Was the 10.11 crash an organized attack? A detailed analysis of two major doubts

Was the largest liquidation in history a deliberate attack?

Original Title: Was the Friday Crash a Coordinated Attack? The Evidence Points to Something Disturbing

Original Author: @yq_acc

Translated by: Jiahua, ChainCatcher

The black swan event from October 10 to 11 led to the largest liquidation in crypto history, amounting to $19.3 billions. Although initial reports blamed the panic on tariff announcements, a deeper analysis of the data reveals some questionable details. Was this a coordinated attack targeting Binance and USDe holders? Let’s examine the evidence.

Suspicion 1: Why these three assets?

The most puzzling aspect of this crash centered on three specific assets—their prices catastrophically collapsed, but only on Binance:

USDe: Plummeted to $0.6567 on Binance, while remaining above $0.90 on other exchanges.

wBETH: Crashed to $430 on Binance, 88.7% lower than ETH’s normal price.

BNSOL: Dropped sharply to $34.9 on Binance, with almost no fluctuation on other exchanges.

This “exchange-specific” crash phenomenon immediately raised alarms. Market panic rarely affects only a single platform with such precision.

Suspicion 2: Coincidence or suspicious timing?

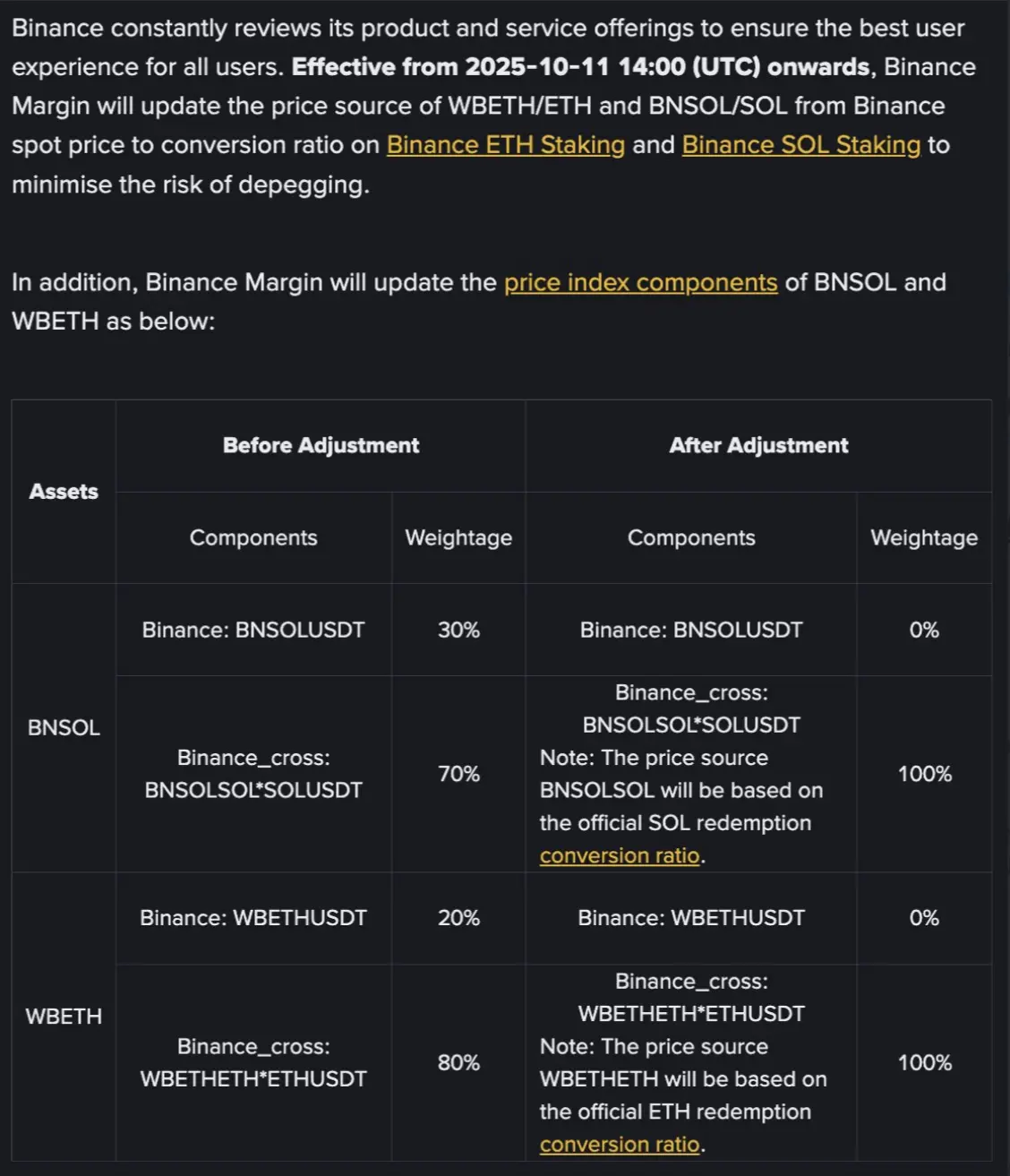

The event becomes even more intriguing. As early as October 6, Binance announced it would update the pricing mechanism for WBETH and BNSOL, expected to take effect on October 14 (later changed to October 11). The crash happened precisely between October 10 and 11—falling exactly within the “vulnerability window” after the announcement and before the new mechanism took effect.

Among thousands of trading pairs, why were only these three assets—announced in advance for updates—subjected to extreme depegging? The probability of this being a pure coincidence is extremely low.

Attack Hypothesis: A Carefully Orchestrated Timeline

Assuming this was indeed an organized attack, the timeline shows meticulous planning:

5:00 AM (UTC+8): The market began to fall due to tariff news, a normal reaction.

5:20 AM (UTC+8): Liquidations of altcoins suddenly accelerated sharply. This step may have been aimed at targeting market makers’ positions.

5:43 AM (UTC+8): USDe, WBETH, and BNSOL simultaneously began to crash on Binance.

6:30 AM (UTC+8): The market structure completely collapsed.

Specific crash details:

-

5:00 AM (UTC+8): Initial market volatility begins

-

Bitcoin starts to fall from $119,000

-

Trading volume within normal range

-

Market makers maintain standard spreads

-

-

5:20 AM (UTC+8): First wave of liquidations

-

Altcoin liquidations accelerate sharply

-

Trading volume surges: 10 times normal activity

-

Market makers begin to withdraw

-

-

5:43 AM (UTC+8): Key depegging event

-

USDe: $1.00 → $0.6567 (-34.33%)

-

WBETH: 3,813 USDT → begins catastrophic drop

-

BNSOL: ~200 USDT → accelerates collapse

-

-

5:50 AM (UTC+8): Maximum dislocation

-

WBETH hits 430.65 USDT (down -88.7% from parity)

-

BNSOL bottoms at 34.9 USDT (-82.5%)

-

Buyer liquidity completely absent

-

-

6:30 AM (UTC+8): Market structure fully collapses

-

Total liquidations exceed $10 billions

-

Market makers fully withdraw

- Binance-specific price anomalies peak

-

USDE/USDT drops at 5:43 AM (UTC+8)

WBETH/USDT drops at 5:43 AM (UTC+8)

There was a 23-minute gap between the first wave of liquidations and the crash of USDe, WBETH, and BNSOL, indicating a sequential execution rather than a random panic event.

BNSOL/USDT drops at 5:43 AM (UTC+8)

The USDe Factor

USDe itself has several weaknesses, making it an ideal attack target:

1.Hidden leverage: Binance’s 12% yield program encouraged users to engage in recursive borrowing, creating up to 10x leveraged positions.

2.Collateral concentration: Many traders used USDe as margin collateral.

3.Thin liquidity: Despite being called a “stablecoin,” USDe’s order book depth was surprisingly shallow.

When USDe crashed to $0.6567, it not only caused direct losses—it may have triggered a chain reaction throughout the ecosystem.

From the Market Maker’s Perspective

A theory circulating among traders is that the first wave of altcoin liquidations at 5:20 AM (UTC+8) was specifically designed to target market makers. Once market makers were forced out due to losses, they would simultaneously remove all orders from trading pairs, causing the market to instantly lose liquidity and become extremely vulnerable.

The evidence is that at the time, many altcoins on Binance were priced far below other exchanges, consistent with the pattern of major market makers being liquidated.

Following the Money

If this was an organized attack, the attackers made astonishing profits:

Potential short-selling profits: $300 million - $400 million

Accumulating at low prices: $400 million - $600 million worth of opportunities

Cross-exchange arbitrage: $100 million - $200 million

Total profit potential: $800 million to $1.2 billions

This is not normal trading profit, but robbery-level returns.

Other Explanations

To be fair, there are other possibilities:

1.Chain liquidation effect: A large liquidation naturally triggers a snowball effect.

2.Over-concentration of risk: Too many traders adopted similar strategies.

3.System stress: Exchange systems failed under extreme trading volumes.

4.Panic psychology: Fear itself created a self-fulfilling prophecy.

However, these explanations struggle to account for why the crash was so precisely targeted at specific assets and a specific exchange.

Suspicious Aspects of the Event

Several factors distinguish this event from a typical market crash:

-

Venue specificity: The price crash was almost entirely limited to Binance

-

Asset selectivity: Only assets with pre-announced vulnerabilities were severely affected

-

Timing precision: Occurred exactly within the vulnerability window

-

Sequencing: Market makers were cleared before the main targets were hit

-

Profit pattern: Consistent with a pre-deployed strategy

If True, What Does It Mean?

If this was indeed a coordinated attack, it represents a new evolution in crypto market manipulation. Attackers are no longer hacking systems or stealing keys—they are weaponizing the market structure itself.

This would mean:

-

Every exchange announcement becomes a potential vulnerability

-

Transparency may paradoxically reduce security

-

Market structure needs fundamental redesign

-

Current risk models are inadequate

Some Disturbing Possibilities

While we cannot definitively prove there was an organized attack, the evidence forms reasonable suspicion. Its precision, timing, venue specificity, and profit pattern perfectly match the profile of a coordinated attack.

Whether through brilliant speculation or deliberate planning, someone turned Binance’s transparency into a vulnerability and seized nearly a billion dollars in the process.

The crypto industry must now grapple with a disturbing question: In our interconnected, 24/7 markets, has transparency itself become a weapon for cunning participants?

Until we have a clear answer, traders should assume all exchanges have similar vulnerabilities. The events of October 10 to 11 may have many explanations, but one thing is certain—it was not random.

This analysis is based on existing market data, cross-exchange price comparisons, and established patterns of market behavior. The views expressed are solely my own and do not represent any institutional position.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning News | Circle obtains financial services license in Abu Dhabi Global Market; Bitget Wallet is raising funds at a $2 billion valuation; HASHKEY discloses IPO details

Overview of major market events on December 9.

Tether: A "dangerous" asset swap worth billions of dollars?

Bitwise CIO: 2026 will be very strong; ICOs will make a comeback