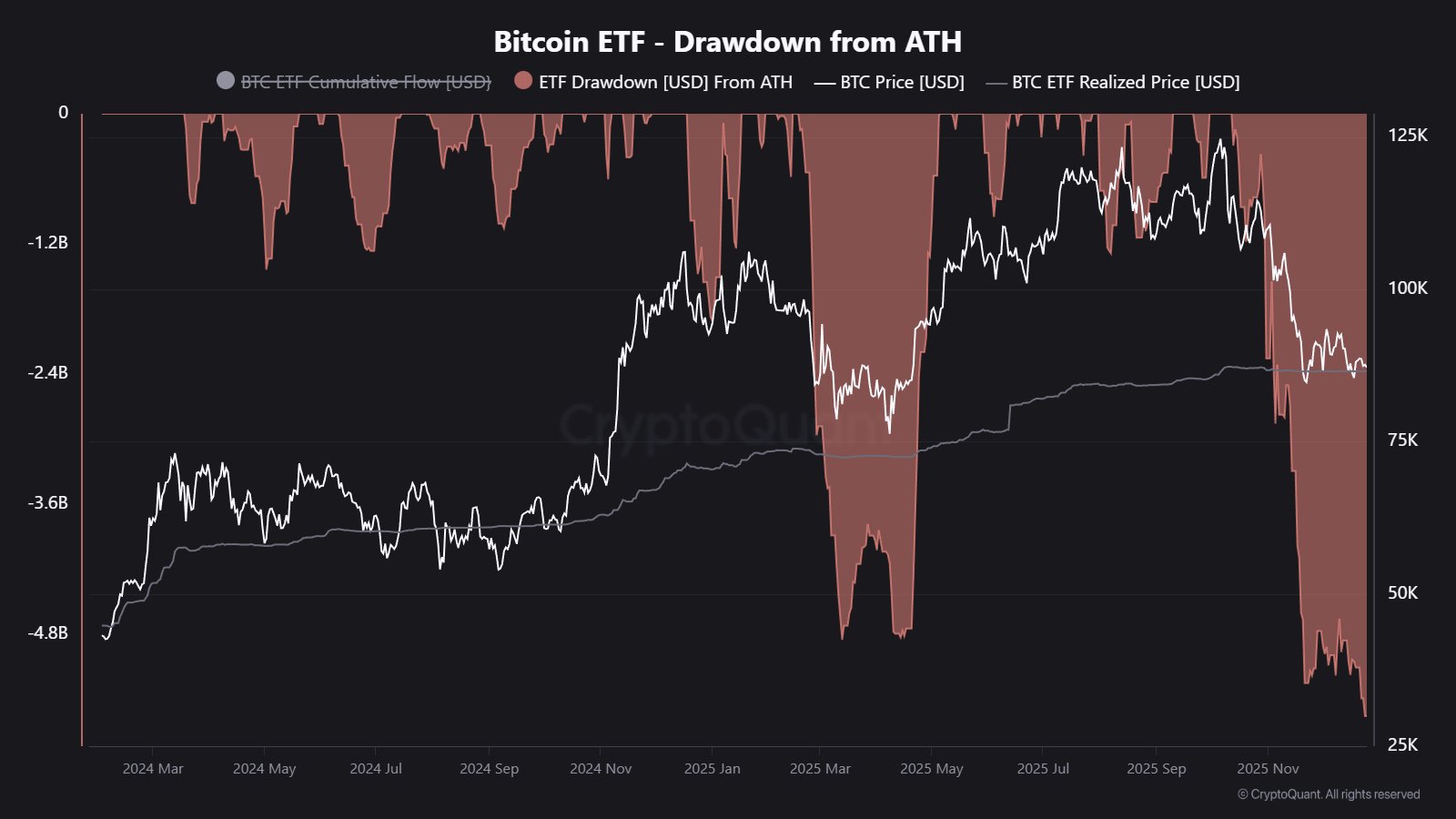

The daily inflow chart for the past week shows steady demand for ETF products. Investors poured in $364 million on Monday, dropping to just $23 million on Tuesday. Things took a massive leap on Wednesday, as investments touched $742 million, followed by strong outings of $553 million and $642 million on Thursday and Friday, respectively.

Bitcoin ETF Inflows Signal Potential Uptrend Amid Rate Cut Expectations

Derivatives trader and founder of decentralized protocol TYMIO, Georgii Verbitskii, explained that last week’s inflow hints at a strategic and meaningful demand impulse from the market.

He added that September and October usually kick off the busy business season, and what happens then often sets the trend for the rest of the year. And as such, the most likely outcome is that this marks the start of a new uptrend, with room for more growth in the last quarter of the year.

Even at that, Wesley Crook, the CEO of blockchain engineering firm FP Block, insists that while the inflow figures have returned to their mid-July levels, “the number itself” isn’t significant enough to drive major change.

Crook maintained that these investments are driven mainly by positive rate cut expectations and growing institutional adoption of the OG crypto. According to the FP Block CEO, the current momentum experienced by spot Bitcoin ETF products is likely to continue, as growing market involvement by institutional players drives the price of the asset higher.

Interestingly, the increased inflows into Bitcoin ETF products come as the market grows increasingly confident of a possible rate cut by the U.S. Federal Reserve. CME Fedwatch tool even pinned the odds of a quarter-point rate cut in September at 96%.

Market Optimism Fuels BTC’s Surge and Strong ETF Inflows

Bitcoin is also riding this newfound market optimism. After recovering modestly over the past week, it is sitting just below $115,300 at the time of writing.

Here are other key trends to note:

- The Bitcoin sentiment remains strongly bullish, supported by solid market drivers.

- Price has surged 90% over the past year.

- It has outperformed 93% of the top 100 cryptocurrencies.

- Furthermore, the asset is currently trading above the 200-day simple moving average.

- Plus, it has logged 15 green days in the last 30 (50% positive performance).

TheBlock founder Farbod Sadeghian believes the recent surge in BTC ETF investments is due to “structural demand.”

The bigger factor is that investors, especially at the institutional level, now see Bitcoin as an allocation worth holding over the long term. The ETF wrapper makes it easier and safer to access, but the underlying appetite is clearly about exposure to the asset itself.

Farbod Sadeghian

He explained that while rate cut expectations usually fuel appetite for risk assets, such settings are mostly short-lived. Still, Sadeghian retained expectations of Bitcoin ETF inflows to “stabilize” and further rally on the back of macroeconomic events such as institutional integration of Bitcoin ETFs into standard portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Gears Up for a Monumental Leap in 2026

Bitcoin drops 32% as ETF money exits – Yet THIS group isn’t backing off

Comparing Crypto Yield Models: Staking Returns of Digitap ($TAP), Ethereum and USDT

Crypto Market Dynamics: A Shift in Focus for 2026