Economist Alex Krüger Says He’s Not Concerned About Bitcoin Correction, Issues Warning About Crypto Accounts on X

A popular economist isn’t concerned about Bitcoin’s ( BTC ) underperformance in the past month and a half.

In a new X post to his 214,900 followers, Alex Krüger shares statistics comparing Bitcoin’s performance in the past couple of years compared to other assets.

“Since Jan 2023

SPY +290%

QQQ +200%

TSLA +93%

NVDA -46%

GLD +234%

Since Election Day 2024

SPY +42%

QQQ +34%

TSLA -7%

NVDA+23%

GLD +20%

Since Jan 2025

SPY +5.2%

QQQ +1.6%

TSLA +11.3%

NVDA -12.5%

GLD -15%”

Krüger thinks Bitcoin often has a few massive days that can counterbalance long stretches of boring underperformance.

“The question you should be asking yourself is whether the recent underperformance (since August) has strong reasons to continue for an extended period or not.

Personally, I am not concerned. Bothered to give profits back to the market, yes, concerned, no. I do hold an equities portfolio though, I’m not crypto only. I also do not have much exposure to mid or small-cap altcoins.”

Bitcoin is trading at $113,678 at time of writing. The top-ranked crypto asset by market cap is up 1.55% in the past 24 hours but is down more than 8.4% from its all-time high of $124,128, which it hit on August 14th.

Krüger also issues a warning to traders about crypto accounts on X.

“95% of crypto Twitter content now comes from KOL farms – companies running fleets of accounts with fake followers, botted engagement, LLM-generated replies, and mass-produced threads shilling tickers. We can thank AI for this.”

Featured Image: Shutterstock/NextMarsMedia/Andy Chipus

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

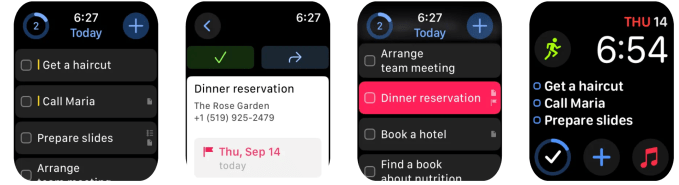

Best Apple Watch apps for boosting your productivity

What Does XRP Really Do? Expert Explains What It Is Built For

Bitcoin Hovering In A Descending Range, But Alts Are Quietly Gaining Momentum

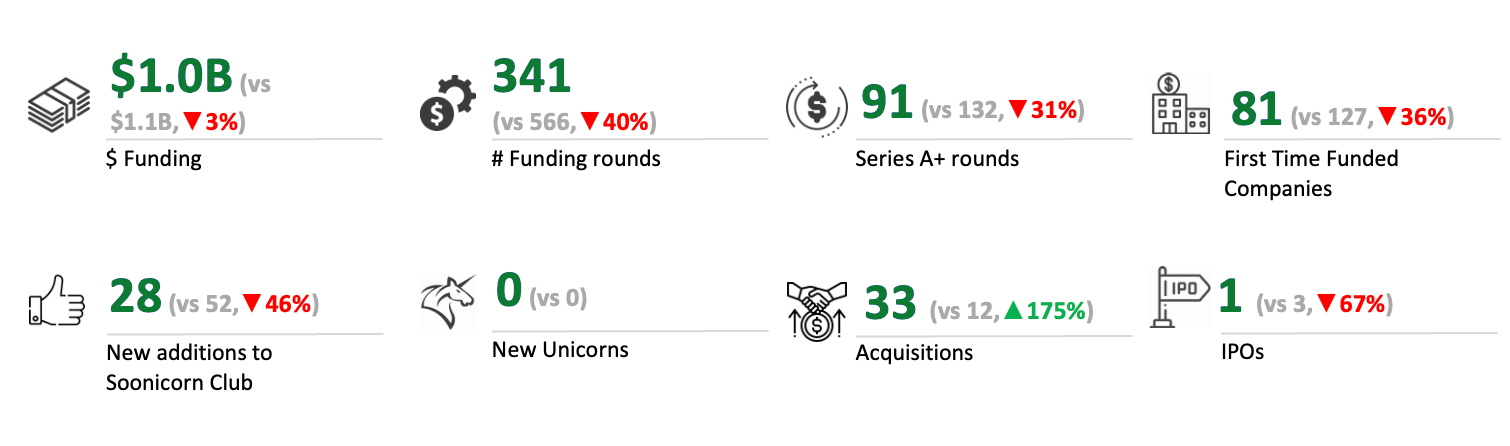

India startup funding hits $11B in 2025 as investors grow more selective