The third quarter of this year presented intriguing developments in the cryptocurrency markets, marked by rapid growth in stablecoin inflows. Data indicates that stablecoin inflows reached $45.6 billion within just three months, representing a 324% increase on a quarterly basis. Leading this surge were Tether (USDT), USD Coin (USDC), and the steadily rising Ethena (USDe). Despite these strong inflows, there is a noticeable decline in reserves held in exchanges. In one week alone, $5 billion exited exchanges, with $4 billion of that specifically from Binance .

Potential Reasons for Exchange Withdrawals

Experts suggest several reasons for these withdrawals. Users may be shifting to self-custody wallets, avoiding risk, or seeking higher returns in DeFi protocols. Brian Armstrong, CEO of Coinbase, offered a different perspective, suggesting that large banks are attempting to eliminate USDC rewards due to new regulatory laws. Armstrong argues that by removing rewards systems, banks aim to maintain their monopoly. He warned the U.S. Senate that bailing out banks would not benefit consumers.

Ethereum: The Center of Stablecoin Activity

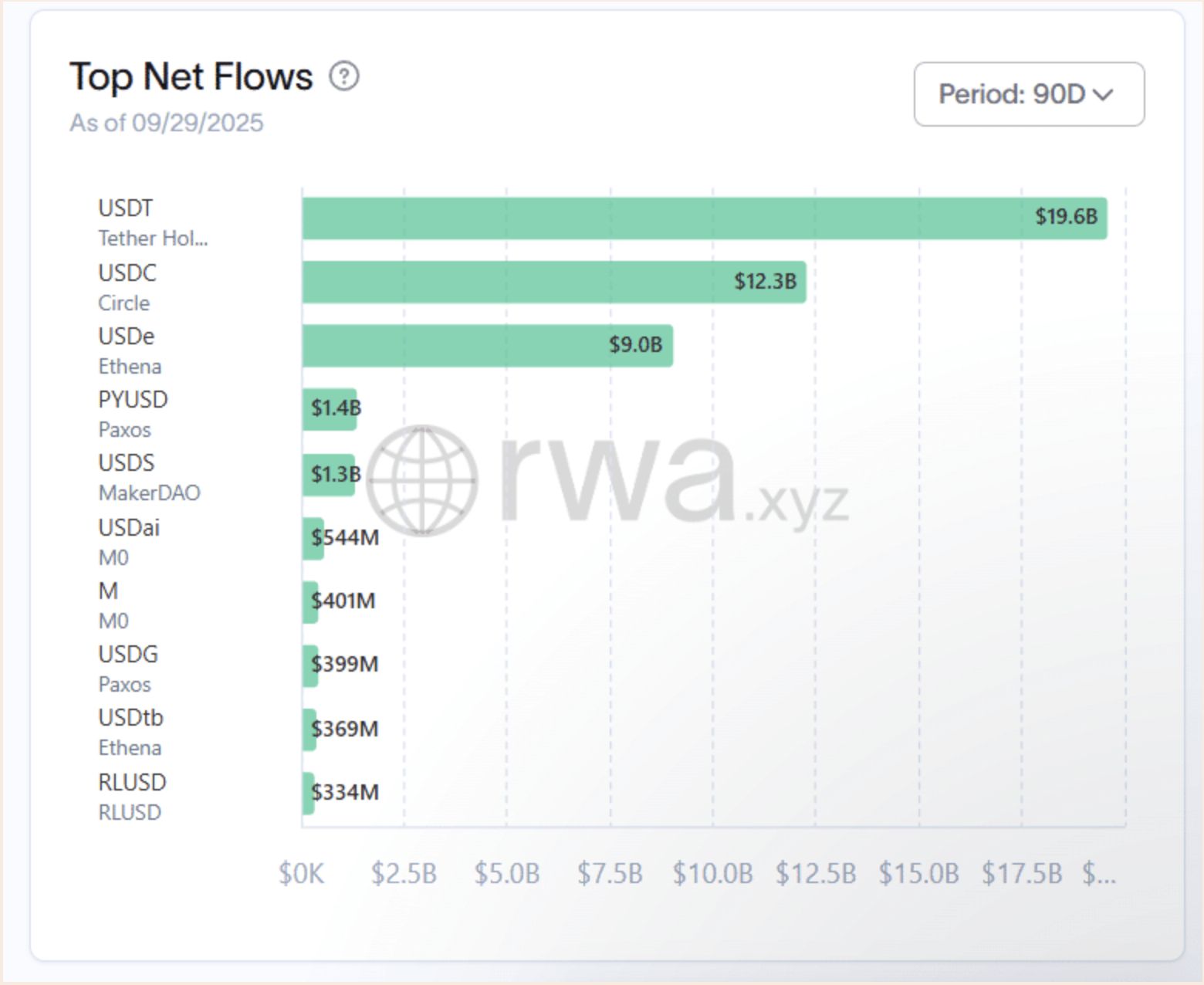

In the past 90 days, over $46 billion flowed into the stablecoin market, with USDT leading at $19.6 billion, followed by USDC with $12.3 billion. Ethena’s USDe experienced a notable rise, contributing $9 billion compared to the previous quarter. PayPal’s PYUSD and MakerDAO’s USDS collectively garnered over $1 billion. A significant portion of this capital influx is centered on Ethereum $4,099 , which hosts $171 billion of the total $297 billion stablecoin market cap. TRON follows with a $76 billion share, while Solana $205 , Arbitrum, and BNB Chain remain below $30 billion.

Moreover, a similar trend was observed in recent announcements by US-based Circle, which reported rapid growth in stablecoin usage in Hong Kong, despite regulatory pressures in the Asian market. This indicates a robust demand for stablecoins globally, not just within the U.S.

In conclusion, the substantial stablecoin inflows highlight a pursuit of stability within the crypto ecosystem. However, the rapid depletion of exchange reserves suggests investors are seeking risk aversion by redirecting funds elsewhere. As regulatory uncertainties persist, the critical position of stablecoins will only intensify. Throughout this, Ethereum’s central role remains pivotal, potentially boosting interest in the DeFi ecosystem.