Bitcoin is no inflation hedge but thrives when the dollar wobbles: NYDIG

Inflation does not have a major impact on Bitcoin’s price, as many believe, but a weakening US dollar does help push up the cryptocurrency alongside gold, according to NYDIG.

“The community likes to pitch Bitcoin as an inflation hedge, but unfortunately, here, the data is just not strongly supportive of that argument,” NYDIG global head of research Greg Cipolaro said in a note on Friday.

“The correlations with inflationary measures are neither consistent nor are they extremely high,” he added. Cipolaro said that expectations of inflation are a “better indicator” for Bitcoin (BTC) but are still not closely correlated.

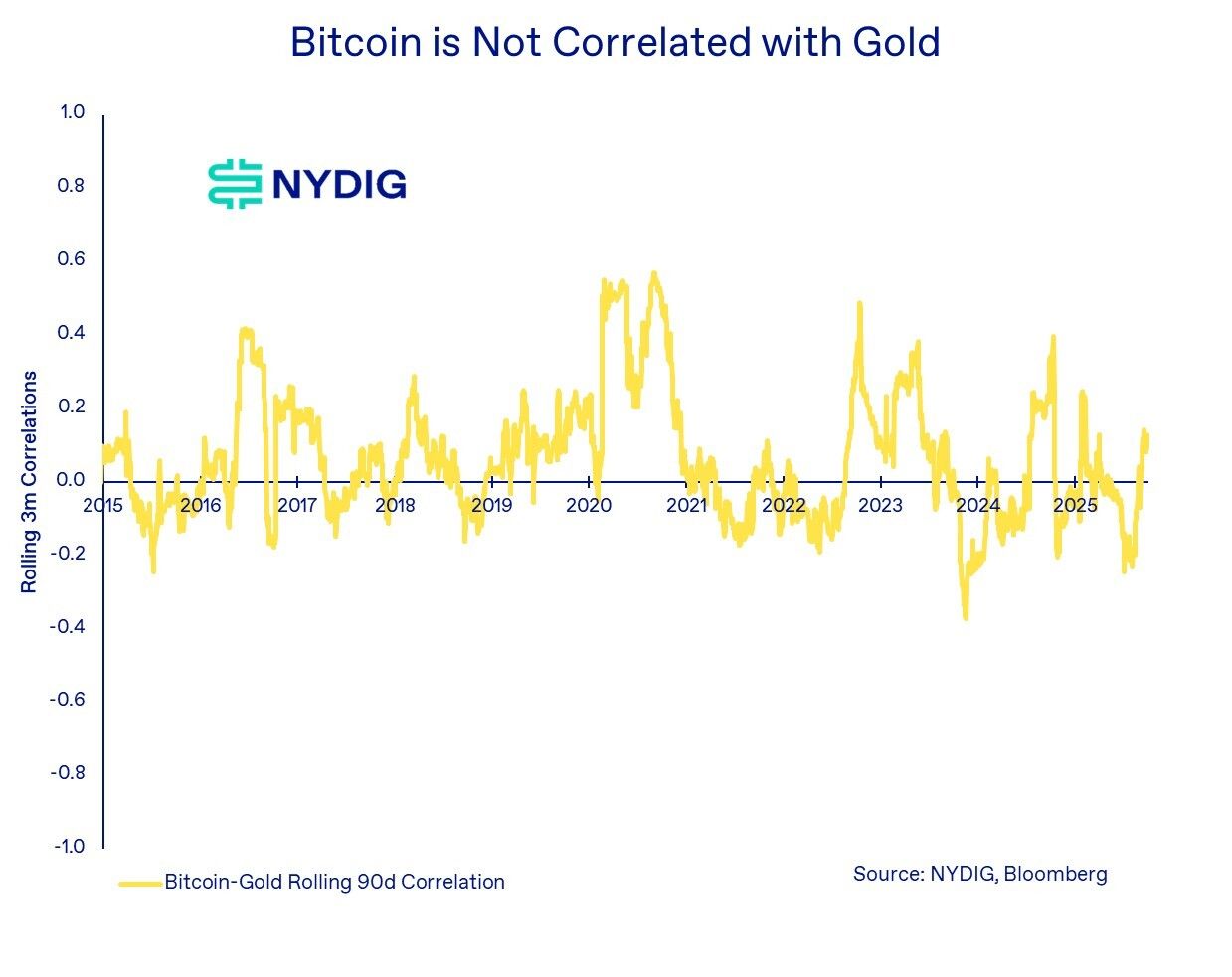

Bitcoin proponents have long lauded that Bitcoin is “digital gold” and a hedge against inflation due to its hard fixed supply and being a decentralized asset. However, it has recently become more ingrained and correlated with the traditional finance system.

Cipolaro added that real gold isn’t much better as an inflation hedge, as it has an inverse correlation with inflation and has been inconsistent across periods, which he said was “surprising for an inflation protection hedge.”

Weakening dollar a boon to Bitcoin, gold

Cipolaro said that gold has typically risen as the US dollar has fallen, as measured against other currencies using the US Dollar Index.

“Bitcoin also has an inverse correlation to the US dollar,” he added. “While the relationship is a bit less consistent and newer than gold’s, the trend is there.”

Cipolaro said NYDIG expects Bitcoin’s inverse correlation with the dollar to strengthen as the asset becomes “more embedded in the traditional financial market ecosystem.”

Interest rates, money supply the real Bitcoin mover

Interest rates and the money supply were the two major macroeconomic factors that Cipolaro said impacted the movements of Bitcoin and gold.

Gold has typically risen on falling interest rates and fallen when interest rates have risen. That same relationship, Cipolaro said, “has emerged and strengthened over time” for Bitcoin too.

He added the relation between global monetary policy and Bitcoin has also been “persistently positive” and strong over the years, with looser monetary policies typically being a boon to Bitcoin.

Cipolaro said that Bitcoin’s similar price movements to gold, relative to macroeconomic conditions, show its “growing integration into the global monetary and financial landscape.”

“If we were to summarize how to think about each asset from a macro factor perspective, it is that gold serves as a real-rate hedge, whereas Bitcoin has evolved into a liquidity barometer,” he added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

70,000 On-chain Data Reveal Meteora Airdrop: 4 Whale Addresses Take 28.5%, Over 60,000 Retail Users Share Only 7%

The airdrop also involved controversial addresses, including individuals linked to insider trading scandals and large holders with abnormal behavior, which further intensified the community's trust crisis and exposed the project to the risk of class action lawsuits.

The Story of the x402 Foundation: From Advancing the x402 Protocol to Becoming the Golden Key for AI Payments

How does the x402 Foundation turn a single line of code into the golden key for AI payments?

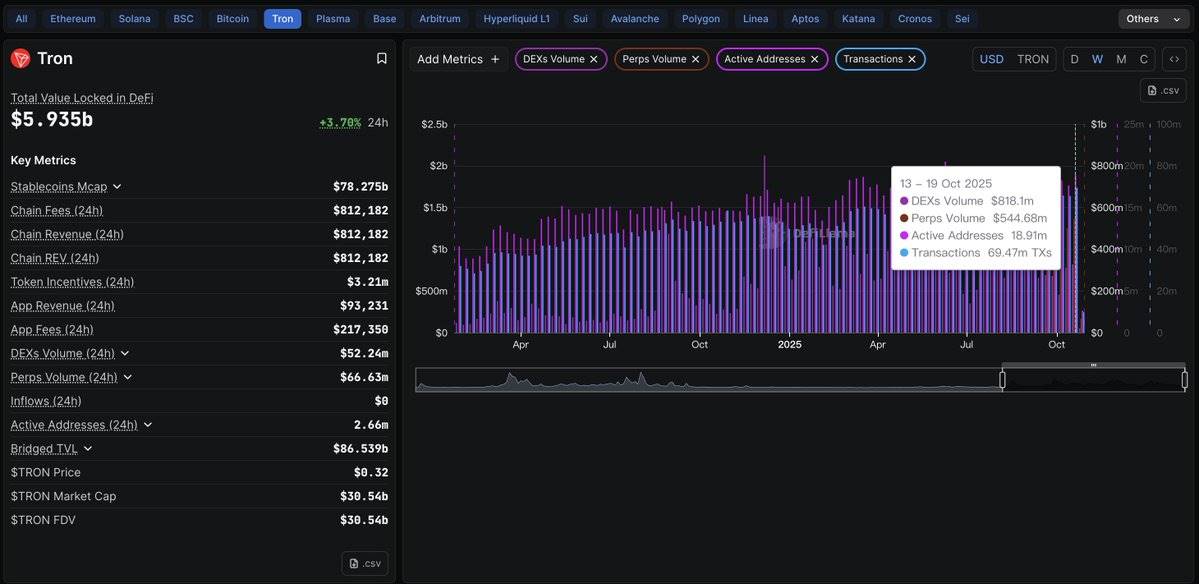

The Return of the Great Sage: How Justin Sun’s “Sun Wukong” Creates a Latecomer’s Contract Legend?

The rise of Sun Wukong not only represents Justin Sun’s strategic positioning in the decentralized contract sector once again, but also symbolizes the resurgence of the Chinese DEX narrative.

JPYC Inc. Launches Japan’s Pioneering Yen-backed Stablecoin

In Brief JPYC Inc. released Japan's first legally recognized yen-backed stablecoin, JPYC. JPYC operates on multiple blockchains and aims to reach 10 trillion yen circulation. Japanese tech and finance firms support JPYC’s integration into various ecosystems.