XRP News Today: Institutional Interest in XRP: Steering Through Market Fluctuations and Regulatory Challenges Toward a Potential 2026 Surge

- XRP gains institutional traction in 2025 via ETF adoption, derivatives growth, and $100M+ AUM for first U.S. spot XRP ETF (XRPR). - CME XRP derivatives exceed $26.9B notional volume, while Ripple's SEC litigation wins boost regulatory confidence and institutional demand. - Long-term forecasts predict $5.36 by 2025 and $23.24 by 2031, driven by cross-border payment adoption and CBDC integration. - Short-term volatility persists with $2.40 price dip, but bullish 4-hour chart patterns and supply-reduction s

XRP, the digital currency at the core of Ripple’s blockchain, has become a central topic among institutions and market watchers in late 2025, fueled by a wave of ETF launches, increased derivatives activity, and optimistic price outlooks. The inaugural U.S. spot

Since launching in May, the CME’s XRP derivatives market has experienced rapid expansion, with notional volumes topping $26.9 billion, Coinpedia stated. Both open interest and trading activity have surged, reflecting growing trust in XRP’s role for cross-border payments and its acceptance in regulated finance, as highlighted in an

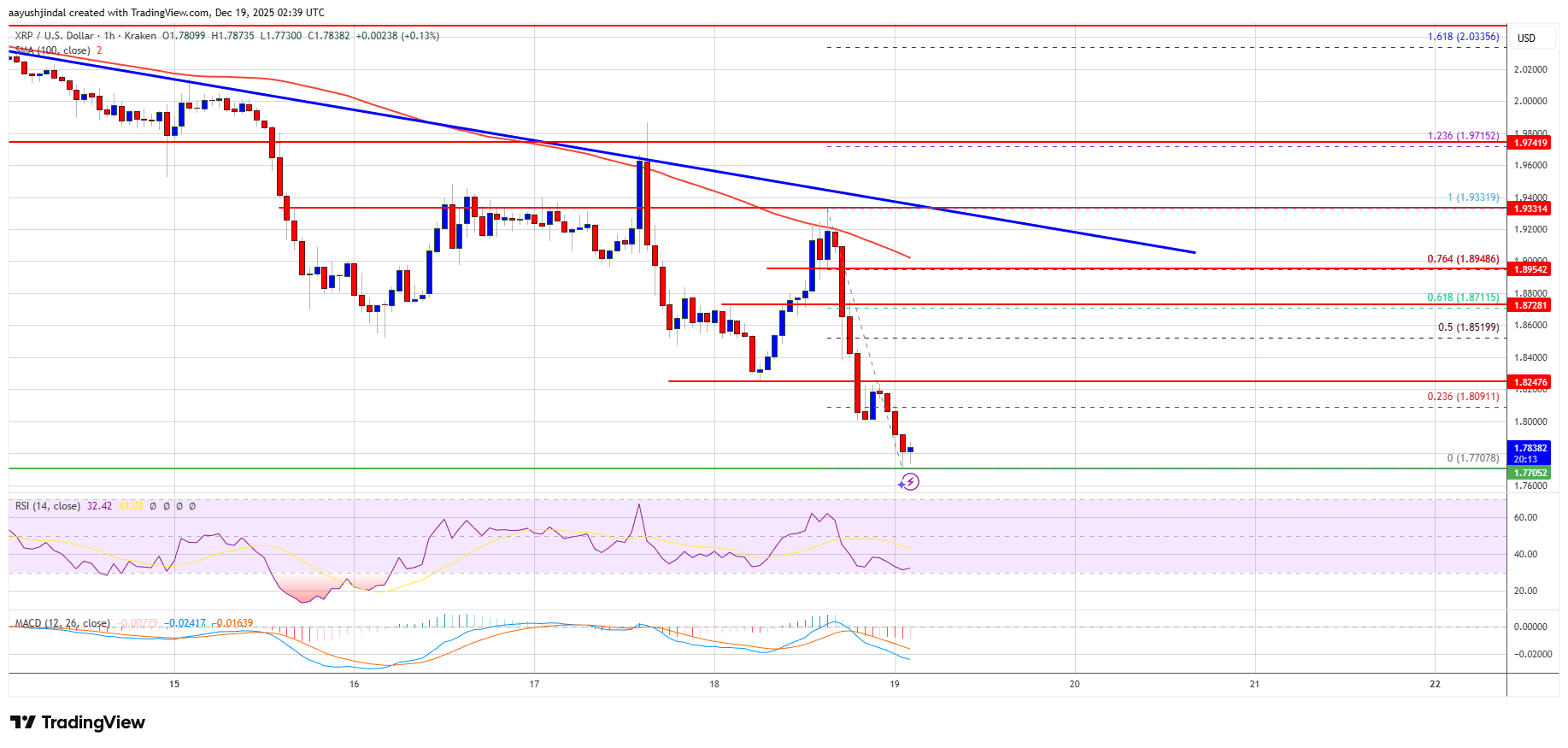

Technical indicators offer a mixed outlook for XRP in the near term. On October 22, XRP was trading at $2.40, down 1.07% in the past day, with bearish signals from the Relative Strength Index (RSI) and Bollinger Bands pointing to ongoing downward momentum, according to a

Looking further ahead, predictions for XRP remain upbeat. Some forecasts see the token climbing to $5.36 by the end of 2025, and potentially reaching $23.24 by 2031, fueled by its use in cross-border payments and central bank digital currency (CBDC) projects, according to Cryptopolitan. These estimates depend on Ripple’s ability to sustain regulatory progress and broaden its partnerships with financial institutions.

Crypto attorney Bill Morgan pointed to XRP and

Despite the positive outlook, challenges remain. XRP’s record high of $3.65, set in July 2025, stands as a psychological barrier, and regulatory risks—though lessening—could reappear, Cryptopolitan warned. Broader economic trends, such as inflation and overall market mood, will also play a role in short-term price swings, FXStreet noted.

The XRP ecosystem continues to gain momentum. With ETFs, derivatives, and institutional treasuries backing the token, conditions are favorable for a possible breakout in 2026. Still, investors are advised to temper optimism with caution due to the unpredictable nature of the crypto market, as Cryptopolitan pointed out.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA could slip below $0.30 as bearish momentum builds

XRP Price Turns Lower as a Familiar Pattern Reappears Again

DAT Remains Uncollapsed as Altcoins Enter Stage 5; Traders Build Watchlists and Place Buy Orders