62,000 Bitcoin Leaves Long-Term Holders’ Wallets

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- 62,000 BTC exits long-term wallets.

- Potential effect on market dynamics assessed.

Bitcoin’s illiquid supply has decreased by 62,000 BTC, shifting from long-term holder wallets, based on on-chain analytics. This change suggests a redistribution of assets, affecting market liquidity and potential price pressures.

Bitcoin’s illiquid supply has decreased recently, with approximately 62,000 BTC moving out of long-term holder wallets, according to on-chain data providers. These transactions could signal a change in market dynamics and investor behavior.

The reduction in illiquid supply could pressure Bitcoin’s market value due to increased liquidity. Community reactions highlight concerns about potential price impacts and future accumulation trends.

Bitcoin’s illiquid supply has decreased, with around 62,000 BTC exiting from long-term holder wallets. Analysts from Glassnode report that this marks a noteworthy shift in market dynamics. Industry participants are closely monitoring these developments.

The main actors involved are the long-term Bitcoin holders, with wallets, historically inactive, moving holdings. On-chain data providers such as Glassnode and The Block have confirmed these changes, sparking discussions on future market movements.

This significant outflow affects Bitcoin directly, introducing additional liquidity, potentially influencing spot prices negatively due to supply-demand mismatches. Glassnode’s analysis highlights this market risk, indicating a need for increased spot demand.

Momentum buyers have largely exited the market, while bargain hunters have failed to generate sufficient demand to absorb this supply. With the number of first-time buyers remaining flat, this supply-demand imbalance will continue to pressure prices until stronger spot demand emerges. — Glassnode, On-chain Analytics Platform

Analysts recognize the event’s timing following a period of accumulation by large whale wallets, who continue amassing Bitcoin without major sell-offs. This suggests a shift without substantial sell pressure among sizable holders.

Past events show that large outflows from long-inactive wallets can temporarily affect market stability and trading volumes. Current data may signal a cyclical event rather than permanent market disruption, given whale activities and market adaptation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

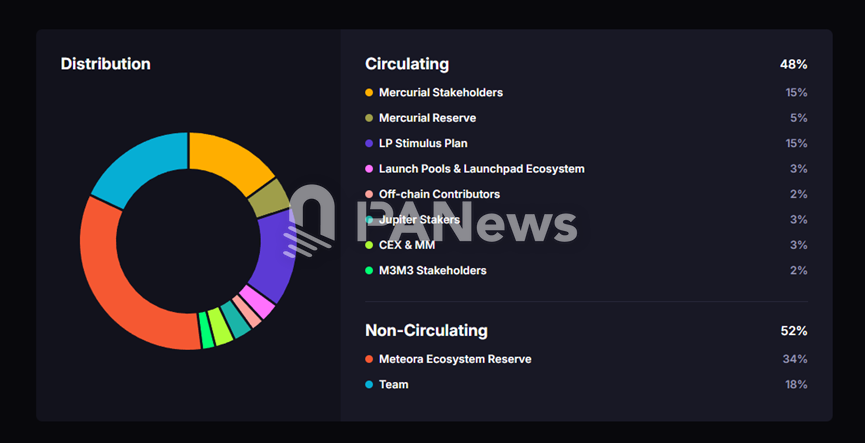

70,000 On-chain Data Reveal Meteora Airdrop: 4 Whale Addresses Take 28.5%, Over 60,000 Retail Users Share Only 7%

The airdrop also involved controversial addresses, including individuals linked to insider trading scandals and large holders with abnormal behavior, which further intensified the community's trust crisis and exposed the project to the risk of class action lawsuits.

The Story of the x402 Foundation: From Advancing the x402 Protocol to Becoming the Golden Key for AI Payments

How does the x402 Foundation turn a single line of code into the golden key for AI payments?

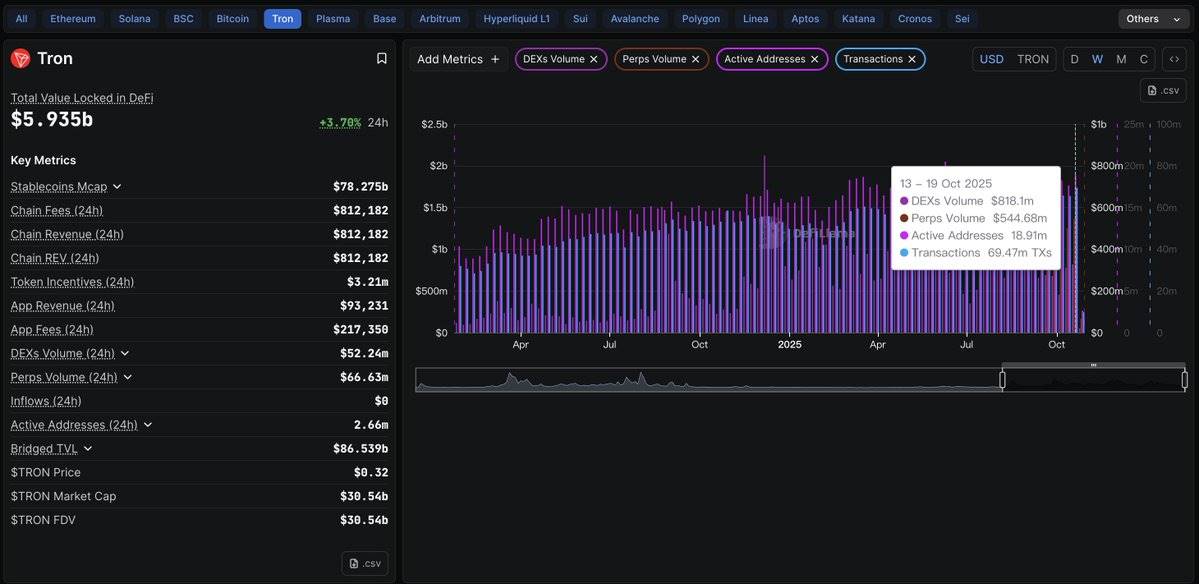

The Return of the Great Sage: How Justin Sun’s “Sun Wukong” Creates a Latecomer’s Contract Legend?

The rise of Sun Wukong not only represents Justin Sun’s strategic positioning in the decentralized contract sector once again, but also symbolizes the resurgence of the Chinese DEX narrative.

JPYC Inc. Launches Japan’s Pioneering Yen-backed Stablecoin

In Brief JPYC Inc. released Japan's first legally recognized yen-backed stablecoin, JPYC. JPYC operates on multiple blockchains and aims to reach 10 trillion yen circulation. Japanese tech and finance firms support JPYC’s integration into various ecosystems.