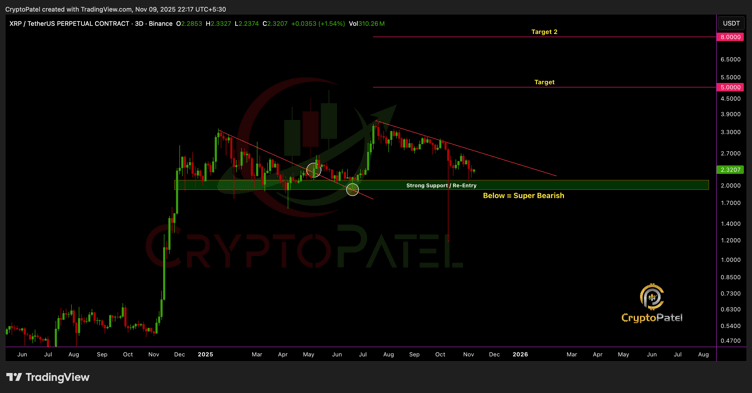

XRP News Today: Institutional Support Transforms the Crypto Market: MoonBull, Solana, and XRP Take the Lead

- Ripple’s $1.25B acquisition of Hidden Road (Ripple Prime) bridges digital assets and traditional finance, attracting institutional clients. - Solana’s price nears $200 with $400M in staking ETFs, as JPMorgan forecasts $6B in potential inflows from mainstream ETFs. - MoonBull ($MOBU) leads meme coin presales with 95% APY staking and deflationary mechanics, raising $450K with 1,400 holders. - Dogecoin (DOGE) gains bullish momentum amid Bitcoin’s recovery, while Shiba Inu struggles with limited institutiona

The crypto sector is experiencing heightened activity as five up-and-coming tokens draw significant investor interest, propelled by institutional involvement, speculative trading, and creative tokenomics. MoonBull ($MOBU) has quickly risen as a leading

Ripple continues to make strategic moves that are transforming the institutional crypto environment. The company completed a $1.25 billion purchase of Hidden Road, rebranding it as Ripple Prime to bridge digital assets with traditional finance, according to

Solana (SOL) is also in the spotlight, with its value approaching $200 and significant inflows into staking ETFs. The REX-Osprey Staking Solana ETF now manages more than $400 million in assets, reflecting increasing institutional trust, according to

Within the meme coin arena, Shiba Inu is facing headwinds due to limited institutional backing, while Dogecoin (DOGE) has turned bullish as Bitcoin’s rebound lifts overall market sentiment, as reported by

Wider market trends reinforce these developments. NFT sales dropped 42% to $93 million, with

With the crypto winter fading, projects that offer real-world utility and have institutional support are gaining momentum. Solana’s ETF-fueled growth and Ripple’s institutional strategies highlight a move toward more sustainable, long-term value creation. The coming quarter will reveal whether these trends can maintain their pace amid shifting regulatory and economic conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Sends 700 ETH to B2C2 After Major Token Dumps

Quick Take Summary is AI generated, newsroom reviewed. Arthur Hayes transferred $700 ETH to B2C2, which is viewed by analysts as preparation for a further token sale or derisking. He has liquidated over $6 million in tokens this week, including $2.4 million ENA and $640,000 LDO. The transfers to market makers like B2C2 and FalconX suggest high-volume trading and a clear intent to derisk or reposition. The community is jokingly noting the aggressive selling, referencing a past "Hayes selling the bottom" pat

Telegram (TON) crypto outlook: can bears keep control?

VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

Experts Turn Bullish on XRP as Franklin Templeton ETF Launches on November 18