XRP News Today: White House Collaborates with Crypto Industry to Transform Financial Systems at Ripple Swell 2025

- White House official Patrick Witt will keynote Ripple Swell 2025, marking first major blockchain conference address by administration representative. - Speech emphasizes coordinated digital asset regulation, aligning with $17B Strategic Bitcoin Reserve and tokenized securities frameworks. - Ripple's political ties and XRP's post-SEC victory surge highlight crypto's growing institutional legitimacy amid regulatory convergence. - JPMorgan's Bitcoin collateral plans and ISO 20022 adoption underscore traditi

The White House has been increasing its involvement with the cryptocurrency industry, highlighted by Patrick Witt, who serves as executive director of the President's Council of Advisors on Digital Assets, confirming he will deliver a keynote speech at Ripple Swell 2025 in New York, according to a

Ripple Swell 2025 has become a key event for institutional adoption, attracting executives from Nasdaq,

Ripple’s reach goes further than just policy. The company has strengthened its political connections, including helping to finance President Trump’s $300 million White House ballroom initiative together with other crypto firms such as

This event mirrors larger trends in the financial sector. For example, JPMorgan is reportedly planning to allow clients to use Bitcoin and

Witt’s keynote comes at a time when U.S. regulators are working to establish the country as a leader in the crypto space. His support for treating digital assets as essential infrastructure aligns with Ripple’s efforts to promote cross-border payments and enterprise use, as Coinotag mentioned. The intersection of regulatory and market forces at Ripple Swell 2025 highlights an industry evolving under increased oversight and institutional interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

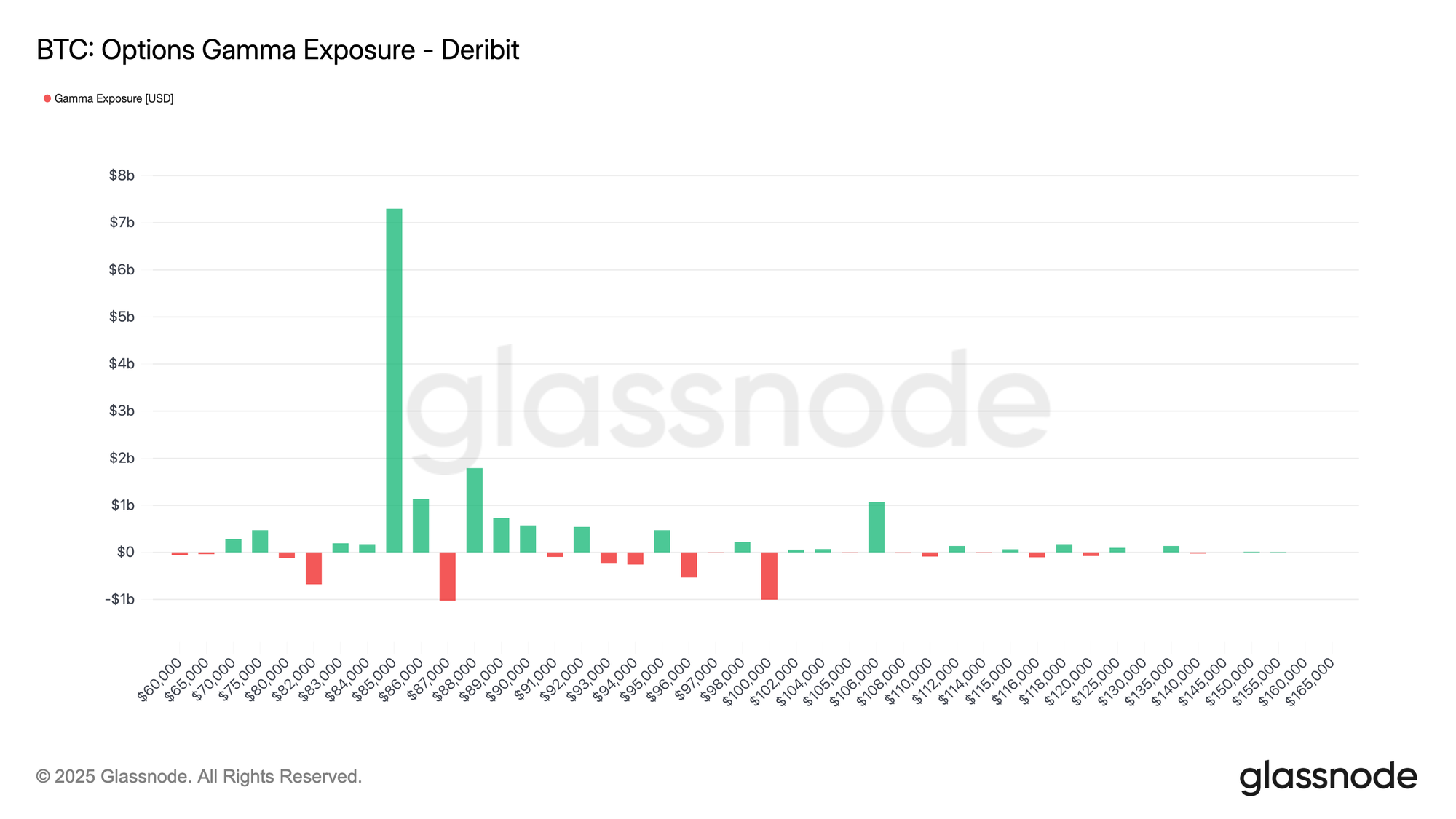

Introducing: Taker-Flow-Based Gamma Exposure

Kalshi backs away from college athlete transfer markets after NCAA president blasts possibility

COINOTAG: CME FedWatch Reveals 26.6% Chance of January 25bps Rate Cut, 73.4% Hold