Key takeaways:

ChatGPT accelerates crypto analysis by interpreting data, summarizing sentiment and creating strategy templates.

Traders use it for practical tasks like bot development, technical interpretation and backtesting simulations.

It augments — not replaces — human decisions and works best when combined with tools like TradingView.

Key limitations include inconsistent real-time data access and reliance on clear prompts and human oversight for accuracy.

The cryptocurrency market operates at a speed and scale that is impossible for any single human to fully comprehend. Every minute, thousands of data points are generated across news feeds, social media platforms, onchain metrics and technical charts. For the average modern trader, the primary challenge is no longer accessing information but processing it effectively to find a clear, actionable signal amid the deafening noise.

This is the precise domain where artificial intelligence, specifically a large language model like ChatGPT, can be transformed from a novelty into an indispensable analytical co-pilot. This guide demonstrates how to systematically integrate ChatGPT into your trading workflow .

What can ChatGPT do for traders?

Before we begin, it is critical to establish the ground rules of using ChatGPT for financial analysis. Ignoring these will lead to flawed conclusions and potential losses.

In its free public version, ChatGPT cannot connect directly to market data APIs. However, ChatGPT Plus and Pro users can access live internet browsing, which allows real-time updates such as the current price of Bitcoin or the latest news. Its core strength remains in analyzing and interpreting the data you provide.

The outputs from ChatGPT are not investment advice. It is a tool for data processing and language interpretation. The responsibility for every financial decision remains entirely with you.

The utility of ChatGPT is 100% dependent on the quality, accuracy and timeliness of the information you feed it. Using flawed data will guarantee a flawed analysis.

How to set up your ChatGPT-powered analysis toolkit

To use ChatGPT effectively, you must first become a proficient data gatherer. Your goal is to collect high-quality information from specialized platforms and then use ChatGPT as the central processor to connect the dots. A professional setup includes three key components:

Source of truth for price data: This is non-negotiable. A platform like TradingView is essential for real-time price action, volume data and an array of technical indicators.

Trusted source for narratives: The crypto market is driven by stories and trends (narratives). Use trusted sources or specialized news terminals to stay informed about regulatory changes, technological upgrades and major partnerships.

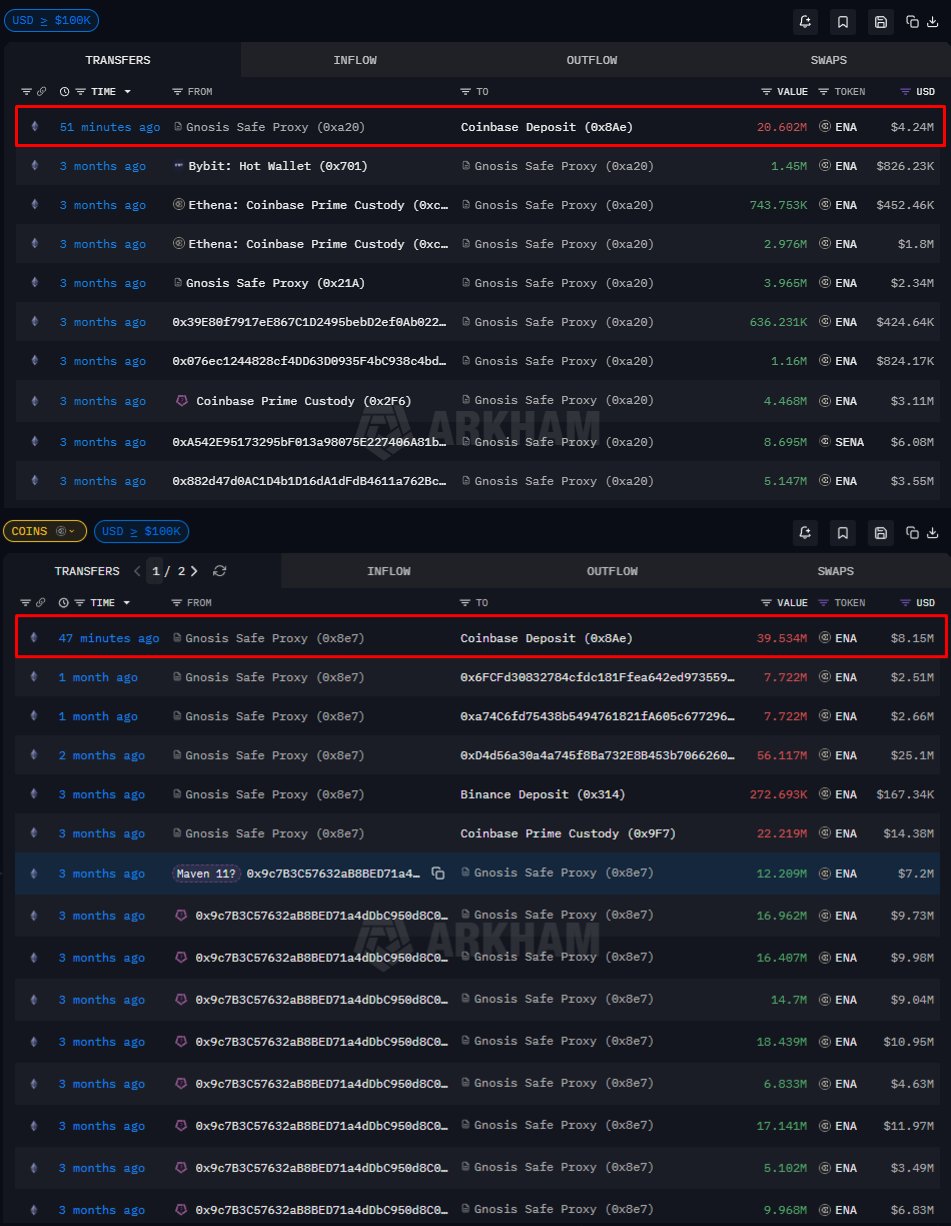

Source for fundamental data: For deeper analysis, tools like Glassnode, Nansen or Santiment provide invaluable insight into the underlying health of a network. This includes data on exchange inflows/outflows, whale wallet activity and network growth metrics, which can often lead to price action.

With these tools, you are equipped to feed ChatGPT the high-quality information it needs to produce a high-quality analysis.

A step-by-step guide to generating signals with ChatGPT

This methodical process guides you from a high-level market overview down to a specific, well-defined trading strategy .

Step 1: Identify the macro market narrative

Crypto capital flows in waves, often chasing the most compelling current story. Is the market excited about AI-related tokens, real-world asset (RWA) tokenization or the latest layer-2 scaling solution? Your first task is to use ChatGPT to identify these dominant narratives.

Action: Go to your news aggregator. Collect the headlines and the first paragraph of the top 10-15 crypto market news stories from the past three to five days.

The prompt:“Act as a cryptocurrency market analyst. I will provide you with a list of recent news headlines and summaries. Your task is to analyze this information and identify the top 2-3 dominant market narratives for August 2025. Categorize each narrative (e.g., ‘AI and Blockchain Integration,’ ‘Regulatory Developments,’ ‘DeFi 2.0,’ ‘Real World Asset Tokenization’). For each dominant narrative, explain why it appears to be gaining traction based on the provided text.”

News items:

“BlackRock files for tokenized treasury bond fund, leveraging Chainlink CCIP for cross-chain settlement.”

“Helium Network’s 5G coverage surpasses 1,000 US cities, driving HNT token burn rate to new highs.”

“SEC chairman indicates a clearer path for tokenized securities, boosting confidence in the RWA sector.”

“IO.net announces major partnership with Render Network to pool GPU resources for AI startups.”

“JPMorgan Chase report highlights real-world asset tokenization as a potential $10-trillion market by 2030.”

“Filecoin sees surge in enterprise data storage contracts following network upgrade.”

This analysis provides a crucial filter. Instead of randomly scanning hundreds of coins, you now have a focused list of sectors where market attention and capital are currently flowing. If “AI and blockchain integration” is a hot narrative, your next steps will focus on assets within that category.

Step 2: Measure market sentiment with ChatGPT

Once you have a narrative and a potential asset (e.g., Fetch.ai’s FET), your next step is to drill down and gauge the real-time sentiment surrounding it.

Action: Spend a few minutes browsing the asset’s official X page, its subreddit and what prominent, credible influencers are saying. Take brief notes on the key points of discussion, both positive and negative.

The prompt:“Analyze the following summary of community sentiment for Fetch.ai (FET). Classify the sentiment as predominantly Bullish, Bearish or Neutral. Identify the primary bullish catalysts and the primary bearish concerns being discussed.”

Bullish points:

A strong AI/agent/ASI narrative, owning its own LLM and infrastructure, gives hope of differentiation.

Major institutional/large fund interest (e.g., Interactive Strength’s $500-million token acquisition plan).

The community feels the price is cheap relative to potential/peers, and many see room for significant upside.

Bearish points:

Product execution and performance, slow features, betas not yet polished and questions around whether agent tech works as promised.

Tokenomics/supply and holder concentration, risk of big holders and fears about centralization.

Dependency on altseason/market cycles: Many believe gains are contingent on broader market strength, not just FET fundamentals.

Neutral points:

Price movements are being viewed with caution: Recent gains are welcomed, but many feel FET is still far below its all-time highs; the risk of support levels failing is also frequently mentioned.

Technical chart watchers point to resistance zones and Fibonacci levels; some believe in possible upside if certain barriers are broken, while others warn of pullbacks or stagnation.

Ranges/“neutral phases” in price action are common topics: People note FET trading in a defined band and say a breakout above resistance or breakdown below support will be important.

How to use the output? This gives you the qualitative context behind the price. A chart might look bullish, but if you discover that the underlying sentiment is turning negative due to a valid concern (like token unlocks), it could be a red flag. Strong positive sentiment driven by tangible developments can give more confidence in a bullish technical setup.

Step 3: Interpretation of technical data

This is where you use ChatGPT as an unbiased technical analysis textbook. You provide the objective data from your charting platform, and it provides a neutral interpretation.

Action: Open your charting platform for your chosen asset. Note the key values for the price and your preferred indicators on a specific timeframe (e.g., the daily chart).

The prompt:“Act as a technical analyst. Provide a neutral interpretation of the following technical data for the Avalanche (AVAX)/USD daily chart. Do not provide financial advice.

Price Action: The price has just broken above a key resistance level at $75, which was the high from the previous quarter.

Volume: The breakout candle was accompanied by trading volume that was 150% higher than the 20-day average volume.

RSI (Relative Strength Index): The daily RSI is at 68. It is in bullish territory but is approaching the overbought level of 70.

Moving Averages: The 50-day moving average has just crossed above the 200-day moving average, a pattern known as a ‘Golden Cross.’

Your Task:

Explain what this combination of indicators typically suggests in a market context.

What would a technical trader look for as a sign of continuation for this bullish move?

What specific signs (e.g., price action, volume) would suggest that this breakout is failing (a ‘fakeout’)?”

The output gives a neutral read on Avalanche’s ( AVAX ) chart, showing how traders view the breakout above $75, strong volume, near-overbought RSI and golden cross; it serves as a guide to spot continuation (holding above $75 with strong volume) versus a fakeout (dropping back below on weak volume or reversals) and can be reused as a framework for other charts, without offering financial advice.

Step 4: Synthesize data into a structured trade thesis

This final step brings everything together. You feed all your gathered intelligence, narrative, sentiment and technicals into ChatGPT to formulate a complete, logical trade plan .

Action: Consolidate the key takeaways from the previous three steps into a single block of text.

The prompt:“Create a comprehensive and objective trade thesis for Chainlink (LINK) based solely on the data I provide below. Structure the output into three sections: 1) The Bullish Case, 2) Potential Risks and Bearish Factors and 3) An Invalidation Thesis.Provided data:

Narrative: The market’s dominant narrative is ‘real-world asset tokenization,’ and Chainlink is consistently mentioned as a core infrastructure piece for this trend.

Sentiment: Sentiment is highly positive due to the recent announcement of the Cross-Chain Interoperability Protocol (CCIP) being adopted by a major global banking consortium.

Technical analysis: LINK has broken out of a six-month accumulation range, clearing the $45 resistance level on high volume. The daily RSI is 66.”

The output should be used as an objective framework: It outlines the positive drivers (bullish case), the key vulnerabilities (risks) and the clear conditions that would negate the setup (invalidation). This allows for structured monitoring of Chainlink’s price action and narrative strength without making financial recommendations.

Future of ChatGPT-powered trading

The primary function of the four-step framework is to provide a systematic method for linking high-level market narratives, like RWAs, with asset-specific data points and technical analysis. This process demonstrates how ChatGPT can be used as an analytical tool to synthesize user-provided information.

Within this workflow, the model can structure qualitative data from news and social media, interpret quantitative technical inputs and formulate outputs based on the defined parameters in a prompt. The model does not perform independent analysis or provide financial advice. The final responsibility for validating the data, assessing the risks and executing any trade remains with the user. Adopting this human-led, AI-assisted workflow is intended to promote a more structured and disciplined approach to market analysis.