Nakamoto plummets 96%, is the story of Bitcoin DATs no longer convincing?

In just a few months, KindlyMD, a medical company, transformed into “Bitcoin Digital Asset Treasury” (DAT) Nakamoto Holdings, experiencing a rollercoaster ride in the capital markets.

Earlier this week, the unlocking of PIPE shares triggered concentrated selling pressure, causing KindlyMD’s stock price to plummet by over 50% in a single day. From its May peak, the stock has fallen a cumulative 96%, now trading at less than $1.50.

From Medical Company to “Bitcoin Treasury”: Rapid Shift in Capital Narrative

In August 2025, medical company KindlyMD completed its merger with Nakamoto Holdings, and the listed entity officially changed its name (Extended reading: $680 million “bottom-fishing” BTC, floating loss of tens of millions, Trump’s crypto advisor’s “whale debut”).

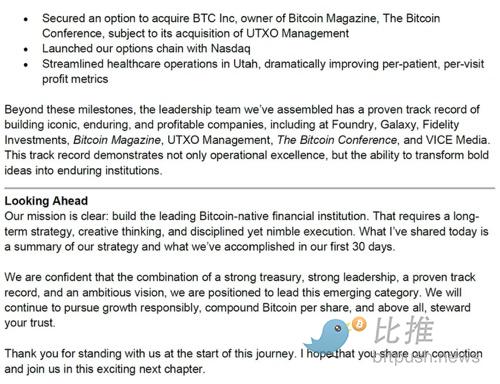

After the transformation, the company announced its core strategy as a “public market Bitcoin treasury,” rapidly raising about $2 billion through PIPE (private placement) and convertible bond financing to purchase thousands of BTC.

It’s worth noting that, by today’s corporate treasury standards, 5,765 BTC is not a huge amount, but it is by no means insignificant. At a Bitcoin price of $114,500, this holding is worth approximately $660 million.

This transformation model is not unique. Previously, Japanese former budget hotel operator Metaplanet and others also announced shifting part of their capital into Bitcoin, aiming to reshape the capital market’s imagination.

PIPE Unlock: The Fuse That Triggered the Crash

The turning point of the story occurred on September 12.

On that day, the company’s Form S-3 registration filed with the SEC became effective, registering previously restricted PIPE investor shares as freely resellable on the secondary market. This meant that previously “locked” massive shares could be sold overnight.

Just one trading day later, on September 15 (Monday), the market witnessed a brutal scene: Nakamoto Holdings’ stock price plunged 54% in a single day, hitting a low of $1.26. From its May peak, the stock has fallen a cumulative 96%, a drop far worse than most expectations.

CEO David Bailey hinted in a late-night shareholder letter: “If you’re here for short-term trading, I suggest you exit.”

However, such “advice to leave” did not stabilize investor confidence, but instead provoked even greater resentment. Well-known crypto trader Scott Melker bluntly stated in a briefing:

“The crypto treasury narrative has been completely destroyed… The extreme volatility of NAKA assets is abnormal, and the company’s claim of ‘building a shareholder base’ is just a cover for insiders selling at high prices and transferring risk to retail investors.”

Currently, NAKA’s market cap has at times fallen below the nominal value of its BTC holdings. In theory, this “discount” should attract arbitrage funds, but with PIPE selling pressure not yet fully released, market sentiment leans more toward a “value trap.”

The Logic Behind the Decline

1. Supply Shock: The S-3 unlocking directly expanded the float, with a large number of sellable shares flooding the market in the short term, triggering the typical “supply surge—price suppression” effect.

2. Arbitrage Realization: PIPE investors usually enter at a discount and have a lower cost basis. After unlocking, selling at higher prices becomes the most rational choice.

3. Uncertainty of Strategic Transformation: KindlyMD is essentially a small medical company, yet within a few months, it attempted to switch tracks through large-scale financing to hoard Bitcoin. This model, “lacking endogenous profit support,” has led the market to widely doubt its sustainability.

4. Asset Discount Effect: After the plunge, the company’s market cap is lower than its BTC holdings, meaning investors are unwilling to simply treat it as a “discounted way to buy Bitcoin,” but remain wary of management’s execution, financing structure, and potential dilution risks.

Conclusion

In fact, analysts have long harbored doubts about this model—“medical company buys Bitcoin, stock price soars” fundamentally lacks sustainability. KindlyMD’s revenue in Q2 2025 was less than $10 million, yet just months later it raised billions to hoard coins; similar stories have also appeared with companies like Metaplanet.

For this reason, well-known short seller Jim Chanos, who became famous for predicting the Enron collapse, warned as early as July that the Bitcoin treasury market is replaying the 2021 SPAC bubble. His core points are:

-

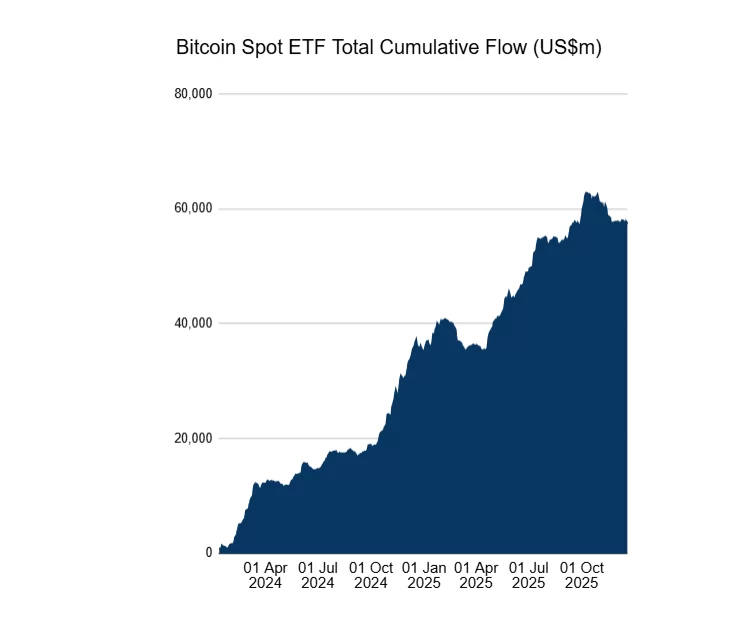

Unreasonable Valuation Premiums: Investors buying these companies’ stocks are actually buying Bitcoin at prices far above the underlying net asset value (NAV) of the Bitcoin. Since investors can buy Bitcoin directly via ETF or spot, there’s no reason to pay a premium for an expensive “tracking fund” with additional operating costs.

-

High-Risk Leveraged Operations: These companies buy more Bitcoin by issuing stocks and debt (leveraging up). This model amplifies returns in a bull market, but in a bear market, faces huge liquidation or dilution risks and may be forced to sell Bitcoin, putting pressure on the entire market.

-

Lack of Fundamental Support: This is not a real tech business or operation, but a form of financial engineering. Jim Chanos believes the market will eventually correct this mispricing and eliminate the premium.

The plunge of Nakamoto Holdings will not quickly end the DAT trading logic, but for retail investors who chased the rally, this shock is already profound enough: not every company can become the next MicroStrategy.

Author: Boot.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Trends Capture Attention as Market Struggles

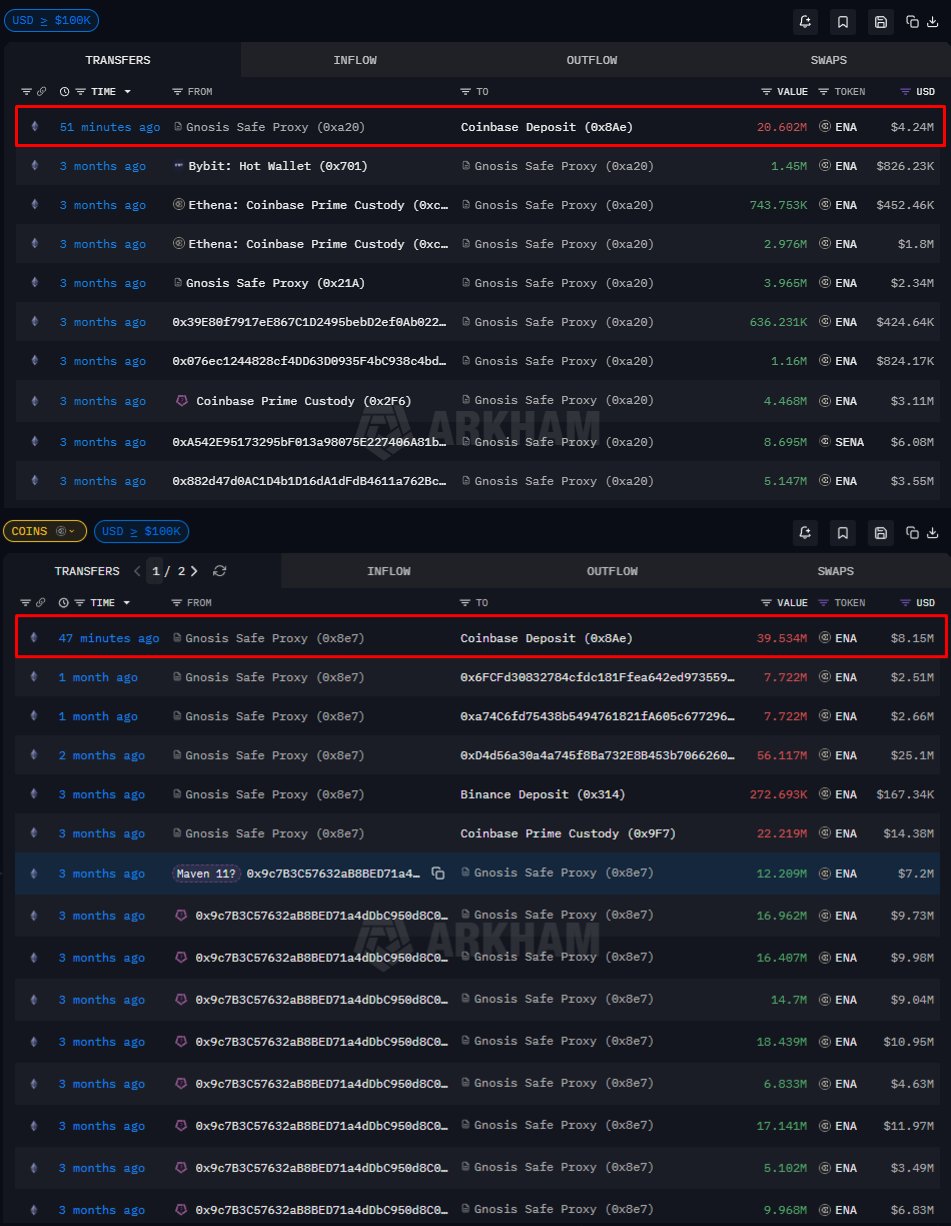

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

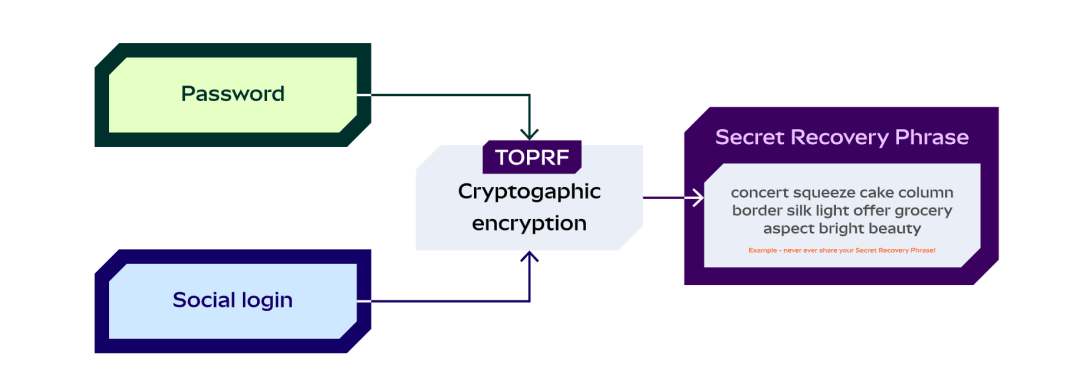

A Brief History of Blockchain Wallets and the 2025 Market Landscape