TRUMP and MELANIA memecoins surge after president says US-China trade deal will happen

Quick Take President Trump’s official TRUMP memecoin rose by as much as 30% hours after the U.S. president said he expected to get a trade deal done with China. Most centralized exchange trading of TRUMP took place on Binance, according to CoinMarketCap. The MELANIA memecoin, inspired by First Lady Melania Trump, rose over 45%.

President Donald Trump's official memecoin had its best day in months, jumping by as much as 30% on Monday.

TRUMP rose above $8 after starting the day at around $6.20, according to The Block price data . The last time TRUMP saw a major upward move came in the spring during a period of volatility. On Monday, the memecoin was changing hands at $7.52 as of 3:42 p.m. ET.

For months, the memecoin had been trading between a range of roughly $8 and $10 before it dropped significantly earlier this month to about $5.40, after President Trump announced retaliatory tariffs on China. TRUMP's price increase on Monday came hours after the president said he expected to get a trade deal done with China.

"I have a lot of respect for President Xi, and we are going to come away with the deal," Trump said Monday morning.

Earlier this month, the entire crypto market tanked after the president announced retaliatory China tariffs.

On Monday, trading volume for the Solana-based Trump memecoin surpassed $1 billion, with Binance leading all other centralized exchanges with nearly 13% of TRUMP trading, according to CoinMarketCap . TRUMP has a market cap of over $1.5 billion.

The official MELANIA memecoin, inspired by First Lady Melania Trump, also rose on Monday, its price increasing over 45% to nearly $0.15.

TRUMP price page. Source: The Block

TRUMP's soaring price on Monday also comes days after President Trump pardoned former Binance CEO Changpeng Zhao. The president and Zhao's ties have become stronger over the year.

Before the pardon, The Wall Street Journal reported that the Trump-backed DeFi project World Liberty Financial had shown an interest in buying a stake in Binance.US . World Liberty refuted the claim. Then, about a month and a half later, the Abu Dhabi investment firm MGX announced it would use World Liberty's USD1 stablecoin to close a $2 billion deal with Binance.

Trump defended his pardon of Zhao, saying the former Binance CEO was "persecuted" by the Biden administration.

"He was recommended by a lot of people ... A lot of people say he wasn't guilty of anything," Trump said last week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Memecoin Dominance Hits All-Time Lows: 5 High-Risk Coins That Could Lead the Next Speculative Rebound

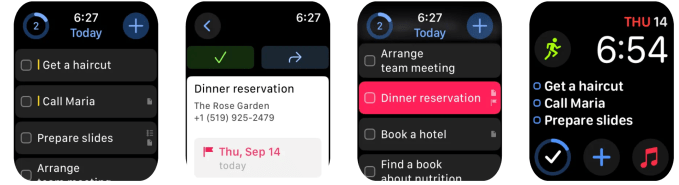

Best Apple Watch apps for boosting your productivity

What Does XRP Really Do? Expert Explains What It Is Built For

Bitcoin Hovering In A Descending Range, But Alts Are Quietly Gaining Momentum