Argentina’s Peso Crisis Fuels Crypto Adoption Amid Soaring Inflation

Argentina's peso crisis is fueling crypto adoption. Citizens use stablecoins and BTC to preserve savings and gain financial freedom, illustrating a global market model.

Argentines are increasingly turning to cryptocurrencies and stablecoins as the peso’s value plummets and monthly inflation rates remain persistently high. This shift showcases a powerful, real-world utility for Web3 technology.

Ultimately, it provides citizens with a vital escape valve. This addresses the chronic economic instability that dollarization has failed to solve. Consequently, the crisis highlights a growing global trend in emerging markets where Bitcoin and dollar-pegged stablecoins are transforming from speculative assets into indispensable tools for daily savings and basic financial inclusion.

The Failure of Fiat and the Rise of the Third Currency

Argentina’s financial woes stem from a deep-seated crisis of trust in the national currency, exacerbated by decades of capital controls and currency mismanagement. Consequently, President Javier Milei’s promise of full dollarization has not materialized, compelling citizens to seek stability through alternative means.

Cryptocurrencies have emerged as the “Third Currency.” They bridge the gap between cash-based daily life and the need for stable savings.

In addition, Bitcoin (BTC) is utilized as an unseizable, non-sovereign store of value. Dollar-pegged stablecoins (USDC) function as a stable unit of account. This allows individuals to effectively self-dollarize without relying on the central bank or the local banking system.

Furthermore, Neeraj K. Agrawal, Communications Director at Coin Center, highlighted this dynamic.

“Stablecoins are now key for Argentines to shield themselves from the peso crisis, illustrating a powerful use case for self-sovereign financial defense,” he stated.

Specifically in urban centers like Buenos Aires, stablecoins are increasingly used for receiving salaries and small transactions. This is a survival strategy, circumventing the high fees and political risk associated with traditional financial institutions.

Argentines are actively fighting to preserve their purchasing power by converting salaries instantly into crypto, demonstrating a bottom-up, decentralized resistance to hyperinflation.

Argentina as a Global Model for Financial Freedom

The accelerated adoption of crypto in Argentina is not an isolated incident; rather, it serves as a global model for financial inclusion in other high-inflation emerging economies like Turkey and Nigeria.

These nations share the common challenge of providing citizens with “currency freedom” outside of volatile national monetary policy.

Argentina stands out with one of the highest crypto adoption rates globally, fueled by necessity. The system primarily benefits professionals and tech workers who participate in the global labor market. They utilize stablecoins to receive stable, dollar-denominated wages across borders, bypassing high international transfer fees and bureaucratic friction.

The Argentine case study proves a vital point. Cryptocurrency is not just a mechanism for avoiding taxes. Furthermore, it is a critical financial infrastructure. This infrastructure empowers citizens with stable purchasing power and equitable access to global economic opportunities. It operates independently of local governmental stability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Nears $116K as Asian Markets Surge

Ethereum Value Forecast: $650M Bet by Short Sellers as Trump-China Tariff Talks Loom

Ethereum Surges Over $4,000 Amidst Market Speculation and Increased Short Positions in Anticipation of Trump-Xi Tariff Discussions

25 basis points not enough? The market bets that the Federal Reserve will continue to cut rates—will Powell signal a shift this time?

Facing internal disagreements and immense political pressure, how will Federal Reserve Chairman Powell signal the future policy path? This may be the key factor determining the direction of the market.

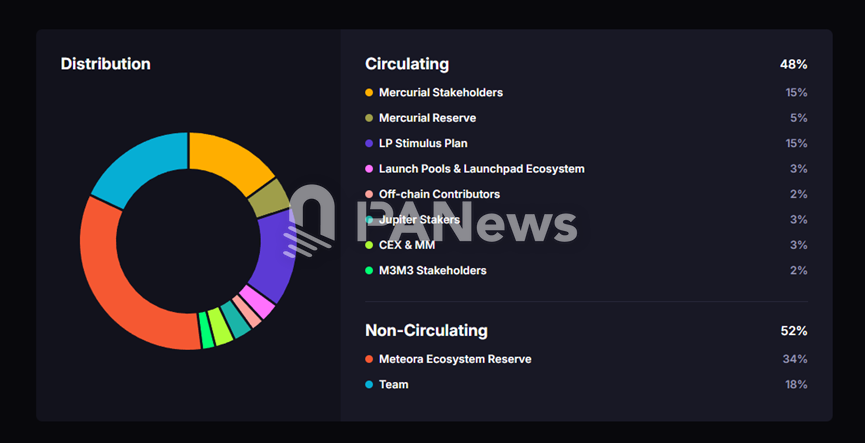

70,000 On-chain Data Reveal Meteora Airdrop: 4 Whale Addresses Take 28.5%, Over 60,000 Retail Users Share Only 7%

The airdrop also involved controversial addresses, including individuals linked to insider trading scandals and large holders with abnormal behavior, which further intensified the community's trust crisis and exposed the project to the risk of class action lawsuits.