SEC Faces Challenges with DeFi: ETF Postponements Underscore Ongoing Regulatory Ambiguity

- Bitwise seeks SEC approval for first DeFi ETF tracking Hyperliquid's HYPE token, signaling traditional markets' shift toward decentralized finance. - SEC delays altcoin ETF decisions amid internal divisions, exemplified by abrupt pause of Bitwise's broader crypto fund under delegated authority. - HYPE's 4% price rise contrasts with 90+ pending ETF applications, as regulators prioritize liquidity safeguards and surveillance-sharing agreements for altcoins. - Proposed generic listing standards aim to cut a

The U.S. Securities and Exchange Commission (SEC) is under increasing scrutiny as Bitwise Asset Management submits a proposal for the first exchange-traded fund (ETF) tied to Hyperliquid’s native token, HYPE. This move marks a significant step toward integrating decentralized finance (DeFi) assets into mainstream financial markets title1 [ 1 ]. Hyperliquid, a Layer 1 blockchain tailored for perpetual futures trading, currently holds a market cap of $11 billion, placing it 21st worldwide. Should it receive approval, the Bitwise Hyperliquid ETF would become the first regulated product to provide direct access to a DeFi token, following the model of recently introduced

The SEC’s recent about-face on Bitwise’s broader crypto ETF, the BITW fund, highlights ongoing regulatory ambiguity. Although the fund was initially greenlit in July 2025, it was quickly suspended just hours later under delegated authority, with Assistant Secretary Sherry Haywood citing the necessity for additional evaluation title2 [ 4 ]. This action reveals internal disagreements within the SEC, as Chair Paul Atkins advocates for clearer crypto guidelines while some commissioners are hesitant to move swiftly. Experts believe the delays are due to the SEC’s efforts to establish universal listing criteria, which could simplify future approvals but have yet to be implemented title4 [ 5 ]. The BITW fund, which tracks a market-cap-weighted basket of leading cryptocurrencies, demonstrates the rising appetite for diversified crypto investments, though its approval remains uncertain title4 [ 6 ].

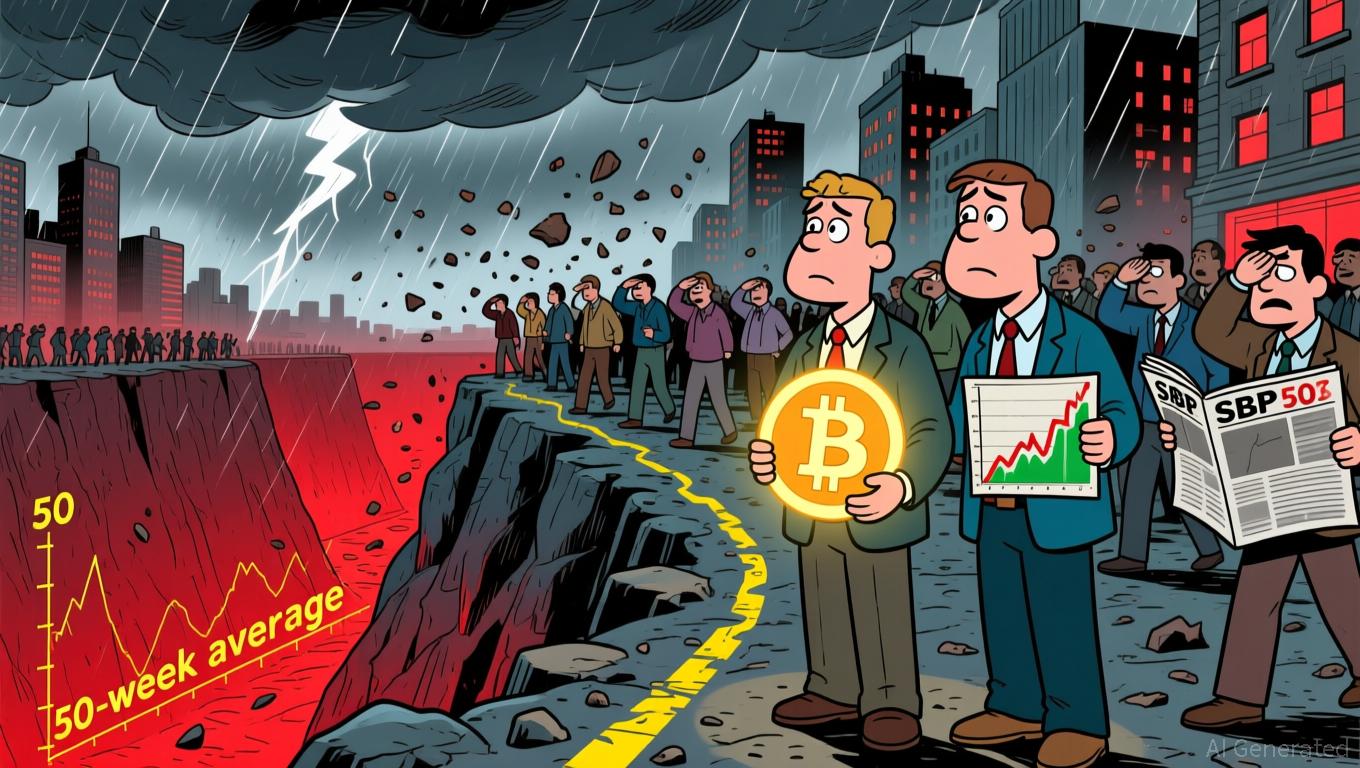

Responses from the market to DeFi-centric products have been varied. Following the Bitwise application, HYPE’s value climbed 4% to $42, as investors anticipated greater institutional involvement in DeFi title3 [ 3 ]. Yet, the SEC’s lengthy review process for altcoin ETFs has resulted in a backlog of more than 90 applications, with some deadlines stretching into late 2025 title6 [ 7 ]. While Bitcoin and Ethereum ETFs have amassed billions in managed assets, altcoin ETF proposals are subject to stricter examination regarding liquidity, custody, and the potential for market manipulation. For example, the SEC has repeatedly postponed decisions on Solana and

The regulatory framework is changing quickly. The SEC’s anticipated generic listing standards, expected to be introduced later in 2025, are designed to cut approval times from 240 days to 75 days by setting clear requirements for crypto ETFs title9 [ 9 ]. This approach would favor tokens with established futures markets or high liquidity, potentially leaving out smaller cryptocurrencies. According to Bloomberg Intelligence analyst James Seyffart, there is a 90–95% probability that ETFs for XRP, Solana, and Litecoin will be approved before the end of the year, provided the SEC finalizes its new standards title2 [ 4 ]. At the same time, firms like Grayscale and Franklin Templeton are converting their existing crypto trusts into ETFs, using the precedent set by the Bitcoin ETF transition to avoid lengthy approval processes title8 [ 10 ].

For investors, the emergence of DeFi ETFs brings both potential rewards and challenges. While regulated DeFi products could boost liquidity and credibility, the SEC’s slow approval process has led to a fragmented market. Major financial institutions like JPMorgan and Goldman Sachs are cautiously expanding their crypto custody offerings, but retail investors remain skeptical of speculative altcoins title5 [ 11 ]. If the Hyperliquid ETF gains approval, it could accelerate the mainstream adoption of DeFi, though the SEC’s emphasis on investor safety suggests a gradual rollout. As regulations continue to evolve, the next several months will be crucial in determining whether DeFi ETFs become a staple in institutional portfolios or remain a specialized niche.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Bitcoin News Update: Blockchain.com’s Co-CEOs Steer Through Crypto Market Fluctuations as Company Relocates Headquarters to Texas

- Blockchain.com appoints Lane Kasselman as co-CEO alongside Peter Smith, adopting a dual leadership model to enhance operational efficiency during transition. - The firm relocates its U.S. headquarters to Dallas, Texas, leveraging the state's tax incentives, regulatory flexibility, and proximity to the Texas Stock Exchange. - This move aligns with broader corporate trends in Texas, as companies like Coinbase and McKesson shift operations to capitalize on business-friendly policies and innovation hubs. - T

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit